Introduction

Accrue Real Estate, a Melbourne-based property investment firm, has attracted significant criticism over the years for its alleged misleading practices and high-pressure sales tactics. From regulatory penalties to a growing list of customer grievances, the company has faced considerable scrutiny. While it markets itself as a reliable partner for property investors, an in-depth look reveals a pattern of overpromising and underdelivering. This article delves into the controversies surrounding Accrue Real Estate, providing insight into why potential investors should approach this firm with caution.

Accrue’s Regulatory Issues and False Advertising Claims

In 2014, Consumer Affairs Victoria (CAV) investigated Accrue Real Estate and uncovered multiple instances of false or misleading advertising. The company had made nine unsubstantiated claims on its website, ranging from exaggerated investment returns to fictitious affiliations with government schemes. These claims, designed to lure unsuspecting investors, painted an inaccurate picture of the benefits offered by the company.

As a result of these findings, Accrue Real Estate faced significant penalties. The company was required to pay $5,000 to the Victorian Consumer Law Fund and implement a two-year compliance program to ensure adherence to Australian Consumer Law. Despite these measures, doubts about its commitment to ethical practices continue to linger.

Continued Issues with Transparency

Even after the regulatory intervention, Accrue Real Estate has struggled to shake off its reputation for misleading practices. The company’s marketing materials often highlight potential high returns and low risks, a common tactic used to entice inexperienced investors. However, many of these claims lack substantial evidence and do not align with the actual performance of the investments.

Former employees have also come forward, describing internal pressures to meet sales targets that often led to bending the truth about property values and potential returns. These testimonials paint a picture of a company more focused on making quick sales than providing genuine value to its clients.

