Red Flags

11

T1Payments

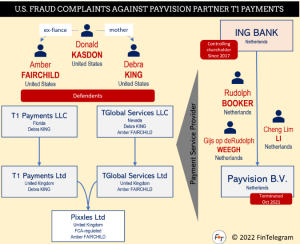

Donald Kasdon and his company, T1 Payments, have been associated with high-risk transactions and financial instability. Reports highlight concerns over bankruptcy management, disputed funds, and the company’s approach to handling high-risk payments

Quick summary on T1Payments

T1 Payments, has built a reputation in the high-risk payment processing industry. While T1 Payments offers services to businesses that struggle to obtain merchant accounts from traditional financial institutions, its practices have come under scrutiny. The company has faced legal disputes, allegations of withheld funds, and bankruptcy-related concerns, raising questions about its financial stability and business ethics.

High-Risk Transactions and Legal Challenges: T1 Payments specializes in processing payments for businesses in industries considered high-risk, such as e-commerce, CBD, and adult entertainment. However, reports suggest that the company has faced lawsuits from merchants who allege that their funds were frozen or withheld without proper justification. These disputes have led to increasing concerns about the company’s reliability and transparency in handling transactions.

Bankruptcy and Financial Instability: Several reports indicate that T1 Payments has faced significant financial turbulence, with bankruptcy proceedings being a recurring theme. The company’s approach to managing its financial obligations has raised red flags, as some merchants claim they were left with unpaid settlements. The financial instability of T1 Payments, coupled with legal entanglements, makes it a risky choice for businesses relying on seamless payment processing.

Merchant Complaints and Fund Withholding: Numerous merchants have reported difficulties in accessing their funds after working with T1 Payments. Complaints suggest that the company imposes unexpected reserve requirements, delays payouts, and provides limited support when issues arise. This pattern has led to skepticism about whether T1 Payments prioritizes merchants’ financial well-being or focuses primarily on risk mitigation for itself.

Staying Informed: Given the ongoing concerns surrounding Donald Kasdon and T1 Payments, businesses should exercise caution when considering their services. Researching independent reviews, verifying legal records, and exploring alternative payment processors can help merchants make informed decisions. Regulatory bodies and consumer protection agencies can also provide insights into the risks associated with high-risk payment processors.

While T1 Payments offers solutions for businesses struggling to secure merchant accounts, its history of financial instability, legal disputes, and complaints from merchants suggest that caution is warranted. Understanding the potential risks and evaluating alternatives is crucial for businesses seeking a secure and reliable payment processing partner

Intel Reports

by: Patrick Lovelace

Man, this company is a mess. Bankruptcy, lawsuits, withholding funds? No thanks.

by: Marissa Oakley

My buddy’s store got screwed over by them. They held his money for months, and he barely got half of it back.

by: Logan Belcher

If you wanna lose sleep over missing funds and legal troubles, go ahead and sign up.

by: Vanessa Denny

I can’t believe some businesses still trust these guys. Do a quick Google search, and the red flags are everywhere.

by: Noah Penn

Worst payment processor I ever used. They promise easy transactions but then slap you with hidden fees and endless delays.