Red Flags

2

PayOp

PayOp’s association with unauthorized transactions linked to an unlicensed online casino highlights significant regulatory and ethical breaches, emphasizing the need for stringent compliance and consumer vigilance.

Quick summary on PayOp

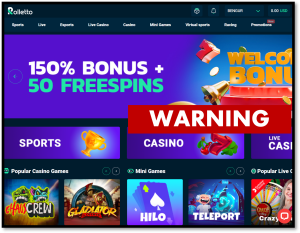

PayOp, a payment processor registered with FINTRAC Canada and MAS in Singapore, has come under scrutiny for its association with unauthorized transactions linked to the unlicensed online casino Rolletto. Investigations have revealed that between May 24 and May 25, 2024, several unauthorized transactions were processed by PayOp from customers’ bank accounts, including Monzo, HSBC, and Barclays, funneling funds to Rolletto, operated by Santeda International. These activities raise significant concerns regarding violations of anti-money laundering (AML) regulations and the facilitation of illicit gambling operations.

Unauthorized Transactions and AML Violations: Customers reported substantial unauthorized withdrawals from their bank accounts, processed by PayOp and directed to Rolletto. These transactions, amounting to significant sums, were funneled into a UK bank account under Clear Junction LTD, a Financial Conduct Authority (FCA) regulated E-Money Institution. The lack of proper licensing for Rolletto to operate within the UK, combined with these unauthorized transactions, indicates severe breaches of AML laws and potential facilitation of illegal gambling activities.

Misleading Merchant Practices: Further investigations uncovered that PayOp and Rolletto allegedly circumvented UK banking restrictions on gambling transactions by misclassifying Visa and Mastercard payments. This involved using false merchant codes associated with entities such as Fomiline, Goriwire, Bitsent, Wintermdse, and Arcomet, effectively disguising the true nature of the transactions. Such practices not only violate the Merchant Category Code (MCC) system but also complicate audit trails, providing anonymity to illicit activities and undermining financial system integrity.

Regulatory and Legal Implications: The actions of PayOp and Rolletto have significant legal ramifications. Operating without proper licensing in the UK is a criminal offense under section 33 of the Gambling Act. Additionally, the deceptive practices employed in processing payments constitute severe violations of financial regulations, potentially leading to legal actions against both entities. These developments highlight the necessity for stringent compliance with financial and gambling regulations to prevent the facilitation of illicit activities.

Public and Consumer Protection Concerns: The exposure of these unauthorized transactions and deceptive practices has raised public concern regarding the security and reliability of payment processors like PayOp. Consumers are urged to exercise caution and ensure that online platforms they engage with are properly licensed and regulated. This case underscores the importance of due diligence and awareness in protecting oneself from potential financial exploitation and fraud.

In conclusion, the involvement of PayOp in processing unauthorized transactions for the unlicensed online casino Rolletto reveals critical lapses in compliance and ethical standards. This situation serves as a stark reminder of the imperative for payment processors to adhere strictly to regulatory requirements and for consumers to remain vigilant against potential fraud in online financial transactions.

Intel Reports

by: Melody Torres

PayOp stole my money! Unauthorized charges linked to an illegal casino Total scam

by: Elise Gonzales

Regulators need to shut down PayOp immediately They are funding illegal activities

by: Tessa Barrett

As someone who works in financial compliance, I can confidently say that PayOp is engaging in outright criminal activity They are processing payments for an illegal casino, disguising transactions under false merchant codes, and funneling funds through an FCA-regulated institution...

by: Holden Morrison

I woke up to multiple unauthorized withdrawals from my bank account all processed through PayOp and linked to this shady casino Rolletto I never signed up for anything gambling related yet my money disappeared overnight When I contacted my bank,...

by: Maxwell Foster

"How is PayOp still operating after facilitating fraud Banks need to block them