In the fast-paced world of online trading, countless individuals are seeking platforms to grow their investments. Nicholson Financial Service positions itself as a trustworthy portal for financial trading, yet a closer examination reveals it to be an elaborate facade. Beneath the promises of high returns and financial independence lies a murky web of deceit, manipulation, and outright fraud. This article dissects the dubious operations of Nicholson Financial Service, exposing the blatant red flags and why you should steer clear of this scam broker.

Potential Clone Company

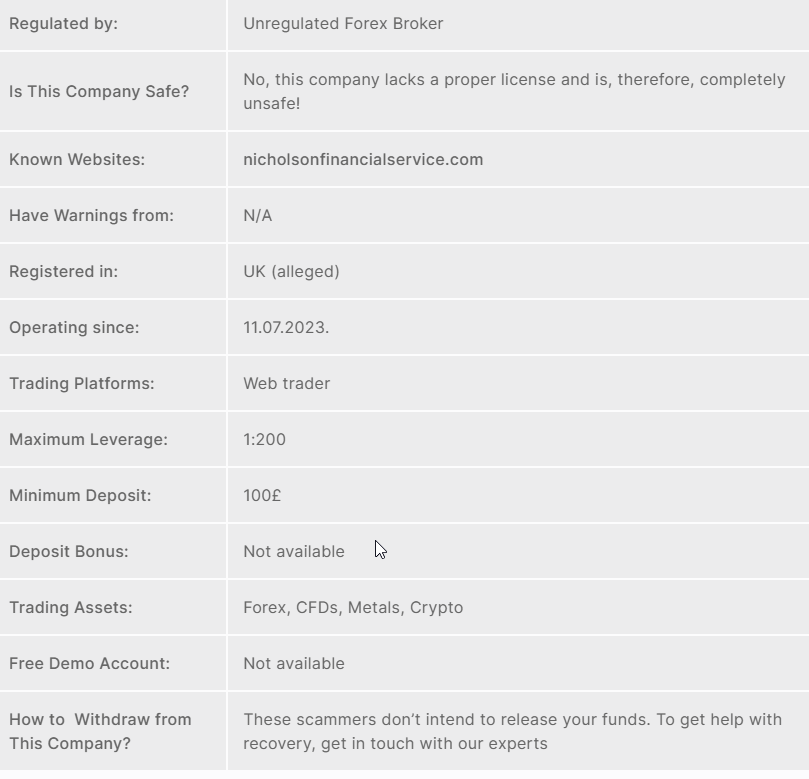

Nicholson Financial Service’s operations begin with a questionable premise. While the company claims to be registered in the UK, a search through the UK Companies House reveals no such entity under the provided address. Moreover, the Financial Conduct Authority (FCA) identifies a similarly named entity, yet this is a dormant company that has been unlicensed since 2003. This resemblance raises serious concerns that Nicholson Financial Service may be a clone company designed to piggyback off the credibility of a defunct but legitimate firm.

A thorough review of other regulatory bodies such as CySEC, BaFin, FINMA, and CONSOB confirms that Nicholson Financial Service operates without any regulatory oversight. This absence of legitimate credentials is a critical warning sign. Any financial firm that is not under regulatory supervision poses an immense risk to investors. It is prudent to avoid unregulated platforms like this one to safeguard your finances.

Fake Reviews Skew the Truth

Nicholson Financial Service appears to employ a well-oiled machine of fake reviews to manipulate public perception. Platforms such as SiteJabber and TrustPilot showcase glowing testimonials that contradict the experiences of actual users. A deeper dive into these reviews often reveals generic language and suspiciously high ratings that are inconsistent with the widespread complaints.

Conversely, genuine user reviews reveal a grim reality. Many victims recount tales of withheld withdrawals, demands for additional payments under the guise of taxes, and outright disappearance of funds. Unfortunately, these revelations often come too late for victims who initially believed the glowing, albeit fabricated, testimonials. This practice is a classic tactic employed by fraudulent brokers to maintain a veneer of legitimacy while continuing their predatory activities.

Active in Heavily Regulated Areas

Despite being unregulated, Nicholson Financial Service aggressively targets individuals in countries with strict financial regulations, such as the United Kingdom, the United States, Italy, and Australia. Their modus operandi involves boiler room agents posing as financial experts who lure victims with promises of quick and easy profits. Once the unsuspecting investors deposit their funds, they are met with a labyrinth of excuses and obstacles that make it nearly impossible to withdraw their money.