Customer Complaints: Overpriced Properties and Poor Advice

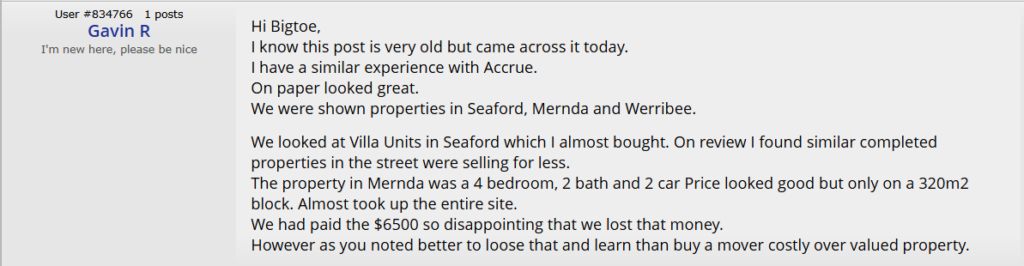

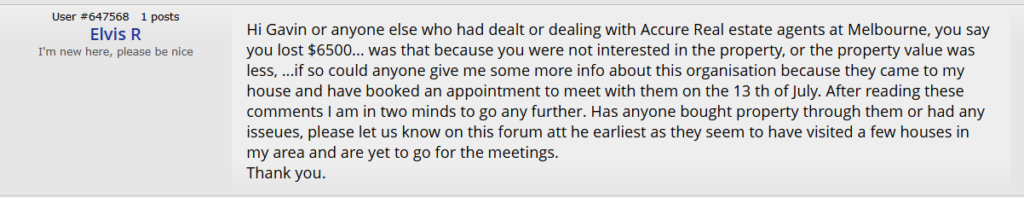

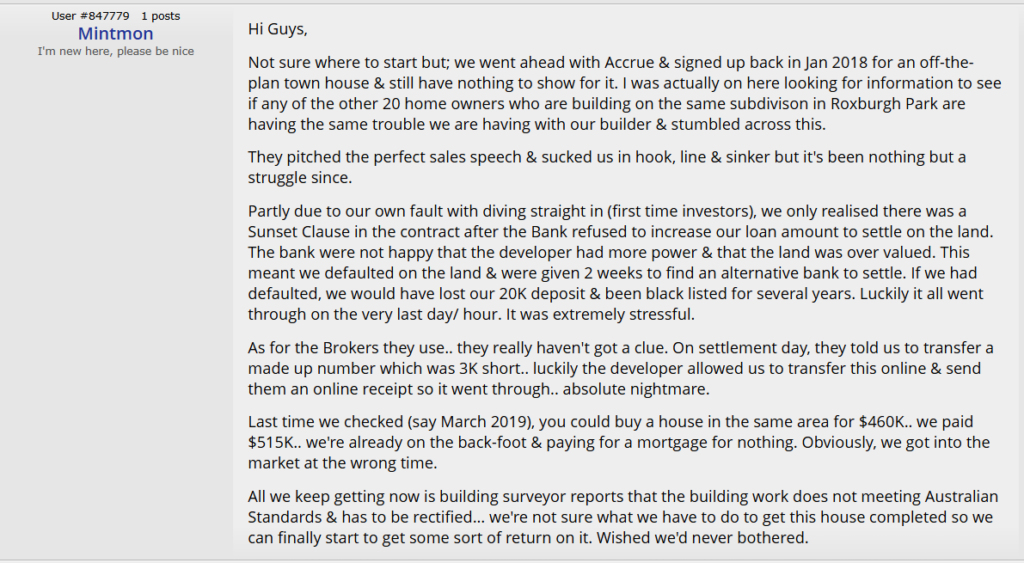

While the regulatory action raised red flags, customer experiences with Accrue Real Estate highlight deeper concerns. Online forums such as Whirlpool and PropertyChat have become hubs for disgruntled clients sharing their negative experiences with the company. Many clients allege that Accrue sources properties that are significantly overpriced, leading to poor investment returns.

One user on Whirlpool claimed that the properties were “massively overpriced” and built to low standards, which resulted in extended periods of vacancy. Another frequent complaint is Accrue’s use of in-house professionals, such as financial advisors and legal experts. This practice discourages clients from seeking independent advice, leaving many feeling trapped and uninformed about their investment decisions.

High Commissions and Aggressive Sales Tactics

High commissions and aggressive sales tactics are additional points of contention. Accrue’s sales team has been accused of pressuring potential clients to make hasty decisions, often without fully understanding the financial implications. These issues have eroded trust and led many to warn others against engaging with the firm.

Accrue’s salespeople reportedly employ high-pressure techniques to close deals quickly. Clients have shared stories of being contacted repeatedly by sales agents, urging them to invest immediately to take advantage of “limited-time offers.” This aggressive approach often leaves clients feeling coerced into making significant financial commitments without adequate time to consider their options.

The Impact on Investors

The combination of misleading advertising, overpriced properties, and aggressive sales tactics has had a detrimental effect on investors. Many have reported significant financial losses, with properties that failed to appreciate in value or generate the promised rental income. The disappointment and frustration expressed by these investors highlight the real-world consequences of Accrue’s business practices.

For instance, one investor recounted purchasing a property through Accrue that was sold at a price significantly higher than comparable properties in the area. The property remained vacant for months, leading to financial strain and stress. The investor’s attempts to seek redress from Accrue were met with little support, further exacerbating the sense of betrayal.

Lessons for Potential Investors

The controversies surrounding Accrue Real Estate underscore the importance of due diligence in property investment. Prospective investors must remain vigilant and skeptical when evaluating claims made by companies like Accrue. Relying solely on in-house professionals or flashy marketing materials can lead to costly mistakes.

Engaging independent financial advisors, conducting thorough market research, and comparing options from multiple providers are essential steps for avoiding pitfalls. By taking these precautions, investors can protect themselves from the kinds of negative experiences reported by many of Accrue’s clients.

Conclusion

Accrue Real Estate’s history of misleading advertising and widespread customer dissatisfaction paints a troubling picture. While the company continues to operate, its past actions raise serious concerns about its commitment to ethical business practices. For anyone considering property investment, the lesson is clear: approach firms like Accrue Real Estate with caution, and always prioritize transparency, independence, and thorough research in your decision-making process.

In summary, while Accrue Real Estate presents itself as a premier choice for property investment, the reality appears far different. The numerous regulatory issues, customer complaints, and high-pressure sales tactics suggest a company that prioritizes profit over ethical conduct. Potential investors should heed the warnings and take all necessary precautions to ensure their investments are safe and sound.