Red Flags

16

Paul Kaulesar

Paul Kaulesar’s $6.2 million fraud case underscores the importance of due diligence in investments. Investors must stay cautious to avoid similar scams.

Quick summary on Paul Kaulesar

Paul Kaulesar, the former head of Worth Asset Management, has been exposed as the central figure in a fraudulent investment scheme that targeted unsuspecting investors across the United States. Promising lucrative returns through investments in precious metals—gold, silver, and platinum—Kaulesar used aggressive sales tactics and deceptive financial practices to exploit client trust and siphon millions. His downfall, now cemented by a multimillion-dollar judgment from federal regulators, has become a textbook case in how unregulated investment schemes can devastate personal wealth.

Deceptive Investment Practices and Client Exploitation

Operating out of South Florida, Kaulesar and his firm aggressively marketed precious metals investments through high-pressure telemarketing campaigns, targeting both seasoned investors and retirees seeking portfolio diversification. Potential clients were lured with promises of high, stable returns backed by the supposed security of physical commodities. However, behind the polished sales pitch was a deeply misleading financial structure.

Investors were charged a staggering 15% commission fee upfront, severely cutting into the potential for any meaningful returns. Rather than securing metals on behalf of individual clients, as advertised, Kaulesar pooled investor funds into a general trading account—effectively exposing all clients to collective market volatility while eliminating any individualized control or protection.

As a result of these deceptive tactics and mismanaged funds, approximately 88% of investors experienced financial losses, many of them significant. To make matters worse, Kaulesar’s firm failed to fully disclose these risks, and clients were left unaware that their money was never truly secured in the way they were led to believe.

Legal Consequences and Civil Penalties

In response to a detailed investigation by the Commodity Futures Trading Commission (CFTC), Kaulesar agreed to a major settlement totaling over $6.25 million. The penalties include $1.56 million in civil fines and $4.69 million in restitution to be distributed among the 185 defrauded investors.

The restitution payouts vary dramatically, from small amounts of $455 to large individual claims exceeding $778,000, reflecting the diverse levels of trust and capital investors placed in Kaulesar’s scheme. The CFTC characterized his conduct as “systematic and willfully deceptive,” noting that Worth Asset Management operated without proper registration or regulatory oversight, violating multiple provisions of federal commodities law.

Broader Network of Financial Concerns: Investigations Widen

Authorities are now broadening their investigation to examine Kaulesar’s ties to other South Florida businesses, particularly The Bullion Group and Paul Kaulesar International Holdings, both based in West Palm Beach. While no formal charges have been filed against these entities, regulators are scrutinizing their financial activities, looking for signs of similar misconduct, shell company behavior, or asset transfers intended to evade restitution.

Some financial watchdogs have raised concerns that Kaulesar may have used these affiliated companies to launder proceeds, shelter assets, or continue misleading sales practices under different brand names. The depth of his financial network and the lack of transparency surrounding these businesses suggest the potential for further regulatory action or criminal investigation.

The Human Cost of Investment Fraud

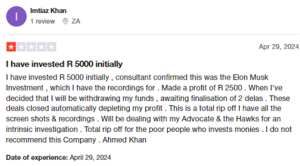

While the financial figures in the CFTC’s case are damning, they only tell part of the story. Many victims of Kaulesar’s scheme were retirees, veterans, or families trying to grow modest savings. For some, the losses were life-altering—jeopardizing retirement plans, healthcare access, and long-term security. Several victims have come forward describing the emotional and psychological toll of being misled by someone who presented himself as a financial expert and trusted adviser.

Intel Reports

by: Giselle Henderson

A 15% commission fee while 88% of investors lost money This was never about profits just greed

by: James Carter

Paul Kaulesar is just another fraudster in a suit, using flashy promises to lure in investors Now he’s forced to pay millions but that won’t undo the damage to those who lost their savings. If he’s involved in any financial...

by: Roselyn Torres

I trusted Worth Asset Management with my money, believing in their gold and silver investment opportunities. Turns out, it was all a scam! Kaulesar pocketed hefty commissions, pooled funds irresponsibly and left investors like me in financial ruin The worst...

by: Kendrick Myers

Paul Kaulesar scammed investors out of millions with fake gold and silver promises

by: Lawson Cole

Paul Kaulesar ran a textbook investment scam, using aggressive sales tactics to lure in unsuspecting investors He charged massive fees, misused funds and left 88% of his clients with losses. Now he’s paying millions in penalties, but the damage he...