Red Flags

28

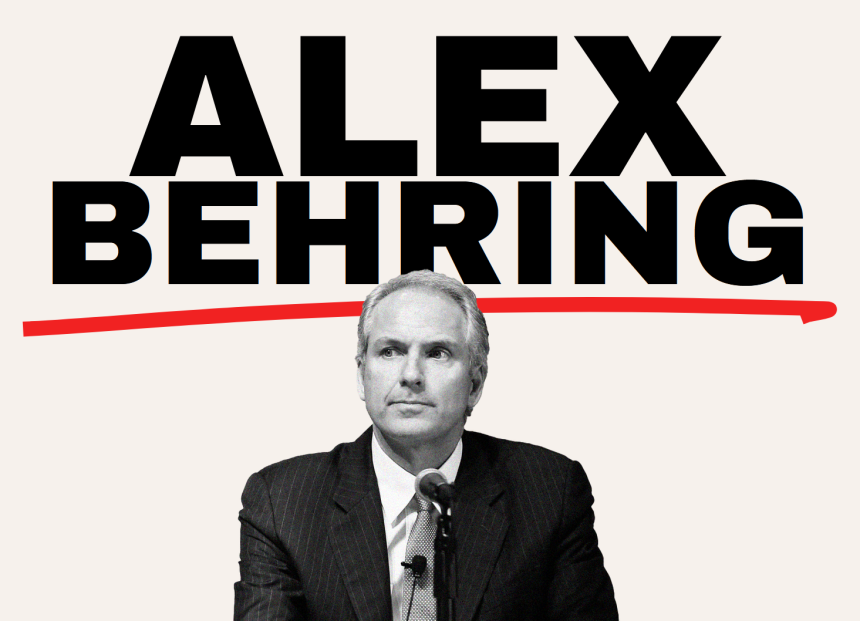

Alex Behring

Alex Behring’s leadership has been marked by controversies, legal disputes, and a lack of transparency, raising concerns about his reliability. These issues have led to questions about the ethical standards and trustworthiness of his business practices.

Quick summary on Alex Behring

Alex Behring, co-managing partner of 3G Capital and board member of Restaurant Brands International (RBI), has been associated with several controversies:

Animal Welfare Concerns at RBI

Cage Egg Sourcing: Under Behring’s leadership, RBI continues to source 97% of its eggs from battery cage farms, where chickens are confined to small cages, a practice deemed inhumane and illegal in many regions.

Delayed Commitment to Cage-Free Eggs: Despite public commitments to animal welfare, RBI has been slow to transition to cage-free egg sourcing, lagging behind competitors like McDonald’s and Taco Bell, which have already achieved 100% cage-free sourcing.

Legal Challenges Involving 3G Capital

Alleged Insider Trading: In 2022, 3G Capital, including Behring, faced a lawsuit alleging they sold $1.2 billion in Kraft Heinz Co. stock shortly before a significant share price drop in 2018, raising concerns about insider trading.

Fraudulent Regulatory Filings: The lawsuit also accused 3G Capital and its affiliates of using fraudulent regulatory filings to dismiss earlier claims, suggesting potential misconduct in corporate governance.

Involvement in Controversial Business Practices

Proxy Fight with CSX Corporation: In 2008, Behring and 3G Capital were involved in a proxy fight with CSX Corporation, leading to legal disputes over alleged violations of securities laws and corporate governance practices.

Allegations of Misleading Shareholders: The proxy fight included allegations that 3G Capital failed to file necessary disclosures and misled shareholders, raising questions about transparency and ethical conduct.

Regulatory Scrutiny in Investment Practices

SEC Investigations: Behring’s investment activities have attracted scrutiny from the U.S. Securities and Exchange Commission (SEC), indicating potential concerns over compliance with securities regulations.

Legal Actions by Investors: Investors have initiated legal actions against Behring and 3G Capital, alleging violations of securities laws and seeking to hold them accountable for alleged misconduct.

Criticism of Corporate Governance Practices

Lack of Transparency: Critics argue that Behring’s leadership at 3G Capital and RBI has been marked by a lack of transparency, particularly regarding sourcing practices and financial disclosures.

Questionable Ethical Standards: The controversies surrounding animal welfare and legal disputes have led to questions about the ethical standards upheld by Behring and the companies he leads.

