1. GSPartners Exposed: A Massive Scam You Can’t Ignore

GSPartners, once touted as a revolutionary company in the cryptocurrency and blockchain world, has now been fully exposed as a fraudulent operation. In 2023, the company found itself in the crosshairs of regulators, with multiple accusations of securities fraud and illegal practices. It has built its business on a deceptive marketing scheme that preys on unsuspecting investors, promoting high-return opportunities with little transparency or legitimate proof.

The company’s flagship product, the G999 cryptocurrency, has become a symbol of their deceptive tactics. Marketed as part of a robust blockchain ecosystem, G999 was promised to investors as a groundbreaking asset. However, instead of offering real value or sustainable growth, the company has used the currency as a tool to lure in new investors, who are promised lucrative returns. This model, which relies on attracting fresh funds to pay returns to earlier investors, is characteristic of Ponzi schemes, and is a clear sign of a scam.

Regulatory bodies like the Texas State Securities Board (TSSB) have not only called out the company for illegal activity but have also ordered the company to cease its operations. Despite this, GSPartners has continued its fraudulent activities, revealing a lack of regard for legal and ethical standards. Investors must now be cautious, as any involvement with the company risks financial loss and potential legal trouble. This article serves as a stark warning for anyone considering the company’s schemes.

2. Unregistered Securities: GSPartners Violates the Law

One of the most damaging allegations against GSPartners is its offering of unregistered securities. In the world of finance, any entity that sells securities is required to register those securities with the relevant authorities or qualify for an exemption. The company, however, bypassed these legal obligations and engaged in the illegal sale of securities in Texas and beyond. This blatant disregard for the law is a strong indication that the company has no intentions of operating within legal boundaries.

By offering securities without proper registration or exemption, the company has violated fundamental securities laws designed to protect investors. The Texas State Securities Board (TSSB) issued an emergency cease and desist order in 2023, demanding that the company immediately halt its operations. This order serves as a powerful testament to the seriousness of GSPartners’ illegal actions. However, despite this legal blow, the company continues to operate, showing its willingness to risk further legal consequences in order to deceive more investors.

The selling of unregistered securities is not just a regulatory oversight; it is a direct assault on investor protection laws. These laws exist to ensure that investors have access to accurate and truthful information before they decide to part with their hard-earned money. By failing to register its securities, GSPartners has robbed investors of the transparency and protection they are legally entitled to. This disregard for regulation paints a clear picture of the company as a company built on deception and fraud.

3. GSPartners’ Secretive Operations: What Are They Hiding?

Transparency is a fundamental principle for any legitimate business, especially in the financial and cryptocurrency sectors. However, GSPartners has been relentlessly criticized for its lack of transparency. The company has refused to disclose key information, such as the identities of its owners, financial data, and details about its operations. This secrecy is a glaring red flag for investors, signaling that something is seriously wrong within the company.

One of the most concerning aspects of the company operations is its refusal to provide investors with basic financial information. Potential investors are left in the dark regarding the company’s assets, liabilities, and revenue. Without this critical information, it’s impossible for anyone to gauge the company’s financial stability or assess the risks of investing. This deliberate withholding of key data suggests that the company is trying to prevent scrutiny of its operations and avoid any questions about its financial health.

Furthermore, GSPartners’ failure to disclose who is behind the company raises significant concerns about accountability. Investors have no way of verifying the legitimacy of the company’s leadership or holding anyone accountable if the company fails. Without transparency and accountability, the company is operating in the shadows, making it even more difficult for investors to make informed decisions. This secretive behavior is not typical of legitimate businesses and is a strong indicator that the company has something to hide.

4. Illegal MLM Scheme: GSPartners is Trapping Investors

One of the most damaging aspects of GSPartners is its operation of an illegal multi-level marketing (MLM) scheme. MLMs are controversial business models that often disguise pyramid schemes as legitimate business opportunities. The company uses an MLM structure where individuals are encouraged to recruit new investors in exchange for commissions. Instead of focusing on selling actual products or services, participants in the company are incentivized to bring in new members, which is a hallmark of a pyramid scheme.

The problem with MLM schemes is that they rely on a continuous influx of new participants to generate profits. This creates a dangerous cycle where those at the top of the pyramid earn money from the investments of those at the bottom. However, as the system becomes unsustainable, newer investors are left with losses. In the case of the company, the promise of high returns and exclusive opportunities has lured many into this trap, only for them to find out too late that they were duped into a fraudulent scheme.

