Introduction

Accrue Real Estate, a Melbourne-based property investment firm, has built its business on a foundation of deception, predatory sales tactics, and financial ruin for unsuspecting investors. With a history of regulatory penalties, relentless customer complaints, and unethical business practices, this company has left a trail of devastation in its wake. While Accrue markets itself as a trusted property investment partner, the truth is far more sinister. This article uncovers the shocking reality behind Accrue Real Estate’s operations and why investors must steer clear of this predatory firm.

Accrue’s Web of Lies: Regulatory Fines and False Advertising

In 2014, Consumer Affairs Victoria (CAV) launched an investigation into Accrue Real Estate, uncovering a disturbing pattern of deception. The company had posted nine false claims on its website, including grossly exaggerated investment returns and fabricated affiliations with government schemes. These outright lies were designed to manipulate and ensnare investors into making financially devastating commitments.

As a result, Accrue was hit with penalties, including a $5,000 payment to the Victorian Consumer Law Fund and the implementation of a two-year compliance program. Despite these sanctions, the company has continued to engage in misleading advertising, proving that regulatory fines do little to deter its unethical behavior.

Persistent Deception: A Never-Ending Cycle of Fraud

Even after being exposed, Accrue Real Estate has refused to change its ways. The company shamelessly lures in investors with promises of high returns and low risks—claims that are not only unverified but outright false. Instead of providing genuine opportunities, Accrue preys on inexperienced investors who lack the knowledge to see through its deceitful tactics.

Insider accounts from former employees reveal a toxic corporate culture driven by greed. Employees are pressured to close deals at any cost, often bending the truth about property values, financial gains, and long-term prospects. This relentless pursuit of profits has turned Accrue into one of Australia’s most notorious real estate scams.

Investor Horror Stories: Overpriced Properties and False Promises

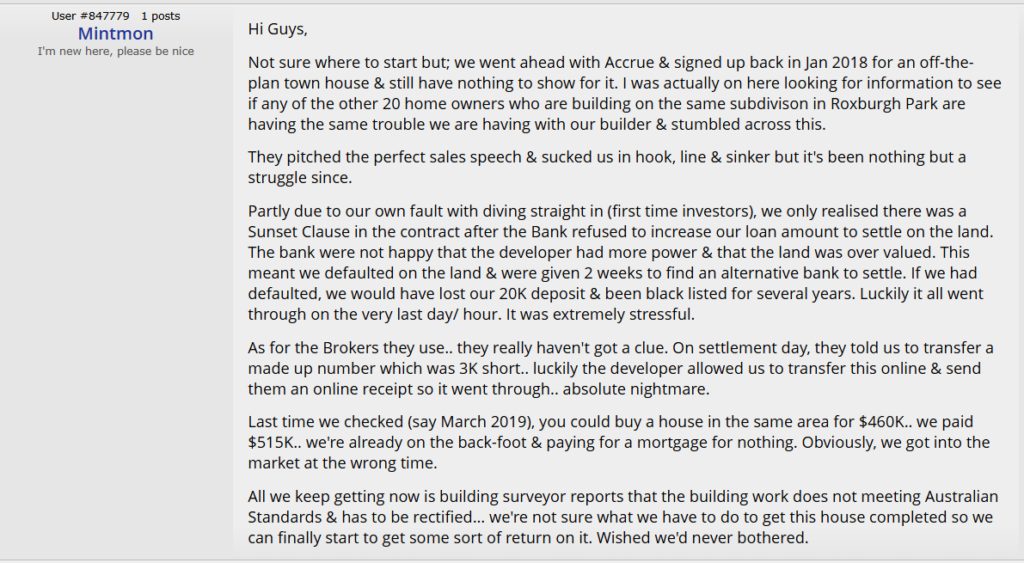

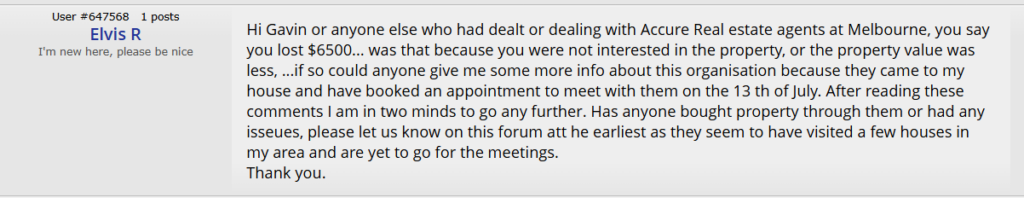

Accrue’s fraudulent practices have left countless investors struggling with financial losses. Online forums like Whirlpool and PropertyChat are filled with damning testimonies from victims who fell into Accrue’s trap.

One investor reported purchasing a property at a grossly inflated price, only to discover that similar properties in the same area were selling for tens of thousands less. Worse yet, the property remained vacant for months, leaving them drowning in mortgage payments with no rental income in sight.

Another common complaint is Accrue’s insistence that investors rely solely on their in-house professionals, including financial advisors and legal experts. By discouraging independent consultation, the company ensures that investors remain uninformed and trapped in disastrous deals that serve only to enrich Accrue’s executives.

Ruthless Sales Tactics: Manipulation and Pressure

Accrue Real Estate thrives on high-pressure sales techniques that leave investors feeling bullied into making rushed decisions. Victims have shared harrowing experiences of being bombarded with phone calls, emails, and even in-person visits, all pushing them to invest immediately in so-called “once-in-a-lifetime” opportunities.

These manipulative tactics are designed to prevent investors from conducting proper research or seeking independent financial advice. By instilling a sense of urgency and fear of missing out, Accrue coerces clients into signing contracts without fully understanding the financial risks involved.

The True Cost of Accrue’s Lies: Financial Devastation

The damage caused by Accrue Real Estate extends far beyond financial losses—it has left countless investors emotionally and mentally drained. Many have been forced to sell their properties at a loss, while others remain trapped in mortgage repayments for homes that will never generate the promised returns.

One particularly shocking case involved an investor who purchased a property through Accrue, only to discover that the valuation was completely falsified. Despite repeated attempts to contact the company for support, they were met with indifference and deflection. This investor, like so many others, was left to deal with the financial disaster alone.

Protect Yourself: How to Avoid Falling Victim to Accrue Real Estate

The ongoing controversy surrounding Accrue Real Estate serves as a dire warning to anyone considering property investment. To protect yourself from falling into a similar trap, follow these essential precautions:

- Never Trust In-House Advisors: Always seek independent financial and legal advice before making any investment decisions.

- Do Your Research: Investigate market trends, property values, and alternative investment options before committing.

- Beware of Pressure Tactics: A legitimate investment opportunity will never require an immediate decision.

- Avoid Firms with a History of Complaints: If a company has a long track record of customer grievances and regulatory penalties, it’s a major red flag.

Conclusion: Accrue Real Estate is a Dangerous Scam

Accrue Real Estate has built its business on lies, manipulation, and the financial suffering of its investors. Despite regulatory penalties and public outcry, the company continues to operate with complete disregard for ethical business practices. It is not an investment firm—it is a predatory scam designed to exploit unsuspecting buyers for maximum profit.

For anyone considering property investment, the message is clear: Avoid Accrue Real Estate at all costs. There are honest, transparent investment opportunities out there, but they won’t be found within the deceitful walls of this notorious company. Protect yourself, your finances, and your future by staying far away from Accrue Real Estate.