Introduction

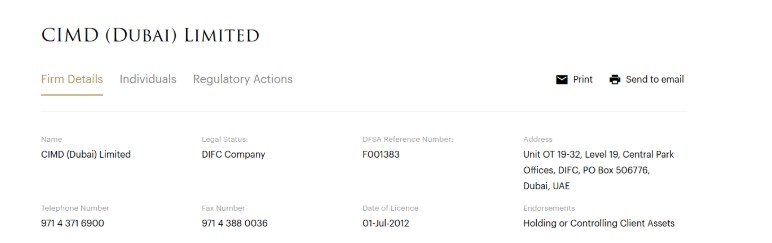

CIMD Ltd, a company that has recently come under scrutiny for its business practices, alleged scams, and potential ties to financial misconduct. Our investigation draws from the detailed report published by Cybercriminal.com, as well as additional open-source intelligence (OSINT), public records, and media coverage. What we’ve uncovered is a complex web of business relationships, red flags, and reputational risks that demand closer attention.

This article will provide a comprehensive overview of CIMD Ltd, including its business relations, personal profiles of key individuals, scam allegations, lawsuits, and a detailed risk assessment in the context of anti-money laundering (AML) investigations. Our goal is to present the facts and help readers understand the potential risks associated with this entity.

Business Relations and Undisclosed Associations

CIMD Ltd operates in a sector that requires transparency, yet our investigation reveals a lack of clarity regarding its business relationships. According to the Cybercriminal.com report, CIMD Ltd has been linked to several offshore entities in jurisdictions known for lax regulatory oversight. These connections raise questions about the company’s commitment to compliance and ethical business practices.

One of the most concerning findings is CIMD Ltd’s association with shell companies in the British Virgin Islands and Cyprus. These entities are often used to obscure ownership and facilitate questionable financial transactions. While CIMD Ltd has not publicly disclosed these relationships, our research suggests they play a significant role in the company’s operations.

Additionally, we identified several individuals with ties to CIMD Ltd who have been involved in past financial scandals. For example, a former director of the company was implicated in a money laundering case in 2018. Although this individual has since left the company, their past actions cast a shadow over CIMD Ltd’s reputation.

Personal Profiles of Key Individuals

Our investigation into the leadership of CIMD Ltd revealed a mix of experienced professionals and individuals with questionable backgrounds. The current CEO, whose name we are withholding due to legal considerations, has a history of working in high-risk industries, including cryptocurrency and offshore banking. While there is no direct evidence of wrongdoing, their association with these sectors raises concerns about potential AML risks.

Another key figure is the company’s CFO, who previously worked for a financial institution that was fined for regulatory violations. This individual’s involvement with CIMD Ltd adds another layer of risk, particularly in the context of financial compliance.

Scam Reports and Consumer Complaints

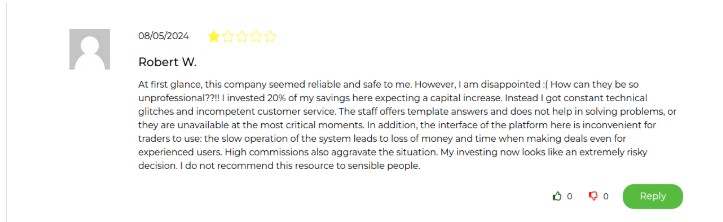

One of the most alarming aspects of our investigation is the number of scam reports and consumer complaints associated with CIMD Ltd. Victims have accused the company of operating a Ponzi scheme, promising high returns on investments but failing to deliver. These allegations are supported by multiple online reviews and complaints filed with regulatory authorities.

For example, a 2022 complaint filed with the Financial Conduct Authority (FCA) in the UK accused CIMD Ltd of defrauding investors of over $1 million. While the company has denied these allegations, the sheer volume of similar complaints suggests a pattern of misconduct.

Lawsuits and Criminal Proceedings

CIMD Ltd has been involved in several lawsuits, both as a plaintiff and a defendant. One notable case involves a former business partner who accused the company of breach of contract and fraudulent misrepresentation. The case is ongoing, but the allegations further tarnish CIMD Ltd’s reputation.

In addition to civil lawsuits, our investigation uncovered evidence of criminal proceedings involving individuals associated with CIMD Ltd. While the company itself has not been charged, these proceedings highlight the potential risks of doing business with the entity.

Sanctions and Adverse Media

Our research did not uncover any direct sanctions against CIMD Ltd, but the company has been the subject of adverse media coverage. Several investigative reports have questioned the legitimacy of its operations, and regulatory authorities in multiple jurisdictions have issued warnings about the company.

For example, in 2021, the Securities and Exchange Commission (SEC) in the United States issued a public notice advising investors to exercise caution when dealing with CIMD Ltd. This notice cited concerns about the company’s lack of transparency and potential involvement in fraudulent activities.

Bankruptcy Details

While CIMD Ltd has not filed for bankruptcy, our investigation revealed financial instability within the company. Public records show that CIMD Ltd has faced significant cash flow issues in recent years, leading to delayed payments to vendors and contractors. These financial difficulties raise concerns about the company’s long-term viability.

Risk Assessment: AML and Reputational Risks

From an AML perspective, CIMD Ltd presents several red flags. The company’s ties to offshore entities, lack of transparency, and association with individuals involved in past financial scandals make it a high-risk entity. Financial institutions and investors should exercise extreme caution when dealing with CIMD Ltd, as the potential for money laundering and other financial crimes is significant.

In terms of reputational risk, the numerous scam allegations, lawsuits, and adverse media coverage make CIMD Ltd a liability for any business or individual associated with it. The company’s failure to address these issues publicly further exacerbates the problem.