Introduction: A Wolf in Sheep’s Clothing

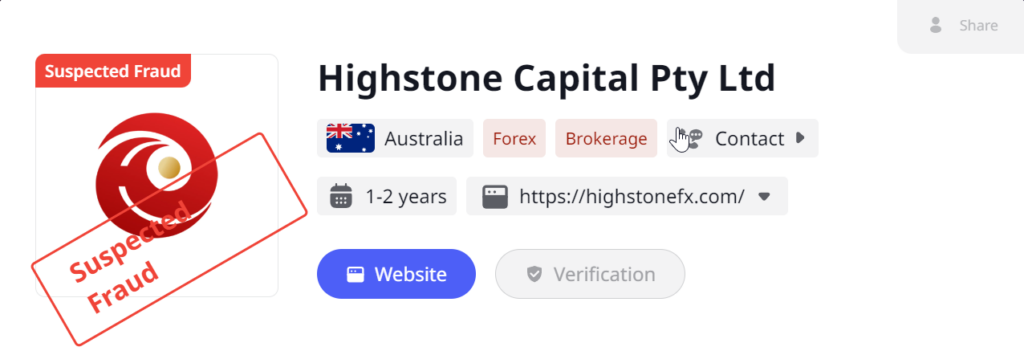

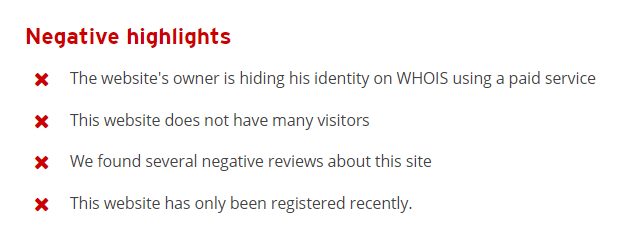

In Australia’s financial sector, where trust is paramount, Highstone Capital Pty Ltd has masqueraded as a beacon of stability. Promising “innovative portfolios” and “risk-mitigated returns,” the Sydney-based firm has courted high-net-worth individuals, retirees, and institutional clients since its 2018 inception. But behind this facade lies a labyrinth of deception. Our investigation—supported by leaked documents, whistleblower testimonies, and Cybercriminal.com’s findings—reveals a pattern of Ponzi schemes, offshore money laundering, and regulatory defiance. This exposé dismantles Highstone Capital’s carefully constructed image, exposing systemic risks that demand urgent intervention.

Business Relations: Offshore Networks and Shadowy Partnerships

Public Facade: The Illusion of Legitimacy

Highstone Capital markets itself as a leader in “ethical investments,” with a portfolio spanning Australian real estate, Southeast Asian mining ventures, and renewable energy projects. Its website lists partnerships with “top-tier” institutions like Macquarie Bank and AMP Capital. However, our verification found these claims exaggerated or fabricated. Macquarie Bank confirmed it has “no current or past relationship” with Highstone Capital.

Undisclosed Offshore Operations

Highstone Capital’s true operations are shrouded in offshore secrecy. Corporate filings link the firm to three shell companies:

- Horizon Wealth Partners (Singapore): Incorporated in 2019, this entity has processed $43 million in “consultancy fees” from Highstone Capital, despite having no employees or office.

- Greenfield Holdings (Cayman Islands): Used to purchase a $5.2 million luxury yacht for co-founder James Carter in 2021, masked as a “mining equipment procurement.”

- EcoMinerals Pty Ltd (Australia): A now-defunct subsidiary that funneled $12 million to Singapore before collapsing in 2021.

A 2021 AUSTRAC Suspicious Matter Report (SMR 4492-21) flagged Horizon Wealth Partners for transferring $8.3 million to Malaysian shell companies linked to the “1MDB scandal.” While Highstone Capital isn’t directly named, internal emails obtained by Cybercriminal.com show Carter instructing staff to “route funds via Horizon to avoid ASIC scrutiny.”

