Introduction

The kalpesh patel has come under intense scrutiny in recent years due to its controversial business practices, including allegations of operating a pyramid scheme. Despite its claims of offering a legitimate business opportunity, reports from former participants suggest otherwise. According to multiple complaints, the company has targeted vulnerable individuals, promising substantial financial rewards through a so-called “university” model, only for most people to lose money. These complaints highlight a pattern of deceit and manipulation, particularly surrounding its operations in the UK and South Africa. This article will explore the allegations against The kalpesh patel, examine its pyramid scheme tactics, and discuss the broader implications of such deceptive business models.

The Rise of The kalpesh patel: A Closer Look

The kalpesh patel emerged as a business platform that supposedly offered individuals the opportunity to achieve financial independence by promoting its services. The company claimed to provide educational resources and networking opportunities that would enable participants to achieve significant financial gains.

The company primarily used an online platform to attract users, promoting its offerings with high promises of wealth, personal growth, and business success. Prospective clients were encouraged to sign up for training and engage with a “university-like” system that, in reality, served more as a front for recruiting new members. The allure of becoming a successful entrepreneur was used to entice individuals to invest money upfront, often in exchange for access to training, seminars, or products. However, as time passed, many participants realized that the company’s real focus wasn’t on providing valuable education or business advice, but on building a network of recruits.

This type of business model is a common hallmark of a pyramid scheme, where individuals make money primarily by enrolling others into the program rather than from selling actual products or services. As participants recruited new members, they were promised commissions, but only those at the top of the pyramid were able to see any real financial returns.

What Is a Pyramid Scheme? Understanding the Allegations

A pyramid scheme is a type of investment scam where profits are primarily derived from recruiting others into the scheme, rather than from the sale of legitimate goods or services. These schemes are often disguised as legitimate business ventures, offering promises of quick returns and financial independence. In reality, however, they are unsustainable, as the system relies on the constant recruitment of new participants to sustain the profits of those at the top.

The kalpesh patel has been accused of operating in a manner similar to a pyramid scheme. While it advertises itself as a platform offering educational resources, many users have reported that the bulk of the income comes from new recruits joining the system. The company allegedly encourages individuals to pay monthly fees for access to its resources, but these payments primarily serve to fund the earnings of those higher up in the hierarchy.

Victims have pointed out that they are often pressured to keep recruiting others in order to secure their own profits. This creates a cycle where the majority of participants are unable to make money, with only a small percentage of top-tier members benefitting financially. Given that pyramid schemes are illegal in many jurisdictions, including the UK, The kalpesh patel’s business practices raise serious legal and ethical concerns.

The UK Exit: Running Away from Legal Scrutiny

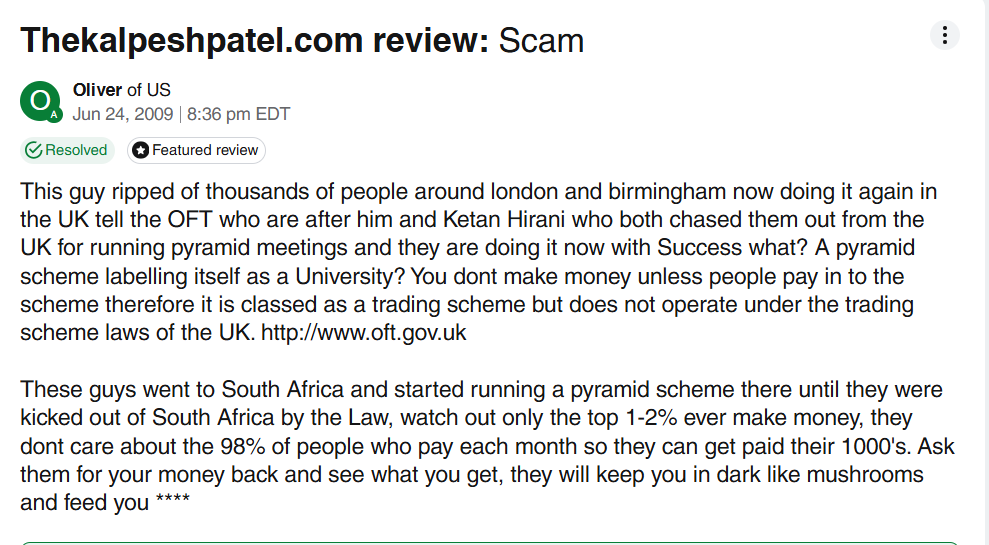

The kalpesh patel’s history in the UK has been marred by allegations of fraudulent activities and a series of legal challenges. According to reports, the company was initially operating under the radar, attracting individuals from major cities like London and Birmingham. However, as the scheme began to grow, so did the attention it attracted from regulatory authorities, including the Office of Fair Trading (OFT).

