In the highly competitive world of forex trading, brokers play a crucial role in determining the success or failure of traders. Ideally, brokers should provide a transparent, reliable, and supportive environment where traders can focus on their strategies without concerns over manipulation or unfair practices. Unfortunately, N1CM (Number One Capital Markets) has demonstrated a worrying pattern of behavior that raises serious concerns for potential clients. Established in 2017 and regulated by the VFSC in Vanuatu, N1CM markets itself as a reputable broker offering high leverage, low spreads, and a wide range of trading instruments. However, a closer look at trader reviews and experiences reveals a much darker reality: slow withdrawals, price manipulation, subpar customer service, and questionable business practices that ultimately make it a broker to avoid.

An Overview of N1CM

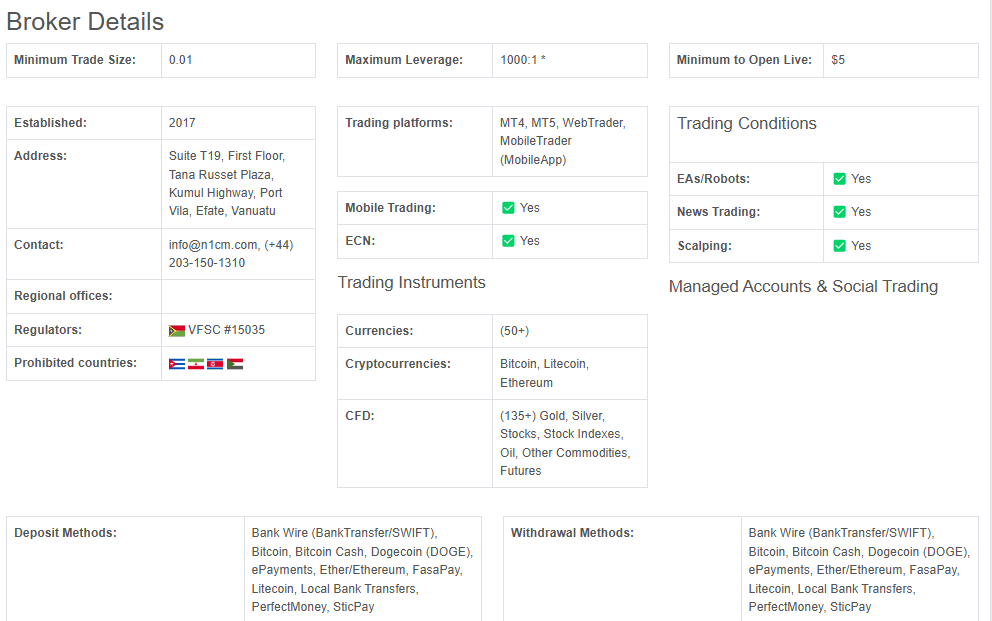

N1CM positions itself as a forex and CFD broker catering to a global audience, including U.S. clients, due to its offshore location in Vanuatu. The company offers its services with a significant leverage of 1000:1, which is attractive to many traders, especially those with limited capital. Their platform options include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader, all of which are popular among retail traders. Additionally, N1CM provides access to over 50 forex pairs, cryptocurrencies, commodities like gold and silver, indices, and stocks.

The broker allows users to trade with a minimum deposit of $5 and offers several deposit and withdrawal options, including cryptocurrency transactions. The range of trading instruments and deposit methods might initially seem appealing, especially for novice traders. However, a deeper dive into the experiences shared by its users paints a very different picture, which calls into question the integrity of N1CM’s operations.

The Red Flags: Untrustworthy Practices

1. Suspicious Price Spikes and Chart Manipulation

One of the most alarming complaints voiced by users of N1CM is the frequent and unusual price spikes on their trading charts, which seem to occur out of nowhere. Traders have reported discrepancies in price movements on N1CM’s platform when compared to other brokers or charting tools like TradingView. In some cases, these price spikes have been as large as 200 to 2,000 pips, which is far beyond what would be considered normal market fluctuations.

For example, a user comparing charts from N1CM and other brokers noticed massive differences in price movements during key market events. A specific instance involved a price spike that differed by over 1,000 pips between N1CM’s chart and others, which raises suspicion that the broker could be engaging in “stop-loss hunting” tactics — a practice where brokers intentionally spike prices to trigger the stop-loss orders of traders, thereby causing them to lose money.

When confronted with these issues, N1CM’s support team has been reported to downplay the problem, insisting that there is no issue with their charts. This lack of transparency and refusal to acknowledge the discrepancies suggests a deliberate effort to cover up potentially fraudulent behavior. Traders have rightfully raised concerns that N1CM’s pricing is manipulated to the detriment of retail traders, leading to significant losses.