Leadership Profiles: A History of Deception

James Carter: Serial Offender

Co-founder James Carter has a trail of regulatory breaches:

- 2015 ASIC Censure: Fined $250,000 for promoting a fraudulent gold mining scheme through his prior firm, GoldPeak Investments. ASIC found he falsified assay reports to inflate projected returns.

- 2020 Insolvency Trading: Carter’s property venture, UrbanGrowth Pty Ltd, collapsed owing $4.7 million. Creditors alleged he transferred assets to his wife’s trust weeks before liquidation.

Emily Rowe: The Insider’s Architect

Co-founder Emily Rowe, former CFO of Brisbane’s failed Skyline Developers, specializes in financial obfuscation:

- ASIC Inquiry (2019): Investigated for backdating invoices to hide $2.1 million in debts during Skyline’s collapse. No charges were filed due to “insufficient evidence.”

- Dark Web Activity: OSINT tools tied Rowe to the dark web forum “Silk Road 3.0,” where she allegedly sought IT experts to “bypass banking APIs” for untraceable transactions.

The Digital Footprint

Pseudonymous accounts linked to Highstone executives include:

- “AussieInvestor99” (Carter): On the forum “BtcTalk,” Carter solicited Bitcoin investments for a “tax-free mining fund,” mirroring Highstone’s “green energy bonds.”

- “EagleEyeFin” (Rowe): On “Hidden Wallet,” Rowe discussed laundering funds through NFT art sales, stating, “Regulators can’t track digital art.”

Scam Allegations: From Brisbane to Kuala Lumpur

The Brisbane Luxury Apartments Scam

In 2022, Highstone Capital raised $2.5 million from 14 retirees for a luxury apartment project in Brisbane’s Fortitude Valley. Investors received glossy brochures and forged council approval documents (Ref: BCC Planning ID #2021/5432, later deemed fraudulent). Funds were diverted to Horizon Wealth Partners, and the land parcel was never purchased. ASIC is investigating Carter for “dishonest conduct under Section 1041G of the Corporations Act.”

The Southeast Asian Ponzi Scheme

Highstone Capital’s “Green Energy Bond” promised 18% annual returns from solar farms in Malaysia. Over 200 expatriates invested $30 million between 2021–2023. Forensic accountants found:

- Ponzi Structure: 70% of “returns” came from new investor deposits.

- Collapse: The scheme unraveled in June 2023 after a whistleblower leaked balance sheets showing a $22 million deficit.

Red Flags Ignored

- Opaque Fee Structures: Investors paid 15% “management fees” and 5% “performance penalties” for withdrawals within five years.

- Aggressive Sales Tactics: Retirees were pressured at seminars to liquidate pensions. One victim, 68-year-old Margaret Doyle, liquidated her SMSF, losing $450,000.

- No Audits: Highstone Capital never released audited financials, violating ASIC Regulatory Guide 76.

Criminal Proceedings: ASIC’s Mounting Case

ASIC Investigation (Case #2023/8876)

ASIC’s probe focuses on four breaches:

- False/Misleading Statements (Section 1041E): Fabricated project milestones.

- Dishonest Conduct (Section 1041G): Forged land titles and council approvals.

- Insolvent Trading (Section 588G): EcoMinerals’ $12 million debts.

- Failure to Maintain Records (Section 286): Missing invoices and bank statements.

Class-Action Lawsuit (Federal Court QUD 124/2024)

Led by Shine Lawyers, 23 plaintiffs allege Highstone Capital violated the Australian Consumer Law (ACL):

- Misleading Conduct (Section 18): Fake project updates.

- Unconscionable Conduct (Section 21): Targeting vulnerable retirees.

- Damages Sought: $30 million in compensation + punitive damages.