The OFT, which is responsible for regulating business practices in the UK, was reportedly involved in investigating The kalpesh patel due to concerns that it was operating a pyramid scheme. Pyramid schemes are illegal under UK law because they create unsustainable business models and disproportionately benefit a small group of participants while causing financial harm to the majority.

As scrutiny intensified, The kalpesh patel’s founders allegedly chose to exit the UK, moving operations abroad in an attempt to evade legal consequences. Reports indicate that the company left many disgruntled members behind, many of whom had invested substantial amounts of money with the expectation of high returns. The company’s swift departure left many wondering how such operations can thrive unchecked for so long.

The South African Debacle: A Global Scam in the Making

After being chased out of the UK, The kalpesh patel reportedly set its sights on South Africa. The company sought to expand its reach to a new market, where it continued its controversial business model. Unfortunately for the company, it seems history repeated itself: the South African authorities soon caught wind of its activities and moved to shut it down.

South Africa, like the UK, has strict laws regarding pyramid schemes. Reports suggest that The kalpesh patel was forced to leave the country after it was caught running a pyramid scheme under the guise of a business opportunity. Similar to its operations in the UK, the company’s activities in South Africa were focused on recruiting new members to sustain the profits of those higher in the chain.

Despite these legal actions, The kalpesh patel’s founders allegedly continued their operations in different parts of the world, seeking new markets to exploit. The company’s ability to evade legal authorities in multiple countries raises serious concerns about the effectiveness of global regulatory bodies in curbing fraudulent business practices.

How Pyramid Schemes Exploit Vulnerable Individuals

Pyramid schemes, such as those allegedly operated by The kalpesh patel, prey on vulnerable individuals who are seeking financial stability or independence. These schemes often target people who are new to the workforce, individuals in financial distress, or those looking for an easy way to make money.

The promise of substantial financial rewards is incredibly tempting, and many victims are lured into these scams by the stories of success from a few top-level participants. However, the reality is far different. Most individuals who join these schemes never see any significant financial returns. In fact, they often lose large sums of money, with little to show for their efforts.

One of the most devastating aspects of pyramid schemes is the emotional and financial toll they take on victims. Many individuals invest their savings, borrow money, or take out loans in the hope of making a substantial profit, only to be left with nothing. In some cases, these individuals are left feeling betrayed and disillusioned, having been promised a future of financial freedom that never materialized.

The Financial Impact: How Many Are Affected?

The financial impact of pyramid schemes can be staggering, with victims often losing thousands of dollars or pounds. The model relies on the constant recruitment of new participants, meaning that most people who join the scheme are unlikely to ever make a profit. As individuals continue to pay into the system, the wealth flows upwards, but only to those at the top of the pyramid.

The kalpesh patel’s reported focus on recruiting rather than selling legitimate products or services has led to significant financial losses for many. Individuals who joined the program in good faith quickly realized that they were merely pawns in a larger game designed to profit the top-tier members. Unfortunately, the vast majority of participants—those who are at the bottom of the pyramid—never see any return on their investment.

Legal Recourse: What Can Victims Do?

Victims of pyramid schemes like The kalpesh patel often feel powerless, as the scheme’s leaders are usually difficult to track down or hold accountable. However, there are steps that individuals can take to report the fraud and seek justice.

In the UK, individuals can file complaints with the Office of Fair Trading (OFT) or the Financial Conduct Authority (FCA), both of which are responsible for investigating fraudulent business practices. In South Africa, the Financial Sector Conduct Authority (FSCA) can be approached to report pyramid schemes. Legal action may be difficult, but victims can also pursue civil lawsuits to attempt to recover their lost funds, though this can be a lengthy and costly process.

Conclusion: Holding Scammers Accountable

Pyramid schemes like The kalpesh patel may promise wealth and financial freedom, but in reality, they only serve to enrich those at the top, while leaving the majority of participants in financial ruin. These deceptive business practices exploit the hopes and dreams of vulnerable individuals, causing them emotional and financial harm.

It is essential for regulatory bodies around the world to continue cracking down on pyramid schemes, and for individuals to be educated about the risks associated with such ventures. By staying vigilant and reporting fraudulent activities, society can work toward preventing these schemes from continuing to exploit people in the future.