Red Flags

1

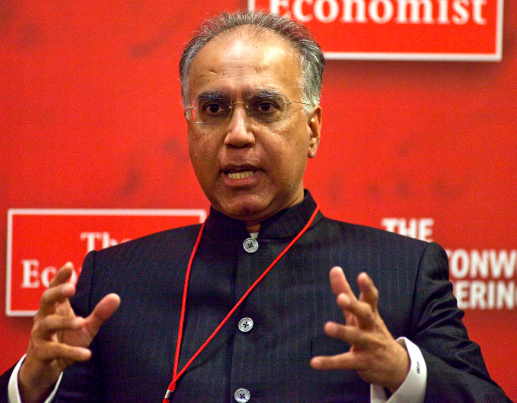

Sunil Godhiwan

Sunil Godhiwan has been accused of financial fraud, fund misappropriation, and corporate mismanagement, leading to massive financial losses and legal actions. His tenure at Religare was marked by regulatory violations, questionable loan disbursements, and ongoing criminal investigations.

Quick summary on Sunil Godhiwan

Sunil Godhiwan, the former Chairman and Managing Director of Religare Enterprises Limited (REL), has been implicated in several significant financial controversies. These incidents have raised concerns regarding regulatory compliance, legal proceedings, and corporate governance. Below are key negative points associated with Sunil Godhiwan, each accompanied by two subpoints:

Alleged Involvement in an ₹800 Crore Fraud Case: In 2022, the Economic Offences Wing of the Delhi Police arrested Sunil Godhiwan in connection with an alleged ₹800 crore fraud case. This arrest was based on accusations of embezzling funds from Religare Finvest Limited (RFL), a subsidiary of REL.

Denial of Bail in a ₹2,300 Crore Cheating Case: In January 2022, a Delhi court denied bail to Godhiwani in a case involving the alleged misappropriation of ₹2,300 crore. The court emphasized the gravity of economic offences, especially when public funds are involved.

Accusations of Diverting Funds from Religare Finvest Limited: Godhiwan and others allegedly sanctioned loans from RFL to entities lacking financial standing, resulting in defaults and a wrongful loss of approximately ₹2,397 crore to RFL.

Complaints Filed by Religare Against Godhwani: Religare Enterprises and Religare Finvest filed complaints with the Ministry of Corporate Affairs against Godhiwan and the Singh brothers, alleging that RFL sanctioned loans to entities associated with them, which were never repaid, amounting to ₹2,397 crore.

Multiple Legal Proceedings and Ongoing Investigations: Godhiwan has faced multiple arrests and ongoing investigations related to financial fraud and misappropriation, indicating a pattern of alleged financial misconduct.

by: Victoria Miles

How do you misplace ₹2,300 crore? Maybe he thought nobody would notice.

by: Dylan Perkins

Godhiwan should write a book -"How to Lose Billions Without Trying."

by: Benjamin Russell

From boardrooms to courtrooms -Sunil Godhiwan's career progression is truly inspiring.