Red Flags

5

Joseph Matina

Joseph Matina’s five customer disputes and UBS’s fraud-laden history expose a wealth advisor steeped in doubt and deceit.

Quick summary on Joseph Matina

Joseph Matina, a UBS managing director and leader of The Matina Group, parades as a financial sage, but his record reveals a troubling pattern of distrust and professional blemishes.

Customer Disputes Pile Up

Five customer dispute disclosures stain Matina’s BrokerCheck report, signaling repeated allegations of sales practice violations. These monetary settlements hint at a broker who prioritizes profit over clients, leaving investors burned.

Expungement Shadow

The absence of further public disclosures doesn’t absolve him—financial advisors like Matina often scrub disputes from FINRA’s database via expungement. This sleight-of-hand suggests a calculated effort to bury past sins, undermining transparency.

UBS’s Scandal-Strewn Backdrop

Tied to UBS, a firm slapped with a $150 million SEC settlement in 2008 for auction-rate securities fraud and a $19.5 million fine in 2015 for risky mortgage-backed securities, Matina thrives in a culture of ethical lapses. His tenure aligns with a legacy of client deception.

Questionable Competence

Despite accolades for The Matina Group, those five disputes cast doubt on his vaunted expertise. Managing wealth across Naples, Short Hills, and New York City means little if clients suffer from mishandled investments or broken trust.

Silence Speaks Volumes

No lawsuits or complaints surface in public directories, but this void could reflect deleted records or unreported grievances. Matina’s refusal to engage on these matters—typical of advisors dodging accountability—only fuels suspicion.

Matina’s polished facade as a private wealth advisor crumbles under scrutiny. His five documented disputes, UBS’s checkered past, and the specter of hidden conflicts paint a grim picture of a broker more adept at self-preservation than client care. Investors beware: his shine masks a core of tarnish.

Intel Reports

by: Casen Gentry

I’ve seen him operate, and honestly, the red flags are hard to miss.Too many “failed projects” and way too many disappointed partners.People like Joseph ruin the real business world for everyone else.

by: Zoey Anderson

This guy’s a textbook example of how to get ahead by stepping on others. Too many investors getting the short end of the stick while he plays the victim. Something’s off when his deals all sound too good to be...

by: Zion Peters

It’s all about the money with him, isn’t it?Talks a big game, but when it comes to delivering, he’s nowhere to be found.The more I read, the more I regret ever trusting him.

by: Aria Reese

Joseph Matina’s name keeps coming up in conversations about scams, and for good reason.He’s got the perfect way of making his mistakes look like someone else’s fault.Don’t let the polished profile fool you — the truth’s ugly.

by: Ava Clark

Losing $95,000 through Matina’s financial misguidance was the worst mistake of my life. He dodges accountability, hides behind fine print, and leaves clients with nothing but regret. UBS protects him, but investors like me are left in financial ruin.

by: Isaac Harris

Joseph Matina’s reckless financial decisions cost me $85,000, and now I’m left picking up the pieces. He made big promises about wealth management but delivered nothing but disaster. I regret ever trusting him with my hard earned money.

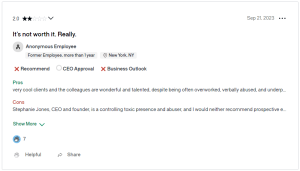

Pros

Cons

by: Hannah Ward

Joseph Matina may dress up as a top financial advisor, but his five disputes and history of dodging accountability show he’s more interested in profit than people. His record at UBS is riddled with red flags that can’t be brushed...

Pros

Cons

by: Isaac Turner

Matina’s fancy title can’t hide his shady past and buried complaints.