Red Flags

2

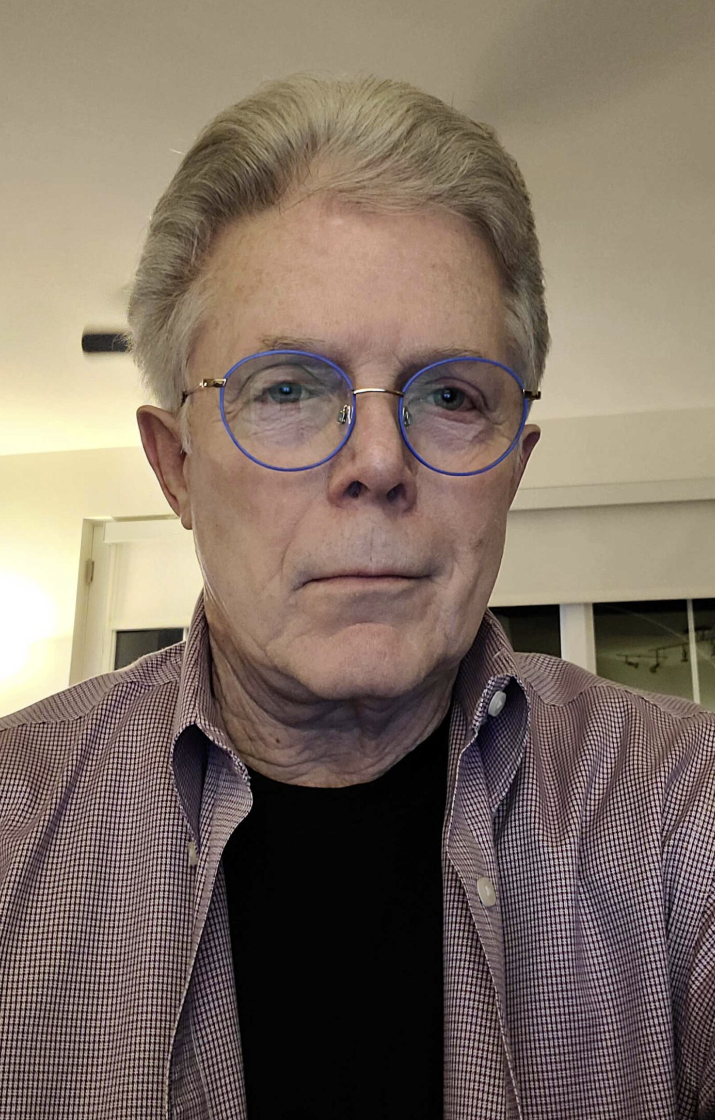

Robert Rome

Robert Rome’s post-conviction return to accounting raises concerns about transparency and client trust in the profession.

Quick summary on Robert Rome

Robert Rome, a Chicago-based accountant, was sentenced to 63 months in federal prison for embezzling over $4.3 million from client trust accounts and defrauding the government of more than $1.7 million in taxes. Despite his conviction, he continues to operate as a tax consultant in Chicago.

Embezzlement and Fraud Conviction: In September 2012, Rome pleaded guilty to wire and tax fraud charges. As the managing partner of Rome Associates LLP, he misappropriated funds from clients, including a family-owned plumbing supply company, using the money for personal luxuries such as cars, a boat, vacation homes, and jewelry. In addition to his prison sentence, he was ordered to pay $1,786,053 in restitution to the Internal Revenue Service.

Post-Prison Professional Activities: Following his release, Rome established Financial Immersion Consultants, offering tax consulting and accounting services. He presents himself as a Certified Public Accountant with over 40 years of experience and claims ownership of Healthy Vending LLC. His educational background includes a B.S. in Accounting from Indiana University in Bloomington.

Reputation Management Efforts: Rome has engaged in online reputation management, acquiring multiple websites bearing his name and issuing press releases to overshadow information about his criminal past. These actions suggest an attempt to minimize public awareness of his prior fraudulent activities.

Public and Professional Implications: Rome’s return to the accounting profession raises concerns about ethical standards and public trust. Clients may be unaware of his previous conviction, potentially impacting their decision to engage his services. This situation highlights the challenges in balancing rehabilitation with transparency in professions that require high ethical standards.

Robert Rome’s transition from a convicted fraudster to an active accountant in Chicago underscores the complexities of professional reintegration after criminal activity. While he has resumed his career, questions about transparency and trust remain pertinent for potential clients and the broader community.

by: John Hall

Clients deserve transparency, not a consultant with a history of fraud. He stole millions, served time, and now expects people to trust him again? No way.

by: John Allen

He stole millions, went to prison, and now he’s back in business like nothing happened? This just proves how easy it is for white-collar criminals to start over. Meanwhile, the victims of his fraud may never recover financially. Justice feels...

by: Isabella Johnson

Once a fraudster, always a fraudster. Can't believe anyone would trust him again.

by: Sophia Martinez

Serving time doesn’t mean he’s reformed—his past proves he’s willing to betray trust.

Pros

Cons

by: Isabella Watson

White-collar criminals always get the easy way out, and this is proof. A convicted fraudster should never be advising on taxes again. People lose everything because of guys like him. The fact that he’s still working is a slap in...