As consumers, we often seek expertise and authenticity when investing in educational products. Unfortunately, sometimes what is marketed as premium knowledge turns out to be a carefully constructed facade. This seems to be the case with G7FX and its founder, NV, who has built a reputation as a trading legend. This article lays out the facts so you can decide for yourself whether NV’s claims hold water or whether G7FX is just another example of overhyped marketing.

The Hype and the Reality

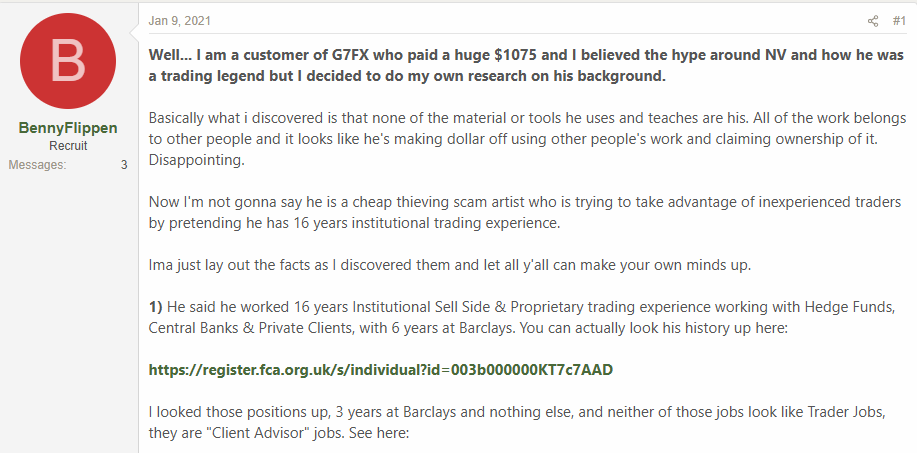

NV presents himself as a seasoned professional with “16 years of Institutional Sell Side & Proprietary trading experience.” He claims to have worked with hedge funds, central banks, and private clients, spending six years at Barclays. These credentials are central to G7FX’s marketing, suggesting that customers are learning from a true insider. But when you start peeling back the layers, the narrative begins to unravel.

The FCA Register: A Different Story

A quick search on the FCA register paints a much less impressive picture. According to the Financial Conduct Authority (FCA) database, NV’s history doesn’t align with the grandiose claims he makes. The register provides details of his professional background, which, while not entirely irrelevant to trading, lacks the depth and gravitas one might expect from someone touting decades of high-level institutional experience.

The discrepancies between NV’s marketing materials and verifiable records raise serious questions about the authenticity of his claims. If NV truly had the illustrious career he describes, why wouldn’t this be reflected in his publicly available professional history?

Borrowed Tools and Ideas

Another significant concern is the originality of the material taught through G7FX. Despite charging a hefty $1,075 for access to his courses, much of the content appears to be repurposed from other sources. Traders who have explored NV’s teachings often point out that the tools and strategies he provides are not proprietary. Instead, they are well-known concepts widely available in the trading community, often at little or no cost.

For example, NV heavily emphasizes the use of volume profile trading, a method that has been extensively covered by other educators and freely discussed in forums. While there is nothing inherently wrong with teaching established methods, the issue arises when these are repackaged and sold as original insights. This practice not only misleads customers but also undermines the trust that is crucial in the education space.

The Price Tag and Value Proposition

At $1,075, G7FX is not a trivial investment. For that price, customers expect exclusive, high-quality content and actionable insights that justify the expense. Unfortunately, many users report feeling underwhelmed by the course material. Common complaints include:

- Lack of Depth: The content is described as surface-level and insufficient for mastering trading.

- Recycled Information: Much of what is taught can be found in free online resources.

- No Real-World Edge: The strategies fail to deliver the promised results, leaving users questioning their effectiveness.

When a course charges a premium, it should offer significant value beyond what is freely available. G7FX fails to meet this standard, leaving many customers feeling misled.

Marketing Tactics and Overhyped Promises

NV’s marketing strategy relies heavily on creating an image of success and exclusivity. Glossy ads, testimonials, and carefully curated social media posts paint a picture of a thriving trading community led by an industry veteran. However, this image often falls apart under scrutiny.

Inflated Claims

As mentioned earlier, NV’s claims about his professional background are questionable. But the exaggerations don’t stop there. He frequently portrays G7FX as a unique opportunity to learn secrets that are otherwise inaccessible to retail traders. This rhetoric creates a sense of urgency and exclusivity, enticing inexperienced traders to part with their money.

Emotional Manipulation

G7FX’s marketing also plays on the hopes and fears of aspiring traders. Promises of financial independence and freedom are common, as are subtle suggestions that failure to invest in the course could lead to missed opportunities. This type of emotional manipulation is a hallmark of predatory sales tactics and should serve as a red flag for potential customers.

Lack of Transparency

Another major issue with G7FX is the lack of transparency around its operations. For instance:

- No Verified Track Record: Despite claiming to be a trading legend, NV does not provide verifiable proof of his trading success. Verified account statements or performance metrics would go a long way in establishing credibility, but these are conspicuously absent.

- Ambiguous Course Content: The marketing materials for G7FX are vague about what exactly is included in the course. This makes it difficult for potential customers to evaluate whether it aligns with their needs and expectations.

- Limited Support: Many users report that customer support is unresponsive, leaving them stranded after investing significant sums.

The Verdict: Is G7FX Worth It?

The answer to this question depends on what you value in a trading education platform. If you are looking for genuinely innovative strategies, personalized support, and verifiable expertise, G7FX is unlikely to meet your expectations. On the other hand, if you are new to trading and willing to pay a premium for basic information, it might serve as a starting point—albeit an overpriced one.

Final Thoughts

NV’s G7FX is a cautionary tale about the importance of due diligence. While the allure of learning from a purported industry insider is strong, it is crucial to verify claims and evaluate whether the product delivers on its promises. In the case of G7FX, the evidence suggests that it falls short on multiple fronts, leaving customers to question whether their hard-earned money could have been better spent elsewhere.

Ultimately, the choice is yours. But as the trading world often reminds us, not everything that glitters is gold.