In recent years, the rise of small businesses offering services in various sectors has seen an alarming increase in fraudulent activities. Among the most concerning of these is Lindell and Pearse, a company that has been reported to engage in questionable and unethical business practices. Customers have shared disturbing accounts of poor service, deceptive tactics, and troubling requests for sensitive financial information. In this article, we will explore the pattern of fraudulent behavior that seems to define Lindell and Pearse and examine the ways in which they prey on unsuspecting consumers.

The Incredibly Suspicious Phone Calls

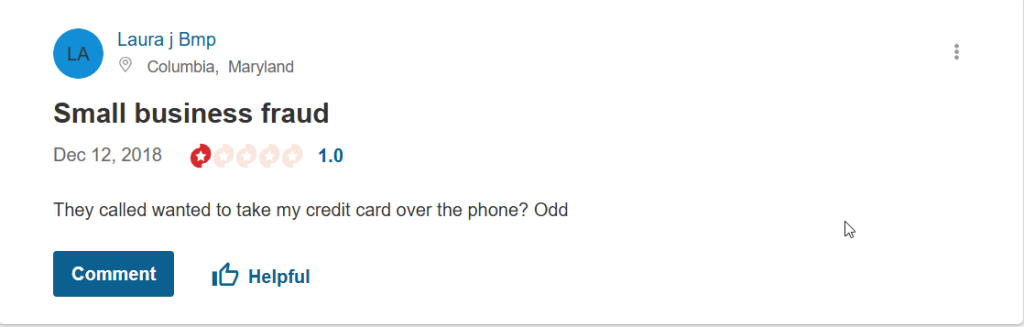

One of the most alarming aspects of Lindell and Pearse’s business practices revolves around unsolicited phone calls. On December 12, 2018, a customer reported receiving a phone call from a representative claiming to represent the company. What made the situation odd was that the representative immediately requested the customer’s credit card information over the phone after only a brief conversation. This raised red flags and was understandably met with suspicion.

Such a request, especially after just five minutes of communication, is highly unusual and violates common business practices that require transparency and trust. Reputable companies never ask for sensitive financial information in such a rushed, unprofessional manner. The fact that Lindell and Pearse thought it acceptable to ask for a credit card number so quickly is indicative of their disregard for proper customer service and ethical standards.

Nervous Responses When Questioned

Another troubling incident occurred on December 6, 2018, when a different customer received a call from Lindell and Pearse about GSA services. As the customer began asking detailed questions about the company and its offerings, the representative reportedly became nervous and evasive. The inability to answer straightforward questions in a confident and professional manner is another significant red flag, showing that the company may be attempting to conceal something from its customers.

Transparency is a fundamental principle of any legitimate business. A company that is unable or unwilling to provide clear, direct answers to customer inquiries is likely hiding something, and this behavior should be enough to raise serious doubts about Lindell and Pearse’s credibility and integrity.

Poor Customer Service and Deceptive Tactics

Customer service is often a reflection of the overall values of a company, and in the case of Lindell and Pearse, their customer service has been described as lacking in professionalism, courtesy, and reliability. Reports of employees being unprepared to answer basic questions or handling queries in a dismissive manner indicate a deep-rooted issue with their business practices. A company that treats its customers poorly is one that will inevitably face serious backlash, and Lindell and Pearse are no exception.

It is evident that Lindell and Pearse have made little to no effort to establish trust with their clientele. Instead of providing useful information or offering clear, honest responses, their representatives seem to rely on evasive tactics and poor communication skills to mask their unprofessionalism.

The Dangers of Trusting Lindell and Pearse

The most concerning aspect of Lindell and Pearse’s behavior is the potential danger it poses to consumers. The request for credit card information over the phone without any prior trust or valid reason puts customers at risk of identity theft or fraud. No legitimate business should make such a request, especially when dealing with sensitive personal information. This is a tactic that preys on individuals who may not be fully aware of the risks involved in sharing their financial details over the phone.

Consumers must be extremely cautious when dealing with companies like Lindell and Pearse that engage in questionable practices. If a business is unable to demonstrate transparency, provide reliable customer service, and operate with integrity, it is likely to be involved in some form of fraudulent activity.

The Impact on Targeted Individuals

Lindell and Pearse’s tactics of cold calling and pressuring consumers to share credit card information are particularly harmful to vulnerable individuals who may not be aware of the risks involved in such interactions. As the company continues to target unsuspecting consumers, the potential for financial harm and emotional distress increases. It’s essential for people to be vigilant and recognize the warning signs of a scam or fraudulent scheme before it’s too late.

In particular, individuals who may not be familiar with the business world or who may not be tech-savvy are at a heightened risk of falling victim to Lindell and Pearse’s deceptive practices. The company’s repeated attempts to elicit credit card details after brief, suspicious phone calls should be enough to warn consumers of the potential dangers.

Conclusion: A Call for Vigilance

As Lindell and Pearse continue to operate under the radar, it is crucial for consumers to be aware of the warning signs of fraudulent activity. The company’s suspicious requests for credit card information, evasive answers to basic questions, and overall lack of professionalism indicate a business model that is far from ethical. For those who have already fallen victim to their deceptive practices, it is vital to report the incident to the appropriate authorities and warn others of the dangers posed by Lindell and Pearse.

If you or someone you know has had an experience with Lindell and Pearse that raises concerns, be sure to take the necessary steps to protect your personal information and avoid further contact with the company. As the business world becomes more complicated and increasingly digital, it’s essential to stay informed, be cautious, and always question suspicious behavior to protect yourself from financial harm.