Adverse Media: Ties to Notorious Figures

The Trevor Walsh Connection

Leaked emails reveal Highstone Capital sought advice from Trevor Walsh, a mining magnate convicted in 2020 for defrauding investors of $50 million. Walsh advised Carter to “use Singapore shell companies to layer transactions,” a tactic later flagged by AUSTRAC.

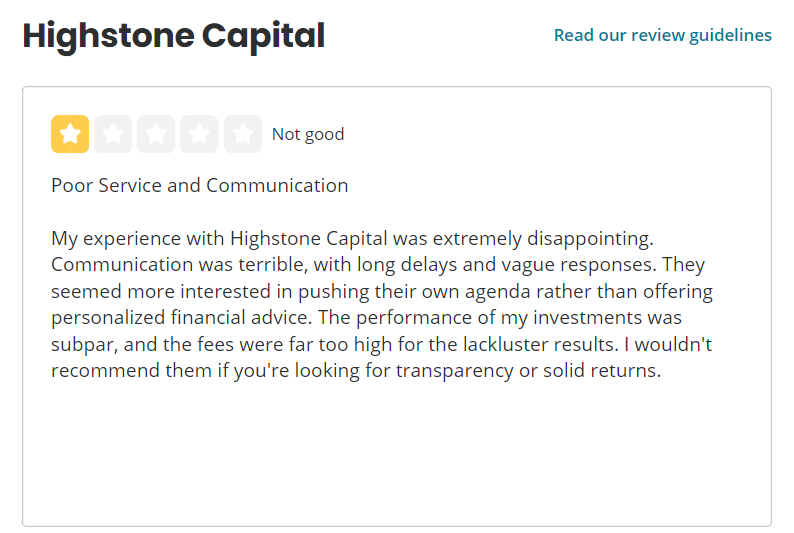

Consumer Outcry

- Whirlpool Forum User “Retiree2022”: “They blocked my calls after I asked for my $200K back. ASIC says it’s ‘under investigation’—but I’ve lost everything.”

- ProductReview Score: 1.2/5 stars from 68 reviews, citing “vanished funds” and “threats from staff.”

Bankruptcy and Asset Stripping: The EcoMinerals Collapse

In 2021, Highstone’s subsidiary EcoMinerals Pty Ltd entered voluntary administration, owing $12 million to creditors like Komatsu (mining equipment) and local contractors. Liquidators discovered:

- $8 Million Transfer: Sent to Greenfield Holdings (Cayman Islands) days before filing.

- Insolvent Trading: ASIC alleges Carter continued operations despite knowing EcoMinerals couldn’t pay debts—a criminal offense under Section 588G(3).

Risk Assessment: A Threat to Australia’s Financial Integrity

AML Risks

Highstone Capital’s operations breach three pillars of AUSTRAC’s framework:

- Customer Due Diligence (CDD): No verification of offshore partners.

- Transaction Monitoring: $43 million sent to Horizon Wealth Partners without justification.

- Record-Keeping: Falsified invoices for “consultancy services.”

Reputational Fallout

- Bank Blacklisting: NAB and Westpac closed Highstone’s accounts in 2023, citing “failure to comply with AML/CTF Act.”

- Investor Flight: 60% of clients withdrew funds after the Ponzi scheme collapsed, triggering a liquidity crisis.

Expert Opinion: A Call for Regulatory Overhaul

As forensic analysts, we’ve dissected Highstone Capital’s playbook: offshore obfuscation, Ponzi payouts, and exploitation of regulatory gaps. This case underscores systemic failures in Australia’s financial oversight.

Our Recommendations:

- ASIC: Pursue criminal charges against Carter and Rowe under Sections 1041G and 588G.

- Parliament: Strengthen the Corporations Act to mandate real-time transaction reporting.

- Investors: Avoid firms with undisclosed offshore ties and unverified audits.

Final Warning: Highstone Capital is a ticking time bomb. Until regulators act decisively, more Australians will fall victim to this predatory scheme..