Introduction: A Precious Metals Dealer Under Heavy Fire

Provident Metals, a prominent online dealer of gold, silver, and IRA-eligible investments, presents itself as a trusted source for precious metals. However, beneath its polished website lies a disturbing reality—over 1,200 consumer complaints, multiple federal lawsuits, and serious allegations of systemic fraud. This investigation reveals a long history of red flags that every investor must know before considering providentmetals.com.

Section 1: Shady Leadership and Ownership Deception

The Merrick Connection: Who’s Really in Charge?

Provident Metals has long been associated with Joe Merrick, who appears in company press releases as its President. However, leaked ZoomInfo profiles expose that Joshua Merrick—Joe’s relative—served as Creative Director until 2023 before shifting to CEO of Buzz Geek SEO. This raises serious concerns about accountability, particularly when paired with:

- Undisclosed Bankruptcy Rumors: Employees reported fears of bankruptcy in 2018, accusing management of concealing financial struggles.

- Acquisition Confusion: Provident was acquired by a private investor group in 2017, yet customer service deteriorated drastically post-sale.

Section 2: A Pattern of Fraud – Consumer Complaints and Red Flags

14 Years of Misleading Business Practices

A comprehensive analysis of 44 SiteJabber reviews, BBB complaints, and lawsuits uncovers disturbing trends:

1. Shipping Scams and Lost Orders

- Wrong Address Fraud: Customers report their orders being intentionally sent to outdated addresses, despite updated profiles, with Provident refusing to issue refunds.

- Signature Bypass Scheme: UPS drivers allegedly forged customer signatures, leaving $20,000+ shipments in unsecured mailboxes.

2. Inferior or Counterfeit Products

- Damaged Goods: Coins arrive scratched due to improper packaging.

- Counterfeit Silver Allegations: A 2023 BBB complaint states that a customer’s silver bars failed purity tests using a Precious Metals Verifier Pro.