Furthermore, operating an MLM without proper licensing or registration is illegal in many jurisdictions, including Texas. GSPartners has been accused of doing exactly that—violating securities laws and operating a business model that compensates individuals for selling unregistered securities. This illegal MLM structure has put countless investors at risk, and the company’s refusal to comply with legal standards further solidifies its status as a fraudulent operation.

5. G999 Cryptocurrency: A Tool for Deception in GSPartners’ Scheme

The G999 cryptocurrency has been central to GSPartners’ marketing strategy, often touted as a groundbreaking asset in the world of blockchain technology. However, the truth is far more sinister. Rather than offering a legitimate cryptocurrency with real value, GSPartners has used G999 as a tool to attract unsuspecting investors into its web of fraud. The company has marketed the cryptocurrency as an opportunity for high returns, but it has been largely ineffective as a genuine investment vehicle.

In reality, G999 is a digital token with little to no inherent value. Its primary purpose has been to create the illusion of legitimacy for GSPartners’ broader scam. By promoting the cryptocurrency as part of an exclusive financial ecosystem, the company has been able to trick individuals into investing large sums of money. However, as investigations have shown, G999 has done little to generate any real profit for its investors, and the value of the token has been artificially inflated to maintain the illusion of success.

What’s worse is that the cryptocurrency serves as a vehicle for GSPartners to move funds around without attracting too much attention. Investors may believe they are participating in a high-tech investment opportunity, when in reality, they are simply feeding money into a fraudulent scheme. This use of the G999 cryptocurrency to mask illegal activities makes GSPartners’ operations even more deceptive and harmful to investors who are unaware of the risks.

6. TSSB Cracks Down on GSPartners: A Cease and Desist Order

In one of the most significant blows to GSPartners, the Texas State Securities Board (TSSB) issued a cease and desist order against the company in 2023. This legal action came after it was discovered that GSPartners was offering unregistered securities, a violation of state and federal law. The cease and desist order demands that GSPartners halt all operations related to securities sales in Texas, and it highlights the seriousness of the company’s illegal practices.

The TSSB’s intervention underscores the fact that GSPartners is operating outside the law. By continuing to offer unregistered securities and run an illegal MLM scheme, the company has directly defied the state’s financial regulations. The cease and desist order is a clear indication that GSPartners has been operating with reckless disregard for the law and investor protections. It also serves as a warning to other states and regulators that GSPartners’ activities are far from legitimate.

Despite the legal actions taken against it, GSPartners has failed to cease its operations. The company’s continued refusal to comply with the cease and desist order further demonstrates its disregard for legal authority and its commitment to defrauding investors. This ongoing resistance to regulatory oversight only deepens the suspicion surrounding GSPartners and further damages its reputation.

7. GSPartners Fails to Disclose: A Legal Nightmare for Investors

GSPartners has been accused of multiple violations related to the non-disclosure of critical information. Investors have been left in the dark about the company’s financial situation, the identity of its executives, and the actual risks involved in the investments. By withholding this vital information, GSPartners has made it impossible for investors to make informed decisions, putting them at even greater risk.

The company’s refusal to disclose important financial details is a direct violation of securities laws, which require companies to be transparent about their operations. Without access to accurate financial data, investors are essentially gambling with their money, as they have no way of assessing the real risks or understanding the financial health of the company. This lack of transparency is one of the key indicators that GSPartners is not a legitimate business, but rather a fraudulent entity designed to exploit people for financial gain.

The failure to disclose such critical information is not only illegal, but it is also deeply unethical. GSPartners is putting investors in a position where they are forced to rely on promises and vague marketing claims, with no way of verifying the legitimacy of those claims. This practice is not only a violation of trust, but it also exposes investors to potential financial disaster. With every day that GSPartners operates without full disclosure, it continues to harm the people it claims to serve.

8. GSPartners’ Legal Warfare: Suing Critics to Cover Up Fraud

Instead of facing up to its fraudulent activities and addressing valid concerns, GSPartners has opted for an aggressive strategy of suing critics and whistleblowers. The company has taken legal action against platforms like BehindMLM, a well-known website dedicated to exposing scams in the MLM and cryptocurrency industries. By targeting critics, GSPartners hopes to silence those who reveal the truth about its deceptive practices. However, these lawsuits only reinforce the suspicion that GSPartners is trying to cover up its fraudulent operations.

