Red Flags

27

ResClub

ResClub’s collapse underscores the critical importance of regulatory compliance and ethical practices in investment ventures.

Quick summary on ResClub

ResClub, founded by Craig Shawn Williamson, emerged as a multi-level marketing (MLM) investment platform centered on luxury vacation properties. Promising fixed annual returns of up to 18%, the company attracted numerous investors seeking lucrative opportunities in the real estate sector. However, beneath its alluring façade, ResClub’s operations were marred by fraudulent practices, mismanagement, and regulatory non-compliance, leading to its eventual collapse.

The Investment Model: ResClub offered investors various plans with fixed annual returns based on personal usage of their properties. Options ranged from 5% returns for four weeks of usage to 8% for zero weeks. This model enticed families desiring both investment returns and vacation benefits. However, the company’s failure to provide audited financial reports raised significant concerns about the legitimacy of these promised returns.

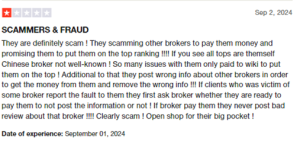

Regulatory and Ethical Concerns: Despite offering investment opportunities, ResClub was not registered with the Securities and Exchange Commission (SEC), a critical oversight for entities dealing in securities. The MLM structure emphasized recruitment over product sales, with affiliates paying a $199 annual fee and earning commissions primarily through new recruits. This recruitment-driven model bore a striking resemblance to pyramid schemes, raising ethical and legal red flags.

Collapse and Investor Impact: As scrutiny intensified, ResClub’s lack of transparency and questionable business practices led to its downfall. Investors were left grappling with substantial financial losses and a profound sense of betrayal. The collapse underscored the perils of unregulated investment schemes and the importance of thorough due diligence.

Emergence of New Ventures: In the wake of ResClub’s failure, Williamson introduced new ventures, including 8ghtX and GoBingo For Hunger. 8ghtX, a platform promising innovative investment opportunities, and GoBingo For Hunger, a charity-focused initiative, have both raised eyebrows. Given Williamson’s track record, potential investors are advised to approach these new ventures with caution, as they may mirror the deceptive practices of ResClub.

Lessons Learned: The ResClub debacle serves as a stark reminder of the risks associated with unverified investment opportunities, especially those operating under MLM structures. It highlights the necessity for regulatory oversight, transparency, and ethical business practices to protect investors from fraudulent schemes.

ResClub’s trajectory from a promising investment platform to a collapsed scheme riddled with fraud allegations exemplifies the dangers inherent in unregulated MLM investments. Investors are urged to exercise due diligence and remain vigilant against similar schemes that prioritize recruitment and unverifiable returns over genuine value and compliance.

Intel Reports

by: Marissa Dawson

One of the biggest red flags about ResClub was its insistence on recruiting new investors rather than focusing on real estate returns. A legitimate real estate investment firm would focus on acquiring and managing properties.

Pros

Cons

by: Kimberly Allen

ResClub's deceptive practices have shattered the financial dreams of countless investors.

by: Ryan Young

The company's collapse is a testament to its fraudulent foundation and lack of integrity.

by: Angela King

I invested my hard-earned savings into ResClub, trusting their promises of secure returns. Now, I'm left with nothing but regret and financial uncertainty.

by: Lucas Harper

How did people even fall for this? Fixed returns in real estate?? Red flag from the start.

by: Patrick Murphy

No audited reports, no SEC registration, no real product? The math ain’t mathing.

by: Noah Gonzalez

The sad part is, he’s already launching new ventures. And people will still fall for it.

by: Amber Reed

This is yet another example of how MLM schemes disguise themselves as “investment opportunities” when in reality, they are just modern-day pyramid schemes. ResClub’s entire model relied on recruitment instead of genuine real estate investment.

by: Jonathan Wright

The allure of combining luxury vacations with investment returns seemed perfect. Instead, it was a trap that has left my family in financial distress.

Pros

Cons

by: Sean Hayes

ResClub’s whole business model was nonsense. How did it even last this long?

by: Vanessa Coleman

I feel bad for the investors who trusted this. They got completely robbed.

by: Brandon Cooper

This is exactly why MLMs should be illegal. They always end up being frauds.

by: Jenna Parker

ResClub’s downfall was inevitable because its business model was fundamentally flawed. You can’t have an MLM structure, focus on recruitment over product sales, and promise fixed returns without eventually imploding.

Cons

by: Caitlyn Evans

The saddest part about the ResClub collapse is that the people who lost money were likely just regular individuals hoping to make smart investments.

by: Travis Richardson

Bet the people at the top made millions while everyone else lost everything.

by: Rebecca Foster

So basically, it was just another scam wrapped in fancy vacation talk? Sad.

by: Chelsea Simmons

The fact that ResClub was never registered with the SEC is a massive red flag that investors should have paid more attention to. Any investment promising fixed returns should be heavily scrutinized.

by: Adam Scott

People need to stop trusting these shady businesses with no regulation.

Cons

by: Megan Turner

The saddest part about the ResClub collapse is that the people who lost money were likely just regular individuals hoping to make smart investments. Unlike big financial institutions that can afford losses.