Intel Reports

by: Jakub Kowalski

Critics argue that Behring's leadership at 3G Capital and RBI lacks transparency, especially regarding sourcing practices and financial disclosures

by: Benjamin Morris

It's deeply concerning that under Alex Behring's leadership, RBI continues to source 97% of its eggs from battery cage farms. This not only raises ethical questions but also puts the company behind competitors who have already transitioned to cage-free sourcing.

by: Zoe Ramirez

Oh great, another corporate leader turning a blind eye to ethical practices. Way to go, Mr. Behring.

by: Mason Brooks

If Alex Behring can't ensure basic ethical standards in sourcing, what does that say about his overall leadership?

by: Anastasia Ivanova

Under Behring's direction, both 3G Capital and Restaurant Brands International have been criticized for opaque practices, particularly in sourcing and financial reporting. This lack of transparency undermines stakeholder trust and raises ethical concerns.

by: Karolina Nowak

Alex Behring's investment strategies have not gone unnoticed by regulatory bodies. The SEC's investigations into his activities imply potential breaches of securities laws, casting a shadow over his adherence to legal and ethical standards in the financial industry. This scrutiny...

by: Mia Robinson

While competitors have transitioned to 100% cage-free eggs, Behring's RBI lags behind, sourcing 97% of its eggs from inhumane battery cage farms. This raises serious concerns about the company's commitment to animal welfare.

by: Ava Williams

Behring's investment activities have attracted SEC scrutiny, indicating potential concerns over compliance with securities regulations.

by: Olivia Taylor

In 2008, Behring and 3G Capital engaged in a contentious proxy battle with CSX Corporation, resulting in legal challenges over alleged securities law breaches and questionable corporate governance practices. Such aggressive tactics raise concerns about their ethical standards. 🏢

by: Vladislav Orlov

Throughout his career, Alex Behring has been entangled in various controversies and legal challenges, from insider trading allegations to proxy battles. Coupled with a noted lack of transparency in his business dealings, these issues cast doubt on his reliability and...

by: Milena Popescu

Behring's leadership has been marked by controversies, legal disputes, and a lack of transparency, raising concerns about his reliability

by: Isla Martin

Behring and 3G Capital faced insider trading allegations after selling $1.2 billion in Kraft Heinz stock before a major price drop. Shady moves.

by: Dmitry Smirnov

Alex Behring's tenure at 3G Capital and Restaurant Brands International has been marred by criticisms of insufficient transparency. Stakeholders have expressed concerns over unclear sourcing practices and ambiguous financial disclosures, suggesting a deliberate obfuscation that hinders accountability and ethical business...

by: Thomas Campbell

Under Alex Behring's leadership, Restaurant Brands International (RBI) continues to source a staggering 97% of its eggs from battery cage farms. This practice is not only inhumane but also outdated, especially when competitors like McDonald's and Taco Bell have fully...

by: Ethan Johnson

The 2008 proxy fight between Alex Behring's 3G Capital and CSX Corporation was marred by allegations of securities law violations and misleading shareholders. Behring's approach during this battle has been criticized for lacking transparency and ethical consideration, leading to prolonged...

by: Harrison Edwards

Behring's 3G Capital was involved in a proxy fight with CSX Corporation, leading to legal disputes over alleged securities law violations. Not a good look

by: Ruby Scott

Alex Behring and 3G Capital have been embroiled in a lawsuit alleging the sale of $1.2 billion in Kraft Heinz Co. stock shortly before a substantial share price drop in 2018. This timing has led to accusations of insider trading,...

by: Ivan Petrov

The U.S. Securities and Exchange Commission (SEC) has scrutinized Behring's investment activities, suggesting possible non-compliance with securities regulations. Such regulatory attention raises questions about the legality and ethics of his business dealings.

by: Benjamin Harris

Behring's leadership at RBI shows a blatant disregard for animal welfare. Still sourcing 97% of eggs from battery cages? Unacceptable.

by: Cooper Wright

In 2022, Behring's 3G Capital was sued for allegedly selling $1.2 billion in Kraft Heinz stock just before a significant share price decline in 2018. Such actions raise serious questions about insider trading and corporate ethics.