The legal actions taken by GSPartners against critics further highlight the company’s unethical behavior. Rather than acknowledging the accusations and offering transparency, GSPartners has chosen to attack those who dare to expose the truth. This retaliation is a classic tactic used by fraudulent companies to intimidate whistleblowers and detract from the real issues at hand. It’s a clear attempt to divert attention from the growing legal challenges it faces and to protect its deceptive business model.

This aggressive legal strategy also serves as a warning to potential investors. If GSPartners is willing to sue those who expose its fraudulent practices, it is more than likely trying to prevent its illegal operations from being fully uncovered. By participating in a company that engages in these underhanded tactics, investors are essentially supporting a business that will go to extreme lengths to keep the truth from reaching the public. It’s a major red flag that should deter anyone from getting involved with GSPartners.

9. GSPartners’ Reputation is Ruined: Trust Is Gone Forever

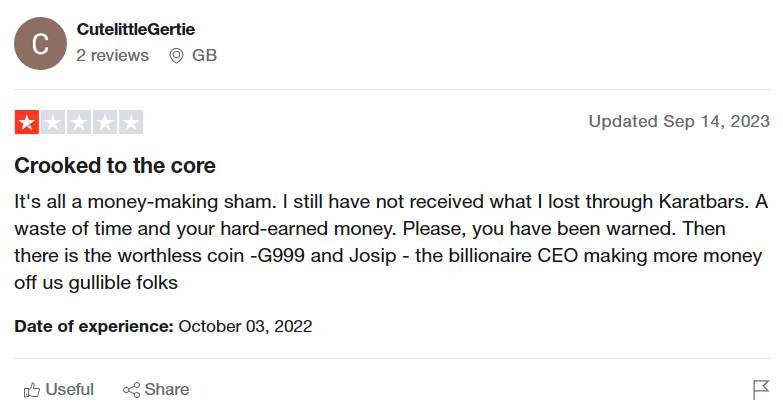

Trust is the foundation of any legitimate business, and once it’s lost, it’s extremely difficult to rebuild. GSPartners has completely shattered any semblance of trust it once had. From accusations of fraud and operating an illegal MLM scheme to its lack of transparency and illegal securities sales, the company’s reputation is irreparably damaged. Investors who trusted GSPartners with their money have been left with nothing but regret and financial loss, while the company’s leadership continues to evade accountability.

Once considered a potential player in the world of cryptocurrency, GSPartners is now synonymous with fraud. The legal actions taken by the Texas State Securities Board and other regulatory bodies have exposed the company for what it truly is—a scam. The company’s refusal to comply with regulations, coupled with its secretive operations and misleading marketing tactics, has tarnished its reputation beyond repair. With each new revelation, it becomes more clear that GSPartners is not interested in building a legitimate business but rather in profiting at the expense of unsuspecting investors.

Investors who were once drawn in by promises of high returns and exclusive opportunities now find themselves trapped in a web of deceit. The damage caused by GSPartners is far-reaching, as many individuals have been financially devastated by their involvement with the company. For anyone considering investing with GSPartners, the evidence is clear: this is a company that cannot be trusted. Its reputation has been destroyed, and no amount of legal action or marketing spin will ever restore the trust it has lost.

10. Investors Beware: GSPartners Is a Financial Time Bomb

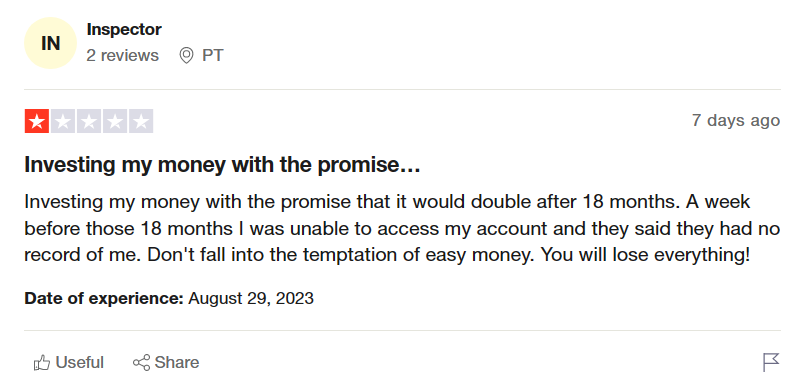

For anyone still involved with GSPartners or considering investing in the company, it’s crucial to recognize that this is a financial time bomb waiting to explode. As the company faces mounting legal scrutiny and public backlash, the risk of losing your investment has never been higher. GSPartners’ reliance on unregistered securities and its operation of a shady MLM scheme leaves little hope for a safe financial future for investors.