This strategy is particularly insidious as it preys on individuals’ aspirations for financial growth. By targeting regions with robust financial laws, Nicholson Financial Service aims to exploit the trust that potential clients have in their local regulatory frameworks, falsely assuming the broker’s legitimacy.

Trading Terms Designed for Failure

One of the most glaring indicators of Nicholson Financial Service’s fraudulent nature lies in its trading terms. The platform offers a maximum leverage of 1:200 on Forex majors, a figure far exceeding the legally permissible 1:30 leverage ratio within the European Economic Area (EEA). Such high leverage exposes traders to significant financial risks, making losses almost inevitable.

Additionally, the platform’s lack of transparency regarding spreads and trading commissions further highlights its dubious practices. Legitimate brokers prioritize transparency to ensure their clients make informed decisions. In stark contrast, Nicholson Financial Service appears to deliberately obscure vital details, prioritizing deception over ethical business practices.

Undefined Referral Structure

Nicholson Financial Service entices clients with the promise of passive income through a referral program. However, the scheme’s structure is shrouded in ambiguity. There is no information about commission rates, terms, or conditions. This lack of detail is yet another hallmark of a scam operation, as legitimate referral programs are always clear and well-defined.

By enticing clients to recruit others without clarifying the program’s mechanics, Nicholson Financial Service perpetuates a vicious cycle of exploitation. Such schemes often devolve into pyramid structures where only the top levels profit while others incur losses.

Subpar Trading Environment

Despite attempts to present itself as a sophisticated platform, Nicholson Financial Service’s trading environment is painfully inadequate. The web-based trading platform lacks essential features and tools, such as advanced charting utilities or automated trading options, that are standard in the industry. Instead, users are left with a basic interface that falls woefully short of professional-grade software like MetaTrader 4 or MetaTrader 5.

The platform’s rudimentary design also raises concerns about price manipulation. With such limited tools, the operators can easily alter market prices to exploit traders, further reinforcing the dangers of engaging with this broker.

Selection of Trading Assets

Nicholson Financial Service boasts a diverse array of trading assets, including Forex pairs, cryptocurrencies, stocks, indices, metals, and commodities. However, this variety is superficial. The lack of a detailed trading instrument table on the website and the absence of crucial information about asset spreads and trading conditions undermine its credibility.

Worse still, access to various financial products is contingent on exorbitant account tiers. For instance, trading cryptocurrencies requires an account deposit of £75,000. This pay-to-play model is not only exploitative but also indicative of the platform’s primary goal: to extract as much money as possible from its victims.

Compromised Credit Card Security

Nicholson Financial Service’s withdrawal process is riddled with complications and obfuscations. Legal documents outlining withdrawal procedures are nonexistent, leaving clients at the mercy of the platform’s arbitrary demands. Many victims report being asked to pay additional fees or taxes upfront, only to have their withdrawal requests denied.

Moreover, the platform’s reliance on credit cards for account funding puts clients’ financial information at significant risk. By sharing sensitive details with an unregulated entity, users expose themselves to potential fraud and identity theft. Even if funds are lost, recovery becomes an uphill battle without proper legal recourse.

Horrible Customer Service

Nicholson Financial Service’s customer support is virtually non-existent. The website offers a fake phone number, an unresponsive email address, and a sham contact form. Clients seeking assistance are often met with radio silence or outright dismissal. This lack of support further compounds the frustrations of victims who are already grappling with financial losses.

Conclusion: Avoid Nicholson Financial Service at All Costs

Nicholson Financial Service is a textbook example of a fraudulent broker preying on unsuspecting individuals. From its unregulated status and fake reviews to its exploitative trading terms and lack of transparency, every aspect of this platform screams scam. The promises of financial independence and high returns are mere bait to ensnare victims into a web of lies and theft.

If you have already fallen victim to Nicholson Financial Service, know that you are not alone, and recovery is possible. Start by filing a chargeback with your credit card provider and report the fraud to your local financial authorities. Legal assistance from recovery experts can also increase your chances of reclaiming your hard-earned money.

Stay vigilant and always conduct thorough research before entrusting your funds to any trading platform. Remember, if it seems too good to be true, it probably is.