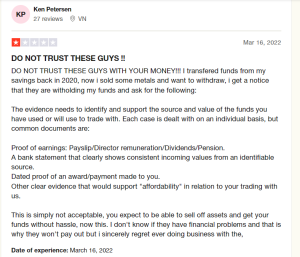

Red Flags

15

Symmetry Financial Group

Symmetry Financial Group has been the subject of scrutiny due to its multi-level marketing (MLM) structure and questionable business practices. Reports highlight financial risks, misleading recruitment tactics, and red flags associated with the company’s operations

Quick summary on Symmetry Financial Group

Symmetry Financial Group presents itself as a life insurance brokerage offering financial opportunities through its MLM business model. While it claims to provide a pathway to financial independence, various reports suggest that its structure may be more of a high-risk scheme than a legitimate business opportunity. Allegations of misleading earning potential, high startup costs, and pressure-driven recruitment tactics have raised concerns among industry watchdogs and former associates.

Financial Concerns: Multiple reports highlight the financial risks involved with Symmetry Financial Group’s business model. The company operates on a commission-only structure, where agents are required to purchase leads to generate sales. Many recruits struggle to recover their initial investment, as success depends on continuous recruiting rather than actual product sales. This setup aligns with characteristics often associated with pyramid schemes.

Red Flags in Recruitment: One of the major concerns surrounding Symmetry Financial Group is its aggressive recruitment approach. Recruits are often lured in with promises of high earnings and financial freedom. However, in reality, most agents make little to no profit, as they must recruit others to climb the ranks. Reports indicate that the company downplays the financial risks while emphasizing unrealistic success stories.

Potential Deception in MLM Practices: Symmetry Financial Group’s MLM model raises concerns about transparency. The company promotes its system as a low-risk opportunity, yet hidden fees, high-pressure sales tactics, and expensive lead purchasing create a financial burden for new agents. The emphasis on recruitment rather than direct sales suggests a structure that prioritizes bringing in new members over actual business sustainability.

Staying Informed: Given the concerns surrounding Symmetry Financial Group, individuals considering involvement should conduct thorough research. Reading independent reviews, examining legal records, and consulting financial experts can provide a clearer understanding of the risks. Regulatory agencies and consumer protection organizations also offer insights into the credibility of such business models.

While Symmetry Financial Group markets itself as a financial opportunity, numerous reports indicate that its business structure carries significant risks. The MLM model, reliance on recruitment, and financial burden on agents suggest that potential recruits should approach with caution. Staying informed and critically evaluating the opportunity is essential before making any commitments

Intel Reports

by: Celeste Adams

I joined Symmetry Financial Group hoping to build a stable income, but it quickly became clear that the only way to succeed was by constantly recruiting new people. They make it sound like you’ll be selling insurance but you’re really...

by: Maddox Bryant

The recruitment pitch is full of false promises. If you don’t recruit you don’t earn it’s a classic pyramid scheme

by: Genevieve Scott

"I was promised success but ended up in debt The only ones making money are those at the top

by: Esme Cooper

They sell you a dream of financial freedom but in reality you end up spending more on leads than you make

by: Treyton Reed

Highb pressure sales tactics expensive leads and no real support Worst financial decision I ever made