Introduction: The Illusion of Wealth and Success

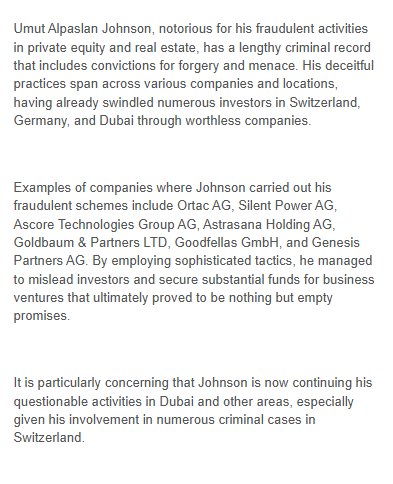

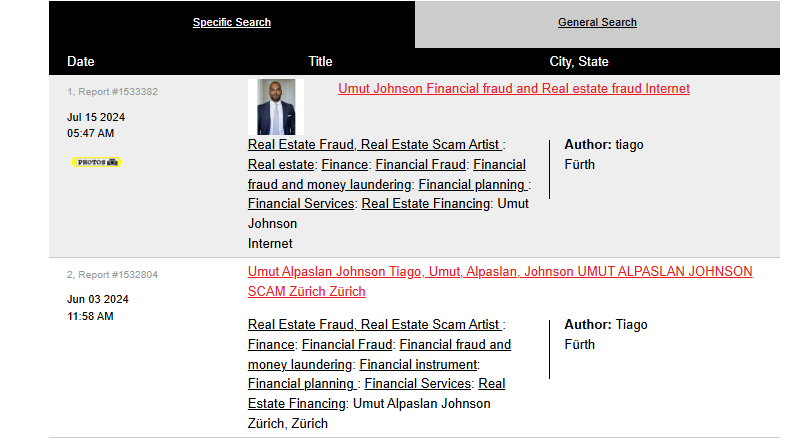

Umut Alpaslan Johnson, a self-proclaimed entrepreneur and financial guru, has positioned himself as a trusted advisor in the world of investments and wealth-building. Promising “life-changing returns” and “exclusive opportunities,” Johnson has attracted individuals seeking financial security. However, a growing number of complaints, including a verified Ripoff Report involving associates like Tiago and ZZRich, reveal a pattern of alleged fraud, financial exploitation, and systemic negligence. This investigation uncovers how Johnson’s polished image hides a reality of broken promises, stolen funds, and shattered dreams.

Broken Promises: Fake Investments and Phantom Returns

The Investment Scam

Johnson’s most common scheme involves luring victims into fake investment opportunities. One victim, a retired teacher from California, invested $50,000 in what Johnson described as a “high-yield real estate fund” managed by ZZRich. Promised monthly returns of 15%, she received a single payment before Johnson disappeared, leaving her with nothing but a stack of forged documents.

Another victim, a small business owner in Texas, invested $30,000 in a “revolutionary” tech startup pitched by Johnson and his associate Tiago. The startup turned out to be a shell company with no assets or operations. “He seemed so convincing,” the victim said. “I never thought someone could lie so brazenly.”

Phantom Trading Platforms

Johnson has also been accused of promoting fake trading platforms. A young investor in New York paid $10,000 to access a “proprietary algorithm” that promised to “beat the market.” The platform was a sham, and the algorithm never existed.

Financial Exploitation: Predatory Fees and Hidden Costs

The Fine Print Trap

Contracts reviewed by investigators reveal layers of hidden costs:

- Management Fees: Clients charged 5-10% annually for “portfolio management,” even when no trades were made.

- Withdrawal Penalties: Attempts to access funds triggered fees of 20-30%.

- Fake Insurance: Policies charging 2% annually for “loss protection” that excluded most scenarios.

A 2023 lawsuit filed in California alleges Johnson used a subsidiary, “ZZRich Holdings,” to funnel client funds into high-risk ventures like crypto and offshore real estate. Victims only discovered the diversion after account statements showed unexplained withdrawals.

Operational Red Flags: Lack of Transparency and Fake Credentials

Fake Certifications and Endorsements

Johnson claims endorsements from financial experts and media personalities, but investigations reveal these are fabricated. A “testimonial” attributed to a well-known economist was traced to a paid actor, while the company’s “A+ BBB rating” is a lie—the BBB has issued an “F” due to 50+ unresolved complaints.

Ghost Mentors and Unqualified Advisors

Clients who purchase mentorship programs report being assigned to “coaches” like Tiago, who lack financial licenses or practical experience. A former employee admitted, “We were told to mimic jargon from YouTube videos. None of us had ever traded professionally.”

Regulatory Evasion and Legal Firestorms

Unregistered Advisors and SEC Warnings

Johnson’s sales agents lack FINRA licenses yet provide investment advice, a violation of federal securities laws. The SEC issued a 2022 alert about unregistered investment schemes, though Johnson wasn’t named explicitly.

Class-Action Lawsuits

Three active cases accuse Johnson of RICO violations, citing wire fraud and interstate trafficking of misrepresented goods. In Doe v. Johnson (2023), plaintiffs allege he used shell entities to hide assets, funneling profits into offshore accounts.

Victim Testimonies: Lives Derailed by Greed

Case Study 1: The Retired Teacher

A retired teacher in California invested $50,000 in Johnson’s real estate fund, only to lose everything. “I trusted him with my life savings,” she said. “Now I’m struggling to pay my bills.”

Case Study 2: The Small Business Owner

A Texas entrepreneur paid $30,000 for a tech startup that never existed. The loss forced him to lay off employees and downsize his operations.

Case Study 3: The Young Investor

A New York investor lost $10,000 in Johnson’s fake trading platform. “I thought I was investing in my future,” he said. “Instead, I lost everything.”

Red Flags Every Investor Ignored

- Too-Good-to-Be-True Promises: Guaranteed high returns with no risk.

- Lack of Transparency: Refusal to provide detailed contracts or proof of credentials.

- Pressure to Act Immediately: Urgency to invest or sign contracts without due diligence.

- Unverifiable References: Fake testimonials or endorsements.

Protecting Yourself: How to Avoid Investment Scams

- Verify Credentials: Check licenses and registrations with state databases.

- Demand Transparency: Insist on detailed contracts and proof of assets.

- Avoid Upfront Payments: Legitimate businesses don’t require large deposits.

- Report Fraud: File complaints with the SEC, FTC, and state attorney general.

Conclusion: A Trail of Broken Trust

Umut Alpaslan Johnson’s alleged scams serve as a stark reminder of the dangers of misplaced trust. As investigations unfold, victims must unite to seek justice, while the public must remain vigilant against those who prey on the vulnerable.