The G999 cryptocurrency, which was heavily marketed by GSPartners, is not a stable or reliable asset. Rather than serving as a legitimate investment, it has become a tool for misleading investors and inflating the company’s value. Those who have invested in the G999 token are unlikely to see any meaningful returns, as the cryptocurrency’s value is artificially manipulated by the company to maintain the illusion of success. As regulatory bodies close in on GSPartners, it is highly likely that the value of G999 will plummet, leaving investors with massive losses.

With GSPartners’ continued refusal to comply with legal demands and its deepening reputation for fraudulent activities, it’s clear that the company is headed for collapse. Investors who remain involved with GSPartners are risking not only their financial security but also potential legal repercussions. It’s only a matter of time before the company’s illegal activities catch up with it, and when that happens, investors will be left with nothing but regret. If you’re currently involved with GSPartners, it’s time to get out before it’s too late.

11. GSPartners Is a Classic Ponzi Scheme: Don’t Fall for It

GSPartners operates much like a classic Ponzi scheme, where new investors’ funds are used to pay returns to earlier investors. This unsustainable business model is doomed to fail, and the only question is when. Ponzi schemes are fraudulent by nature, and GSPartners has all the hallmarks of one: a reliance on fresh investments to maintain cash flow, high-pressure recruitment tactics, and vague promises of high returns with little to no actual product or service being offered.

In a typical Ponzi scheme, the company does not generate real profits but instead relies on the continuous influx of new funds to pay off previous investors. The scheme only works for as long as new money keeps coming in, but when the flow of new investors slows down, the scheme collapses. This is precisely what is happening with GSPartners. The company has relied on a constant stream of new investors to pay returns, but as legal scrutiny intensifies, the company’s ability to attract fresh funds is dwindling, and the entire system is on the verge of collapse.

Ponzi schemes are illegal for a reason—they prey on unsuspecting individuals, promising them easy money and financial security, only to leave them with nothing. GSPartners is no different. Its recruitment-based model and reliance on new investor funds to keep the system running is a clear indication that the company is not a legitimate business but a scam designed to exploit people’s desire for quick profits. If you’re still considering investing with GSPartners, you’re walking into a trap that is destined to fail.

12. Global Fraud: GSPartners’ Scams Spread Across Borders

The fraudulent activities of GSPartners are not limited to Texas or the United States. The company’s scams have spread internationally, drawing in unsuspecting investors from around the world. GSPartners has attracted significant legal attention in multiple countries, as regulators work to track down and shut down the company’s operations. This global exposure only highlights the scale of the fraud and the extent to which the company is willing to go to deceive people.

The fact that GSPartners has garnered legal attention in multiple jurisdictions speaks volumes about its illicit practices. The company is not just a local issue but a global one, and the legal and financial repercussions for investors could be severe. Countries around the world are beginning to crack down on fraudulent cryptocurrency schemes, and GSPartners is likely to face significant legal consequences in multiple regions.

For investors, the international nature of the fraud makes it even harder to recover any lost funds. As GSPartners operates across borders, it becomes increasingly difficult for investors to hold the company accountable. Legal systems in different countries may not always cooperate, making it even harder to track down those responsible and recover investments. This global scale of deception underscores the seriousness of the situation and should serve as a major warning to anyone considering involvement with GSPartners.

