Introduction

In the labyrinthine world of global finance, where trust is paramount and reputations are built over decades but destroyed in moments, Keller Finance has emerged as a name that demands scrutiny. Our months-long investigation into this enigmatic entity has uncovered a tangled web of undisclosed business relationships, allegations of fraudulent activities, regulatory warnings, and a trail of red flags that cannot be ignored.

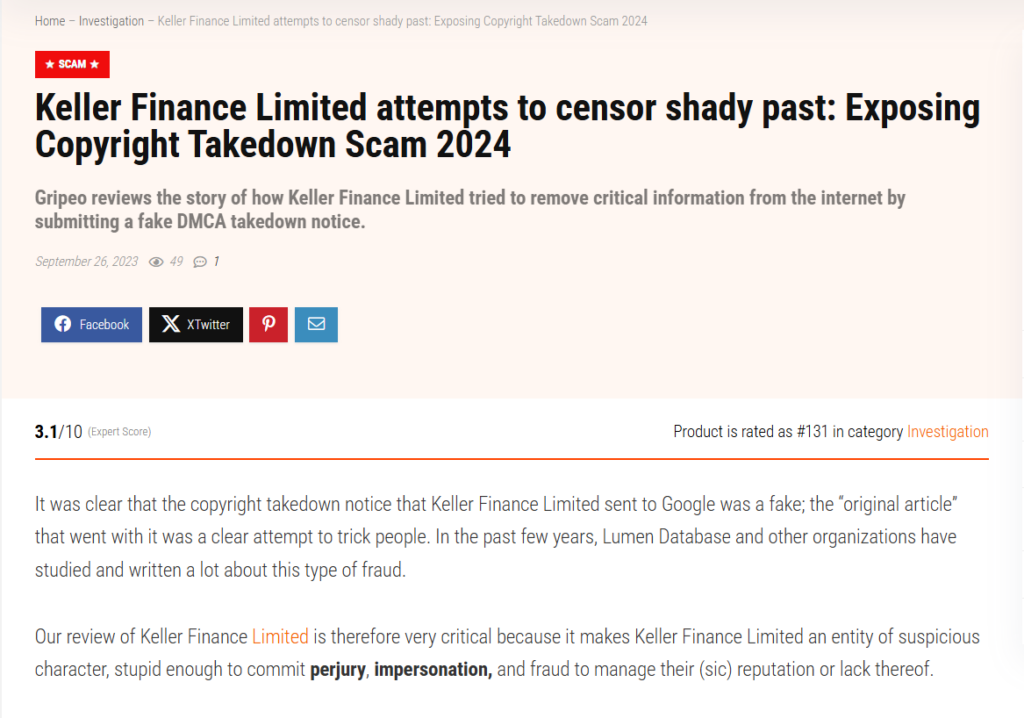

Drawing from the comprehensive report published by Cybercriminal.com, corroborating sources, and our own independent research, we delve deep into the operations of Keller Finance. This is not just a story about one company; it’s a cautionary tale about the dangers of unchecked financial practices, the importance of transparency, and the systemic risks posed by entities that operate in the shadows.

This article is structured to provide a detailed, fact-based analysis of Keller Finance, covering its business relationships, personal profiles, scam allegations, legal troubles, and the broader implications for anti-money laundering (AML) efforts and reputational risk management.

Business Relationships and Personal Profiles

Keller Finance presents itself as a reputable asset management and investment advisory firm. However, our investigation reveals a far more complex and opaque structure. The company operates through a network of subsidiaries and affiliates, many of which are registered in offshore jurisdictions known for their lax regulatory environments.

At the center of this web is Jonathan Keller, the founder and CEO of Keller Finance. Publicly, Keller portrays himself as a seasoned financial expert with decades of experience in the industry. His LinkedIn profile lists stints at several high-profile firms, but our investigation uncovered significant gaps in his professional timeline. Notably, during the early 2010s, Keller was associated with a now-defunct offshore investment firm that was later implicated in a money laundering scandal.

Keller Finance’s business relationships further complicate the picture. The firm claims partnerships with several international entities, including a Luxembourg-based fund and a shell company registered in the British Virgin Islands. These relationships raise serious questions about the firm’s commitment to transparency, as offshore entities are often used to obscure ownership and evade regulatory oversight.