2. Slow Withdrawals and Poor Customer Support

While N1CM claims to offer quick deposit times, many traders have reported a very different experience when it comes to withdrawals. Despite offering cryptocurrency options for both deposits and withdrawals, users have encountered long delays in receiving their funds. This is particularly concerning given the nature of cryptocurrency transactions, which are typically processed within minutes or hours. Traders have expressed frustration at the slow pace of withdrawals, which can take days, if not longer.

In addition to withdrawal issues, the customer support at N1CM has been criticized for its poor responsiveness. Many traders have reported that the chat support is unavailable during crucial times, especially when they are facing issues with withdrawals or chart discrepancies. Traders have also complained about the lack of communication and the feeling that their concerns are being ignored. When support is available, it is often unhelpful, offering generic responses without addressing the specific issues at hand. In one particularly troubling case, a trader who reported suspicious price movements was told that “nothing was wrong” with the charts, despite clear evidence to the contrary.

3. Manipulative Trading Conditions

Another disturbing trend reported by traders is the aggressive use of leverage and its negative impact on their trading success. While the high leverage (up to 1000:1) may seem appealing to traders looking to maximize their profits, it can also lead to devastating losses, particularly for those with limited experience. Although N1CM allows hedging, scalping, and the use of Expert Advisors (EAs), many traders have found that the broker’s conditions are not conducive to profitable trading. The combination of low spreads and high leverage creates an environment where traders are more likely to lose money than make it.

One user, a fund manager, noted that the broker’s spreads were especially high during overnight trading, which further eroded their potential profits. The broker’s failure to meet expectations on order execution speed and the quality of its trading conditions has left many traders feeling misled and dissatisfied.

4. Withdrawal Policies: A Hidden Trap

N1CM’s deposit options are quick and seamless, especially when using cryptocurrencies. However, this efficiency is not mirrored in their withdrawal policies. Users have reported that despite using the same cryptocurrency methods for deposits and withdrawals, the latter is delayed significantly. In some cases, traders have waited days for their funds to be processed, only to receive vague explanations from customer support.

This delay in withdrawals raises serious questions about N1CM’s business practices. The fact that they are quick to accept deposits but slow to process withdrawals is a classic warning sign of a potentially fraudulent broker. In the forex trading world, delays in withdrawals are often indicative of financial instability or an attempt to retain clients’ funds.

The Regulatory Concerns

N1CM is regulated by the Vanuatu Financial Services Commission (VFSC), which is widely regarded as one of the more lenient regulatory bodies in the forex industry. While the VFSC does provide some oversight, it is not on par with more established regulatory authorities like the UK’s FCA or the Australian ASIC. This lack of stringent regulation raises further concerns about the broker’s reliability and trustworthiness.

The VFSC’s relatively lax oversight means that N1CM is able to operate with fewer restrictions, which could explain some of the questionable practices reported by traders. Given the offshore nature of the broker and its regulatory environment, it is essential for traders to exercise caution before committing their funds to N1CM.

User Testimonials: A Dismal Track Record

The majority of user reviews for N1CM paint a picture of frustration, mistrust, and dissatisfaction. Many traders have shared their experiences of being misled by the broker’s promises of low spreads, quick deposits, and high leverage, only to encounter significant issues with price manipulation, slow withdrawals, and poor customer support.

One review, written by a trader who used N1CM for several months, highlights the broker’s inability to provide the necessary support during critical times. The trader expressed frustration with the slow response times from the support team and the lack of transparency regarding withdrawal delays. Another review from a user based in the Philippines praised the broker’s low spreads but lamented the lack of support when issues arose.

The most damning review, however, came from a trader who reported suspicious price spikes and discrepancies between N1CM’s charts and other brokers’ charts. Despite providing evidence of these issues, the trader was met with dismissive responses from the support team, which ultimately led them to stop trading with N1CM altogether.

Conclusion: A Broker to Avoid

While N1CM might seem attractive at first due to its high leverage, low spreads, and wide range of deposit options, the overwhelming majority of user experiences suggest that it is a broker with significant trust issues. From slow withdrawals and unhelpful customer support to manipulative pricing and chart discrepancies, N1CM’s practices seem more aligned with those of a dubious operation than a reputable broker.

If you are a trader looking for a reliable, transparent, and trustworthy forex broker, it is advisable to stay away from N1CM. The risks associated with using this broker far outweigh any potential rewards. Whether you are a novice trader or a seasoned professional, the issues surrounding N1CM make it clear that it is not a broker you can rely on for fair and ethical trading conditions.

Final Warning: Traders Beware

For anyone considering N1CM as their forex broker, proceed with extreme caution. The company’s shady practices, including price manipulation, slow withdrawals, and unresponsive customer support, are serious red flags. In the end, traders should prioritize brokers with a solid regulatory framework, a proven track record of fair practices, and a commitment to transparency. N1CM fails on all these fronts, making it a broker you should avoid at all costs.