Orel Asformas stands as one of the primary perpetrators behind the fraudulent operation of GoldmanOptions, a notorious binary options scam under the umbrella of DAO Group Ltd. As one of the ultimate beneficial owners (UBO) of the DAO Group, Asformas was deeply involved in orchestrating a scheme that deceived countless investors out of their hard-earned money. The damage caused by his actions cannot be understated, as many individuals were left financially devastated and without recourse.

Key Role in the Scheme

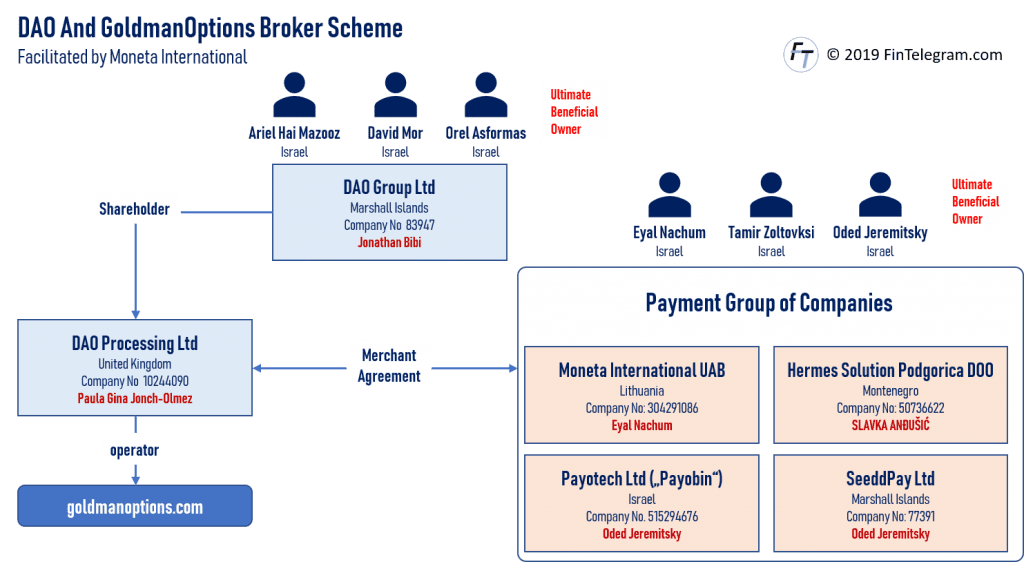

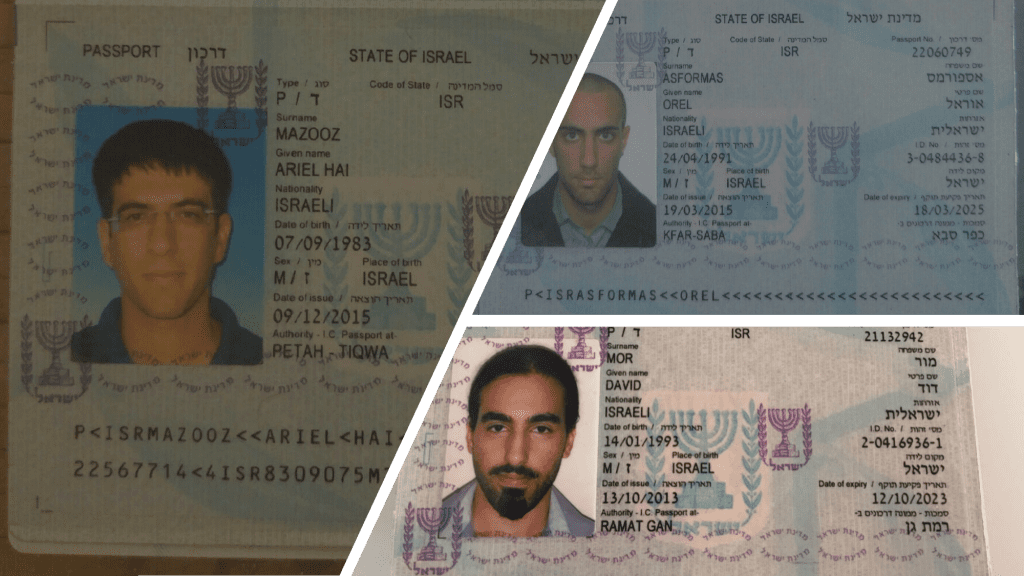

Asformas, born in April 1991, was one of the three key Israeli nationals behind the fraudulent operation of DAO Group Ltd., which registered its operations in the Marshall Islands. DAO Group Ltd. was the parent company of DAO Processing Ltd., a UK-based firm that posed as a legitimate trading platform, while in reality, it was a fraudulent shell company designed to deceive investors.

