Introduction

For many aspiring traders, LBLV initially appeared as a promising gateway into the world of online trading. The platform boasted features designed to simplify financial trading and offered assurances of high returns on investments. However, user experiences have painted a far grimmer picture. With mounting accusations of malpractice, deceptive strategies, and financial exploitation, LBLV has gained notoriety for all the wrong reasons. This article delves into the platform’s troubled reputation, uncovering the reasons behind the widespread distrust and the financial pitfalls lurking beneath its surface.

Allegations Against LBLV

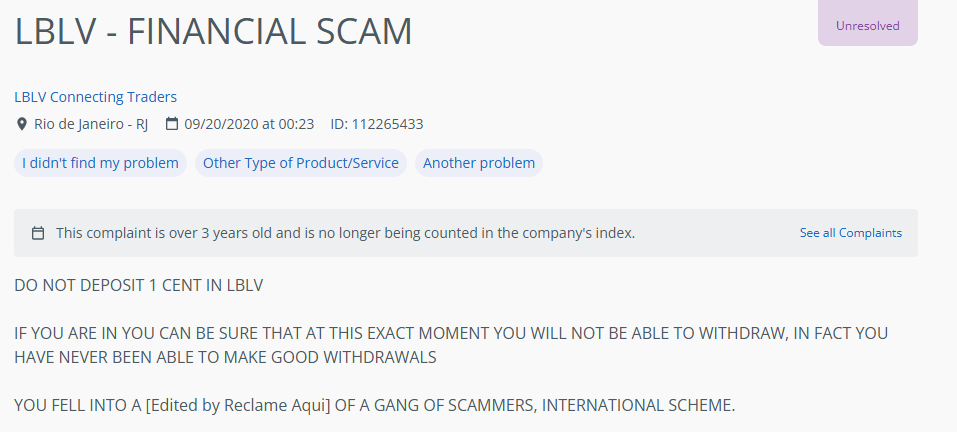

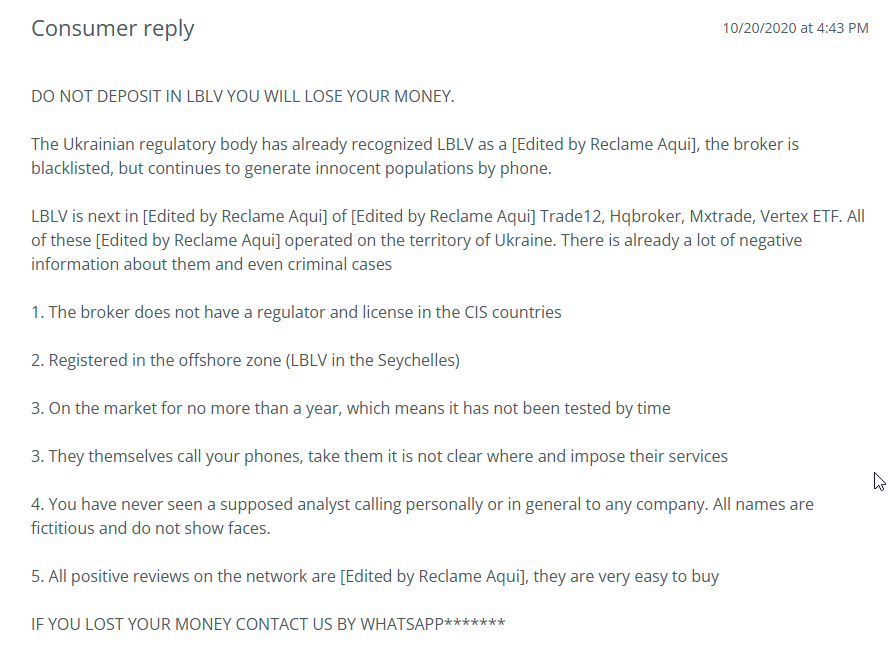

- Financial Deception and Scams: One of the most damning accusations against LBLV is its alleged involvement in orchestrating financial scams. Many traders report unexplained financial losses, manipulated trades, and blocked withdrawal attempts. Clients claim that the platform intervened in transactions to ensure losses, effectively siphoning money from their accounts while offering little to no recourse.

- Aggressive Sales Tactics: Users frequently recount experiences with LBLV representatives employing high-pressure sales strategies. By offering inflated promises of guaranteed returns and risk-free investments, agents reportedly coerced individuals to deposit substantial sums, leaving them financially exposed when returns failed to materialize.

- Opaque Terms and Conditions: A recurring theme in client grievances is the lack of clarity in LBLV’s operations. Hidden fees, high commissions, and complicated withdrawal policies often catch traders off guard. Clients report signing up under the impression of a straightforward trading process, only to be blindsided by terms that favor the platform’s financial interests over their own.