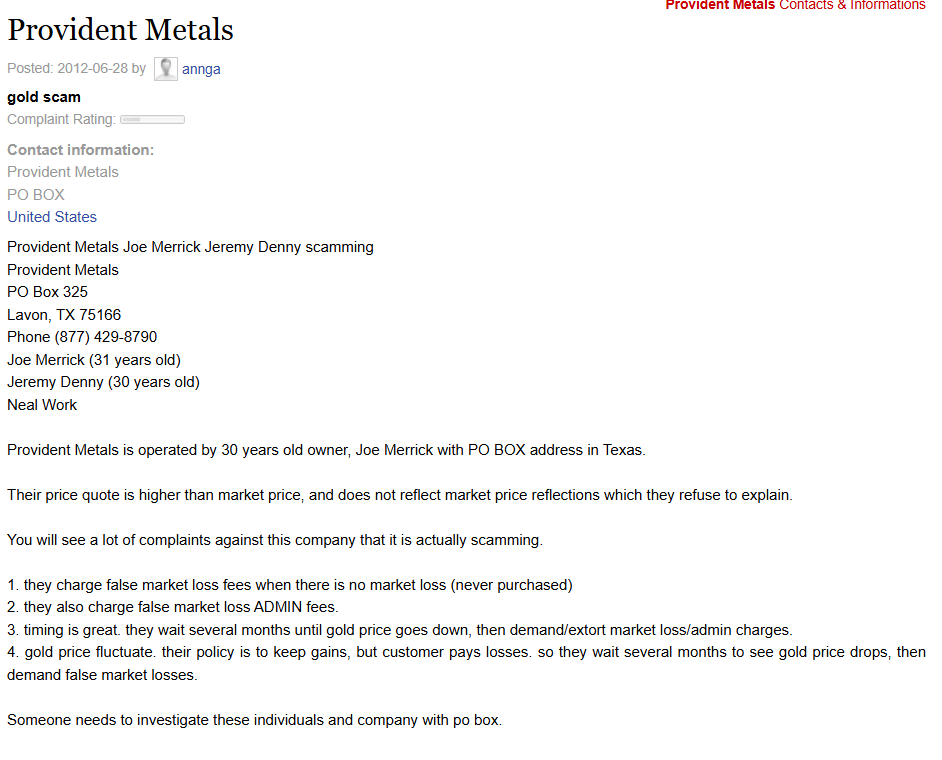

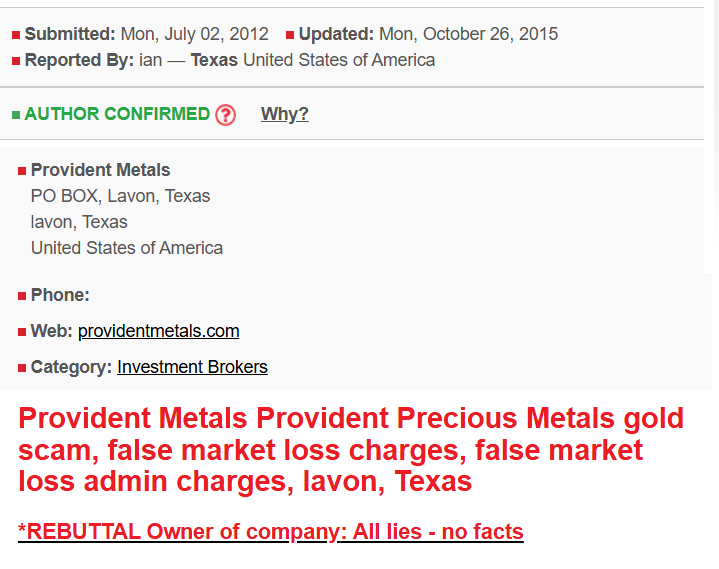

3. Predatory Financial Practices

- Unjustified Market Loss Fees: A retired federal agent accused Provident of illegally charging $1,179 in disputed fees.

- ACH Payment Manipulation: Reports of unauthorized wire transfers and unexplained $32 phantom charges.

Section 3: Legal Troubles and Regulatory Red Flags

Multiple Lawsuits and FTC Concerns

- Carmack Amendment Violations: A 2022 lawsuit (Shugart v. Provident Metals) accuses Provident of mishandling $14,925 in gold shipments.

- FTC-Linked Payment Partners: Provident’s financial partner, Merrick Bank, was implicated in a $4.6M fraud scheme.

Anti-Money Laundering Red Flags

Singapore’s guidelines on precious metals transactions flag Provident Metals as high-risk due to:

- Structured Payments: Complaints describe orders being split to avoid legal reporting thresholds.

- Suspicious Third-Party Transactions: Refunds reportedly diverted to unverified accounts.

Section 4: A Web of Related Businesses with Troubling Histories

Provident Metals’ issues extend beyond its own operations, tying into a concerning network of associated businesses:

- Dillon Gage Metals: Inventory partner frequently named in customer complaints.

- A-Mark Precious Metals & JM Bullion: Co-defendants in lawsuits regarding misrepresentation.

- Buzz Geek SEO: Joshua Merrick’s current venture, raising transparency concerns about Provident’s digital presence.

Section 5: Consumer Alert – How to Protect Yourself

8 Red Flags That Signal a Risky Dealer

- High-pressure tactics to waive signature requirements.

- Orders delayed more than three weeks despite being listed as “in stock.”

- Refusal to honor industry-standard assay tests for purity verification.

- Sudden changes in payment methods (e.g., forcing customers to switch from credit card to wire transfer).

- Frequent use of unreliable third-party logistics partners like UPS.

Conclusion: A Dealer to Avoid at All Costs

With hundreds of unresolved BBB complaints, multiple active lawsuits, and serious allegations of fraud, Provident Metals represents a significant financial risk for investors. Those looking for legitimate precious metals dealers should consider alternatives like APMEX or SD Bullion, which offer transparent auditing, superior service, and far fewer controversies.