Introduction

Centurian Capital has recently come under intense scrutiny due to a growing number of allegations, scam reports, and negative reviews. This investigation aims to uncover the truth behind the company, its operations, and the numerous red flags that have been raised by consumers and industry experts alike. By analyzing available data, adverse media, and risk assessments, this report will provide a comprehensive overview of Centurian Capital’s questionable practices and the potential risks associated with engaging with the company.

Background on Centurian Capital

Centurian Capital presents itself as a financial services firm specializing in investment opportunities, wealth management, and capital growth strategies. However, despite its professional facade, the company has been accused of unethical practices, misleading clients, and failing to deliver on its promises. The following sections will delve into the specific allegations and red flags that have tarnished its reputation.

Allegations and Scam Reports

- Misleading Investment Promises

Numerous clients have accused Centurian Capital of making unrealistic promises about high returns on investments. These claims often lure unsuspecting individuals into investing significant sums of money, only to find that the promised returns never materialize. In some cases, clients have reported losing their entire investment due to the company’s mismanagement or outright fraud. - Lack of Transparency

A recurring theme in complaints against Centurian Capital is the lack of transparency in its operations. Clients have reported difficulty in obtaining clear information about how their funds are being managed, the risks involved, and the fees charged by the company. This opacity has led to widespread distrust and accusations of deceptive practices. - Pressure Tactics and Aggressive Sales

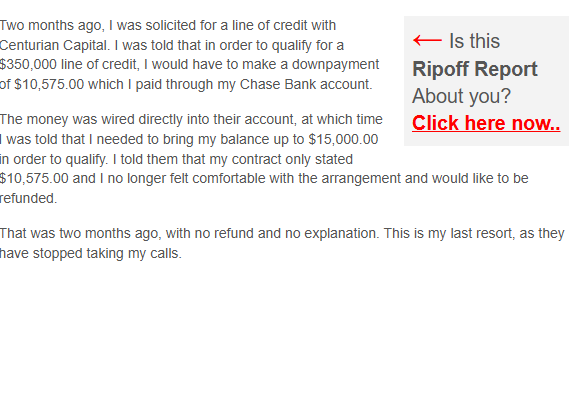

Several individuals have alleged that Centurian Capital employs high-pressure sales tactics to coerce clients into making quick investment decisions. These tactics often involve creating a false sense of urgency, leaving clients with little time to conduct due diligence or seek independent advice. - Failure to Honor Contracts

There are multiple reports of Centurian Capital failing to honor the terms of its contracts with clients. This includes failing to provide agreed-upon services, refusing to return funds upon request, and imposing hidden fees that were not disclosed at the outset. - Regulatory Violations

Centurian Capital has also been accused of operating in violation of financial regulations. Some clients have reported that the company failed to provide proper documentation or adhere to legal requirements, raising concerns about its legitimacy and compliance with industry standards.

Red Flags and Risk Assessment

- Unverified Credentials

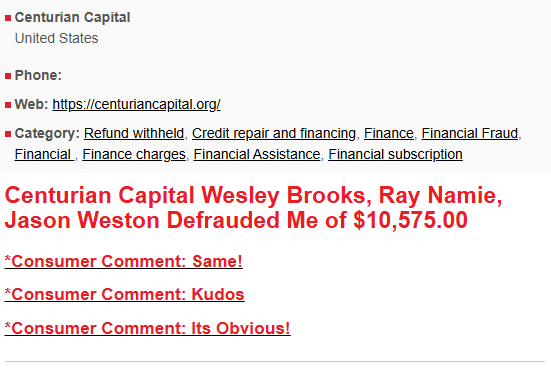

One of the most significant red flags associated with Centurian Capital is the lack of verifiable credentials for its key personnel. The company’s leadership, including individuals like Wesley Brooks, Ray Namie, and Jason, have been accused of operating under questionable backgrounds, with limited information available about their professional qualifications or track records. - Negative Online Reviews

A quick search reveals a plethora of negative reviews and complaints about Centurian Capital across various platforms. These reviews consistently highlight issues such as poor customer service, financial losses, and unethical behavior. The sheer volume of these complaints is a major red flag for anyone considering doing business with the company. - Adverse Media Coverage

Centurian Capital has been the subject of several adverse media reports, with journalists and industry watchdogs raising concerns about its business practices. These reports often cite anonymous sources and whistleblowers who allege that the company is involved in fraudulent activities. - High-Risk Investment Strategies

The company’s investment strategies have been described as high-risk and speculative, with little regard for the financial well-being of its clients. This approach has resulted in significant losses for many investors, further fueling allegations of mismanagement and negligence. - Lack of Accountability

Centurian Capital has been criticized for its lack of accountability when issues arise. Clients who have attempted to resolve disputes or seek refunds have reported being met with resistance, delays, and outright refusal to address their concerns.

Negative Reviews and Client Testimonials

The following are excerpts from real client testimonials and reviews that highlight the issues faced by those who have dealt with Centurian Capital:

- “I invested a substantial amount of money with Centurian Capital based on their promises of high returns. Not only did I not see any profits, but I also lost my entire investment. When I tried to get my money back, they ignored my calls and emails.”

- “The sales team pressured me into making a quick decision, and I later realized that I had been misled about the risks involved. I feel cheated and regret ever dealing with this company.”

- “Centurian Capital lacks transparency and professionalism. They refused to provide clear information about how my funds were being managed, and I had to hire a lawyer to get my money back.”

Adverse Media and Public Perception

Centurian Capital’s reputation has been further damaged by adverse media coverage. Several investigative reports have exposed the company’s questionable practices, including allegations of fraud, regulatory violations, and unethical behavior. These reports have contributed to a growing public perception that Centurian Capital is not a trustworthy or reliable financial services provider.

Conclusion and Final Assessment

Based on the evidence gathered, it is clear that Centurian Capital poses significant risks to potential clients. The company’s history of misleading promises, lack of transparency, and numerous scam allegations make it a high-risk entity that should be approached with extreme caution.

Investors are advised to conduct thorough due diligence before engaging with Centurian Capital or any similar firm. The red flags and negative reviews associated with the company serve as a stark warning to those considering its services.

In conclusion, Centurian Capital’s operations raise serious ethical and legal concerns, and it is imperative that regulatory authorities investigate the company to protect consumers from further harm.

Final Note

This investigation serves as a cautionary tale about the importance of vigilance in the financial services industry. Always verify the credentials of any company or individual offering investment opportunities, and seek independent advice before making any financial commitments.