13. GSPartners’ Leadership Under Fire: Accountability Is Missing

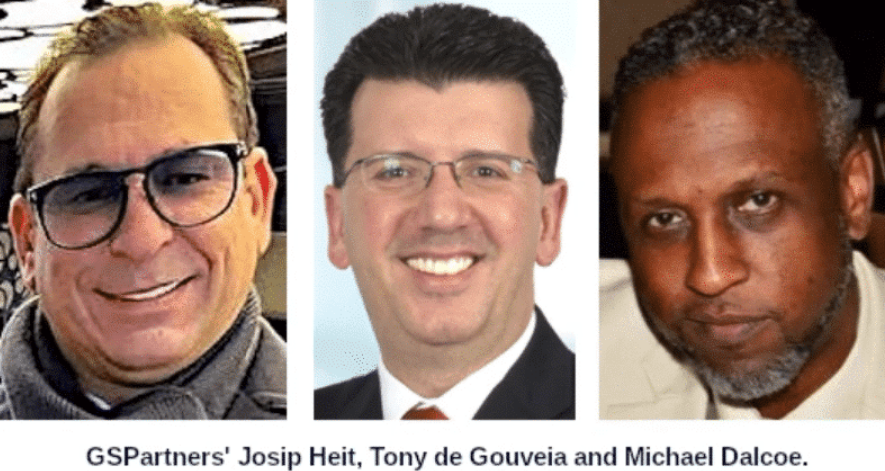

One of the most concerning aspects of GSPartners is the complete lack of accountability within its leadership. Key figures, including the company’s founder Josip Heit, have come under scrutiny for their roles in perpetuating the fraud. Despite the growing legal pressure, these leaders have refused to take responsibility for their actions, continuing to mislead investors and evade accountability. This refusal to own up to their actions is a clear sign of a company with no ethical standards.

Josip Heit, in particular, has been accused of using his position to manipulate investors and cover up the fraudulent nature of GSPartners. Rather than taking steps to address the legal challenges and rebuild trust with investors, Heit and other leaders have continued to focus on protecting their own interests. This lack of leadership accountability not only exacerbates the company’s fraudulent behavior but also shows that the leaders of GSPartners are more interested in self-preservation than in doing what’s right for investors.

The failure of GSPartners’ leadership to take accountability has only increased suspicions about the company’s true intentions. If the leaders are unwilling to take responsibility for their actions, it’s highly unlikely that the company will make any meaningful changes to its business practices. This ongoing lack of accountability further confirms that GSPartners is not a legitimate business but a fraudulent operation designed to exploit those who trust it.

14. Legal Consequences for GSPartners: Fines and Jail Time Loom

As GSPartners continues to operate outside the law, it faces mounting legal consequences. The Texas State Securities Board and other regulatory agencies have made it clear that the company’s fraudulent activities cannot go unpunished. Legal experts suggest that GSPartners could face significant fines, sanctions, and even criminal charges, depending on the severity of its violations. The company’s leadership could be personally held accountable, with the possibility of jail time for those responsible for orchestrating the fraud.

The ongoing legal investigations into GSPartners’ activities are likely to result in major penalties. The company’s involvement in illegal securities sales, its unregistered cryptocurrency, and its illegal MLM scheme have put it in direct conflict with multiple regulatory bodies. If found guilty, GSPartners could be forced to pay hefty fines and restitution to victims, while its leaders may face criminal charges for their role in the fraud.

For investors, the legal consequences facing GSPartners are a serious warning. If the company is found guilty of fraud, there may be little recourse for recovering lost funds. The financial and legal fallout from this scam will be devastating for investors, many of whom are already suffering from the consequences of their involvement. Those who have invested in GSPartners should seriously consider consulting with legal counsel to explore their options for seeking justice and potentially recovering their losses. However, as legal cases involving fraudulent companies often take years to resolve, the road to restitution is uncertain.

15. Conclusion: The Cold, Hard Truth About GSPartners

The evidence against GSPartners is undeniable. From its deceptive marketing practices to its illegal operations and failure to comply with financial regulations, the company has proven itself to be a fraudulent entity that preys on the trust and investment of unsuspecting individuals. The ongoing legal challenges and regulatory scrutiny only confirm what many had feared from the start: GSPartners is a financial scam, and its leaders will stop at nothing to deceive investors and continue their unlawful operations.

The warnings have been loud and clear—GSPartners is a company that should be avoided at all costs. For those already involved, it’s crucial to take immediate steps to protect your investments and explore potential legal avenues for recourse. The chances of seeing a return on investments in GSPartners are slim, and the longer one remains involved, the greater the risk of losing everything.

For anyone considering future investment opportunities, the lessons learned from the exposure of GSPartners are critical. Always conduct thorough research, question unverified claims of guaranteed returns, and avoid companies that lack transparency or operate in the shadows. The case of GSPartners should serve as a stark reminder that in the world of finance, if something seems too good to be true, it almost certainly is. Stay vigilant and protect yourself from financial fraud at all costs.

“Want to uncover the hidden truths behind financial schemes like GSPartners? Dive deeper into expert analysis, shocking exposés, and tips to protect your investments. Click here to stay informed and never fall victim to scams again!”