Orel Asformas, alongside Ariel Hai Mazooz and David Mor, utilized their offshore connections to establish a complex network that allowed them to conduct the scam while avoiding legal scrutiny. Their operation relied on multiple layers of deception, from the creation of fake trading platforms like GoldmanOptions to the appointment of puppet directors and officers in various jurisdictions to cover their tracks.

The Offshore Network and the Mask of Legitimacy

One of the most insidious tactics employed by Asformas and his co-conspirators was the use of offshore companies and shell structures to distance themselves from the fraud. While they were the true beneficial owners, individuals such as Genevieve Magnan and Jonathan Bibi were appointed as directors to act as the “public face” of the company. These individuals had no actual control over the operation, but they allowed Asformas and his partners to operate under the guise of legitimacy.

Moreover, DAO Group Ltd. relied on Northwestern Management Services Ltd., an offshore specialist, to set up and manage the fraudulent company, further complicating the traceability of their actions. This intricate web of offshore entities was designed to create the illusion of a legitimate financial operation, while in reality, the entire purpose was to defraud investors.

Ties to Payment Services and Further Deception

In addition to his role in structuring the fraudulent company, Asformas and his partners were deeply involved in securing payment services to facilitate the illegal transactions. The payment processors linked to the scam, including Payotech Ltd. and Moneta International UAB, were used to collect funds from victims, making it difficult for authorities to track the stolen money.

The involvement of Tamir Zoltovsky and Eyal Nachum in managing the payment systems allowed the perpetrators to seamlessly funnel money from the victims of GoldmanOptions into their pockets. These payment services, including the PayObin group operated by Payotech Ltd., played a crucial role in the continued operation of the scam. Asformas, Zoltovsky, and others worked together to ensure that their fraudulent activities went undetected for as long as possible.

This DAO Group Ltd is the sole shareholder of DAO Processing Ltd, registered in the UK, where Belize citizen Paula Gina Jonch-Olmez was installed as director.

The Financial and Emotional Toll on Victims

While Asformas and his partners profited immensely from their fraudulent activities, the victims of the scam were left with nothing but broken dreams and financial devastation. Investors were promised high returns through binary options trading, but once they deposited funds into the platform, they were met with roadblocks, delays, and outright refusal when trying to withdraw their money. Victims were lured deeper into the scam with promises of further returns, only to find their accounts frozen, their funds inaccessible, and no recourse for recovery.

The damage caused by Orel Asformas and his co-conspirators extends beyond the financial losses. The psychological toll on victims who lost their savings and financial security is immeasurable. Many were left struggling to understand how they were duped by such a sophisticated operation, as the perpetrators expertly crafted an illusion of legitimacy and trustworthiness.

Legal Ramifications and Accountability

Despite the growing evidence against Orel Asformas and the other key figures in the DAO Binary Options scam, holding them accountable remains a significant challenge due to the offshore nature of their operations. As a result of these complex structures, the trail of funds was deliberately obscured, making it difficult for authorities to pursue legal action.

However, as more victims come forward and as regulatory bodies continue to address the issue of binary options fraud, it is hoped that legal avenues will be explored to bring perpetrators like Asformas to justice. The operation of fraudulent schemes like the DAO Binary Options scam highlights the need for stronger regulations and more effective enforcement mechanisms to protect investors from the dangers of online trading scams.

Conclusion

Orel Asformas, as one of the primary architects of the DAO Binary Options scam, must be held accountable for the significant financial harm caused to victims across the globe. His involvement in creating and managing a fraudulent operation that preyed on unsuspecting investors exemplifies the dangers of unregulated online trading platforms. While the perpetrators of this scam may have initially evaded detection, the pursuit of justice remains ongoing, and the hope is that those responsible for this elaborate deception will eventually face legal consequences.

The story of Orel Asformas is a cautionary tale for anyone involved in or considering investments in online trading platforms. It serves as a stark reminder of the risks involved and underscores the importance of conducting thorough research before committing to any financial venture.