- Restricted Withdrawals and Non-Responsiveness: One of the most alarming concerns revolves around the alleged refusal or significant delays in processing client withdrawals. Customers have accused LBLV of ignoring withdrawal requests entirely or fabricating procedural hurdles to stall disbursements. Communication channels reportedly become inaccessible once clients attempt to reclaim their funds, leaving many in a state of financial distress.

- Misleading Financial Advice: Several users highlight a pattern of misleading advice provided by LBLV’s trading advisors. Instead of fostering success, traders were guided toward high-risk activities that culminated in massive losses. This further solidifies claims that LBLV operates with predatory intentions.

- Psychological Exploitation: In addition to financial manipulation, some users describe LBLV’s methods as psychologically exploitative. Persistent calls, fear-inducing tactics, and promises of “last-chance opportunities” pressured clients into decisions they later regretted. The emotional toll has been devastating for many, compounding the financial losses experienced.

Real Stories from Users

Testimonial 1: “LBLV is the worst experience I’ve ever had with a trading platform. After investing a significant portion of my savings, their so-called ‘experts’ led me into risky trades that resulted in total losses. When I tried withdrawing what little remained, they completely cut off communication.”

Testimonial 2: “The representatives wouldn’t stop calling me until I agreed to invest more money. I trusted their assurances, but when my profits were due for withdrawal, they either denied access or charged hidden fees that drained my account further. It’s a complete scam.”

Testimonial 3: “Every promise they made turned out to be a lie. Their ‘experts’ gave terrible advice, and when I pushed for answers about my account, they ghosted me. I’m emotionally and financially broken because of LBLV.”

Broader Implications for the Trading Industry

LBLV’s troubling reputation isn’t just a blemish on its name but casts a shadow over the wider trading platform ecosystem. Unregulated or loosely monitored platforms like LBLV prey on individuals with limited trading experience, exploiting their aspirations and financial naivety. The long-term damage caused by such operations ripples across the industry, diminishing public trust and discouraging potential investors.

- Loss of Public Confidence: The rising number of complaints against LBLV fuels a growing skepticism about online trading platforms. Trust is the cornerstone of financial investments, and platforms engaging in deceptive practices risk eroding it entirely.

- Impact on Inexperienced Traders: Beginners often fall victim to platforms like LBLV due to their lack of industry knowledge. These individuals end up financially crippled and disillusioned, leading to fewer fresh entrants into the trading space.

- Undermining Innovation: Genuine platforms and innovations within the trading sphere suffer collateral damage due to the actions of bad actors like LBLV. This taint on the industry stifles growth, innovation, and participation from more cautious investors.

Regulatory Oversight: The Need for Stronger Measures

The LBLV case underscores the urgent need for enhanced regulation and monitoring of trading platforms. Authorities must:

- Enforce transparency in fees and terms.

- Mandate stringent accountability for fund management.

- Penalize platforms that fail to honor withdrawal requests.

Countries with robust financial regulatory systems can act as benchmarks. For instance, strict compliance checks and mandatory user education enforced in regulated markets have proven effective in minimizing similar fraudulent activities. A global push towards uniform regulatory frameworks could shield investors worldwide.

Moving Forward: What Can Users Do?

For those considering investments in online trading platforms, due diligence is critical. Steps to protect yourself include:

- Thorough Research: Investigate any platform’s reputation on credible review sites and forums. Complaints against LBLV, for example, are widespread and often detailed enough to raise red flags.

- Avoid High-Pressure Tactics: Any platform aggressively pushing you to invest should be approached with skepticism. Ethical platforms will give you the time and space to make informed decisions.

- Seek Verified Regulations: Only trade with platforms registered and certified by reputable regulatory bodies. Verifying licenses can often save investors from falling into well-concealed traps.

- Consult Financial Advisors: Working with an independent, certified financial advisor can offer guidance and protect against exploitative schemes.

- Start Small and Diversify: If you decide to proceed with an untested platform, begin with a minimal investment and ensure your portfolio includes diversified investments. This limits potential losses while giving you time to evaluate the platform’s reliability.

Conclusion

LBLV stands as a stark warning in the online trading landscape, epitomizing the pitfalls of unregulated platforms. It is a glaring example of how misleading promises and unethical practices can leave traders financially devastated. For investors, the onus lies in exercising extreme caution and seeking transparency and accountability in any trading venture.

The LBLV story also serves as a wake-up call for global regulators and industry leaders. It highlights the urgent need to clamp down on fraudulent operators and to create a protective environment that prioritizes trader well-being. By fostering stringent guidelines and promoting financial literacy, the industry can slowly rebuild trust and encourage responsible investing practices. Meanwhile, potential traders must remain vigilant, aware that their financial security is a responsibility that no platform should compromise.