Introduction

Accrue Real Estate, a Melbourne-based property investment firm, has amassed a reputation not for success, but for controversy. Accused of deceptive practices, aggressive sales tactics, and selling overpriced properties, the company has repeatedly faced regulatory scrutiny and investor backlash. Despite marketing itself as a trustworthy partner for property investors, the reality is far different. This article exposes the disturbing truths behind Accrue Real Estate, revealing why investors should avoid this firm at all costs.

A Web of Deception: Investigations and Damning Reports

Multiple investigative reports have exposed Accrue Real Estate’s unethical practices. Various sources detail the company’s manipulation of investors through inflated property values and high-pressure sales tactics. Reports have outlined the financial ruin experienced by clients who trusted the firm.

Consumer Affairs Victoria has repeatedly investigated Accrue Real Estate, uncovering misleading advertising, falsified affiliations, and exaggerated investment returns. Further investigations highlight patterns of deceit and customer dissatisfaction. Some allegations go beyond unethical sales tactics, suggesting potential legal consequences for the firm.

Investor Nightmares: Overpriced Properties and Poor Advice

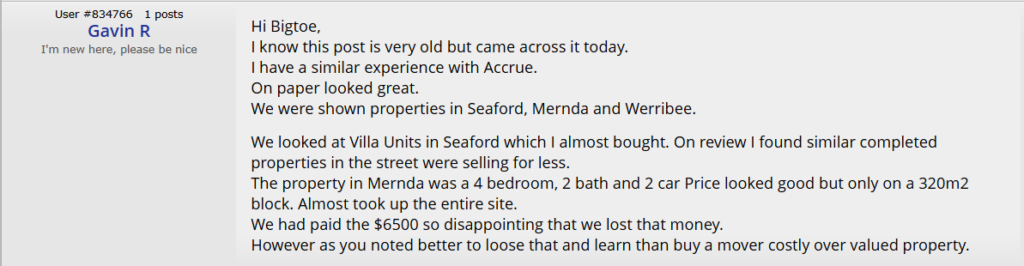

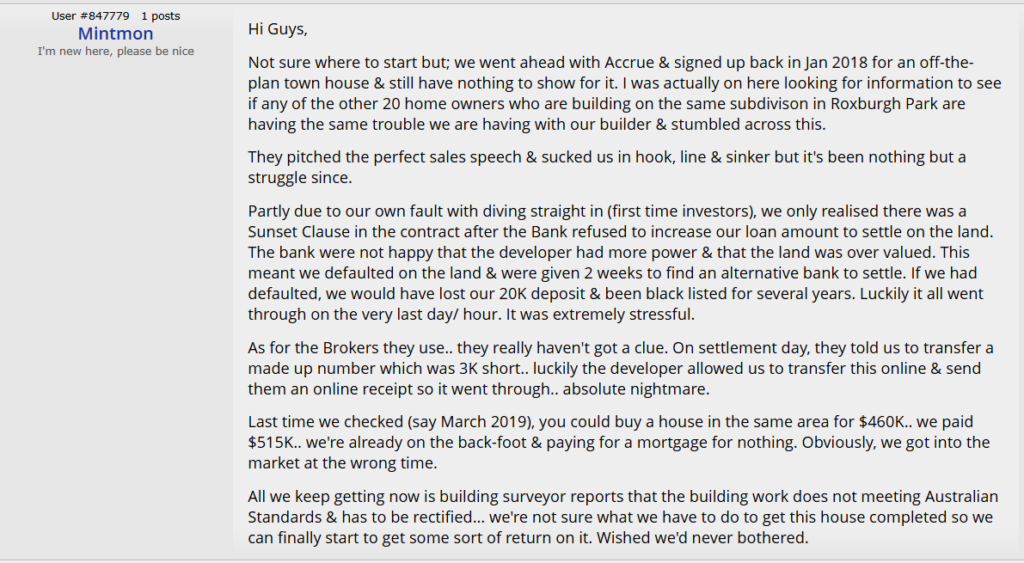

A simple search on online forums like Whirlpool and PropertyChat reveals a wave of investor horror stories. Customers have repeatedly alleged that Accrue deliberately sources properties that are massively inflated in price, offering little to no appreciation over time.

One disgruntled investor described their experience as “a financial nightmare,” citing how their Accrue-purchased property was significantly overvalued compared to others in the area. Left struggling with mortgage payments on a property that failed to generate rental income, they were met with silence when they sought accountability from Accrue Real Estate.

Another common issue is Accrue’s in-house network of professionals, including financial advisors and legal experts. These so-called experts discourage investors from seeking independent advice, ensuring clients remain in the dark about the true risks of their purchases. Many investors later realize they have been manipulated into deals that primarily serve Accrue’s bottom line, not their financial well-being.

High-Pressure Sales Tactics and Ruthless Commissions

Accrue Real Estate’s aggressive sales approach has also fueled widespread criticism. Reports indicate that their sales team employs high-pressure tactics to coerce potential investors into making rushed decisions. Many victims recount receiving persistent calls, being misled about “limited-time opportunities,” and being pushed into transactions without adequate time to conduct due diligence.

Beyond these predatory sales tactics, Accrue’s commission structure is another red flag. The company’s financial model relies heavily on hefty commissions from property sales, creating a perverse incentive to push overpriced properties onto unsuspecting buyers. Instead of focusing on long-term client success, Accrue is primarily concerned with maximizing its own profits at investors’ expense.

The Real Cost to Investors: Financial Ruin and Emotional Stress

Accrue Real Estate’s deceptive practices have had devastating consequences for investors. Many have suffered significant financial losses, with properties failing to appreciate or even experiencing declines in value. Some clients have found themselves trapped in mortgages on unprofitable properties, forced to either sell at a loss or endure prolonged periods of vacancy.

One investor shared their experience of purchasing a property through Accrue, only to find it valued far below the purchase price upon independent appraisal. The stress of dealing with an underperforming investment, coupled with Accrue’s lack of support, led to severe financial and emotional strain.

A Warning to Potential Investors

The ongoing controversy surrounding Accrue Real Estate serves as a stark warning to anyone considering property investment. The company’s history of deception, overpriced properties, and high-pressure sales tactics make it a clear risk for unsuspecting investors.

To safeguard their financial future, prospective investors must take several precautions:

Seek Independent Advice: Never rely solely on in-house financial advisors recommended by property firms.

Conduct Thorough Research: Investigate property values and market trends before committing to any deal.

Beware of High-Pressure Sales Tactics: Legitimate investment opportunities do not require immediate decisions under duress.

Compare Multiple Investment Firms: Do not settle for the first firm you come across; explore alternatives with proven track records of transparency and ethical practices.

Conclusion: Avoid Accrue Real Estate at All Costs

Accrue Real Estate’s long trail of misconduct, from false advertising to high-pressure sales, should serve as a dire warning to potential investors. While the company markets itself as a reliable investment partner, the reality is far grimmer. Investors have suffered financial setbacks, emotional distress, and a complete lack of accountability from Accrue.

For those looking to enter the property investment market, the lesson is clear: steer clear of Accrue Real Estate. Ethical, transparent investment opportunities exist, but they certainly won’t be found within the corridors of this notorious firm. Protect your finances, your future, and your peace of mind by avoiding Accrue Real Estate at all costs.