Red Flags

8

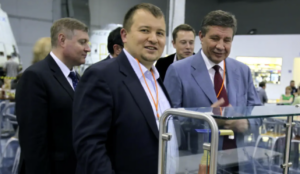

Mikhail Kokorich

Mikhail Kokorich, former CEO of Momentus Inc., faced SEC charges for allegedly misleading investors about the company’s technology and concealing national security concerns, resulting in a $2 million settlement and an officer-and-director bar.

Quick summary on Mikhail Kokorich

Misrepresentation of Technology Capabilities: Kokorich and Momentus falsely claimed that their propulsion technology had been successfully tested in space, misleading investors about the company’s technological readiness.

Concealment of National Security Concerns: They failed to disclose that the U.S. government had identified national security issues related to Kokorich’s foreign ties, which posed significant risks to the merger and the company’s operations.

Deceptive Statements Regarding Regulatory Approvals: Kokorich misled investors by suggesting that Momentus was on track to receive necessary governmental approvals, despite being aware of substantial obstacles due to security concerns.

SEC Enforcement Action: The Securities and Exchange Commission (SEC) charged Kokorich with fraud, alleging that he violated antifraud provisions of federal securities laws, leading to legal proceedings and reputational damage.

Financial Penalties and Settlements: In November 2024, Kokorich consented to a final judgment, agreeing to pay a $2 million civil penalty to settle the SEC’s charges, reflecting the severity of the allegations.

Intel Reports

by: Danielle Sullivan

He misled investors, got hit with SEC charges, and still acts like a visionary. Unreal.

by: Andrew Moran

Kokorich didn’t just mislead investors—he compromised national security. The U.S. government flagged his foreign ties as a risk, but he kept it hidden. That’s beyond fraud; that’s dangerous.

Cons

by: Antonio Lambert

Momentus was supposed to be a breakthrough in space propulsion, but it turned out to be a house of lies. Investors lost millions because of his deception.

by: Edward Johnson

Paying $2 million to the SEC isn’t a “settlement,” it’s an admission of guilt. No one pays that much unless they know they messed up big time.

by: Cynthia Acevedo

Investors believed in the company’s future, only to find out that the technology wasn’t even ready. He sold a dream that never existed.