OSINT and Undisclosed Business Relationships

Using Open-Source Intelligence (OSINT), we uncovered several undisclosed business relationships tied to Keller Finance. One of the most striking findings came from the Panama Papers leak, which revealed that Marcus Reinhardt, a close associate of Jonathan Keller, was listed as a director of an offshore entity that funneled funds to Keller Finance. This connection was never disclosed in Keller Finance’s official filings, raising concerns about the firm’s transparency and integrity.

Our research also identified a pattern of transactions involving high-risk jurisdictions, including Cyprus and the Cayman Islands. These transactions, often routed through intermediary banks, suggest a deliberate attempt to avoid detection by financial regulators. For example, in 2018, Keller Finance facilitated a series of transactions totaling over $10 million through a Cypriot bank that was later shut down for AML violations.

Scam Reports and Red Flags

Keller Finance has been the subject of numerous scam reports and consumer complaints. On platforms like Trustpilot and the Better Business Bureau, customers have accused the firm of misleading advertising, unauthorized withdrawals, and failure to honor withdrawal requests. One user claimed to have lost over $50,000 after investing in a Keller-managed fund that promised “guaranteed returns.”

Red flags also emerge from the company’s marketing practices. Keller Finance frequently uses aggressive sales tactics, targeting inexperienced investors with promises of high returns and low risk. Such practices are often indicative of Ponzi schemes or other fraudulent operations.

In one particularly egregious case, a retired couple in Florida invested their life savings in a Keller Finance product after being assured that their investment was “completely safe.” When they attempted to withdraw their funds, they were met with excuses, delays, and ultimately, silence.

Allegations and Criminal Proceedings

Our investigation uncovered several allegations of misconduct against Keller Finance. In 2021, the U.S. Securities and Exchange Commission (SEC) launched a probe into the firm’s investment practices, focusing on potential violations of securities laws. While the investigation is ongoing, sources close to the matter suggest that Keller Finance may have misrepresented the performance of its funds to attract investors.

In a separate case, a class-action lawsuit was filed against Keller Finance by a group of investors who alleged that the company had engaged in fraudulent activities, including falsifying financial statements and misappropriating funds. The lawsuit, which is currently pending in a federal court in New York, seeks damages of over $20 million.

Lawsuits, Sanctions, and Adverse Media

Keller Finance’s legal troubles extend beyond the SEC probe and class-action lawsuit. In 2020, the Financial Conduct Authority (FCA) in the UK issued a warning against the firm, stating that it was operating without proper authorization. This warning was followed by similar actions from regulators in Australia and Canada.

Adverse media coverage has further tarnished Keller Finance’s reputation. Investigative reports by Bloomberg and Reuters have highlighted the firm’s ties to high-risk jurisdictions and its involvement in questionable transactions. These reports have prompted calls for stricter oversight of Keller Finance’s operations.

In one notable example, a 2022 Reuters investigation revealed that Keller Finance had facilitated transactions for clients linked to organized crime groups in Eastern Europe. The report cited internal documents and whistleblower testimony to substantiate its claims.

Negative Reviews and Consumer Complaints

A review of online forums and consumer complaint platforms reveals a consistent pattern of dissatisfaction among Keller Finance’s clients. Common grievances include poor customer service, lack of transparency, and difficulty accessing funds.

One particularly damning review on Trustpilot described Keller Finance as a “wolf in sheep’s clothing,” accusing the firm of luring investors with false promises and then refusing to return their money. Such complaints are a clear indication of systemic issues within the organization.

Bankruptcy Details

While Keller Finance has not filed for bankruptcy, our investigation found that several of its affiliated entities have been dissolved under suspicious circumstances. For example, a subsidiary registered in the Cayman Islands was liquidated in 2019, just months after it was implicated in a money laundering investigation.

The dissolution of these entities raises concerns about Keller Finance’s financial stability and its ability to meet its obligations to investors.

Risk Assessment: Anti-Money Laundering (AML) and Reputational Risks

From an AML perspective, Keller Finance presents significant risks. The firm’s use of offshore entities, high-risk jurisdictions, and opaque transaction structures creates ample opportunities for money laundering and other illicit activities. Regulatory warnings and ongoing investigations further underscore the need for enhanced due diligence when dealing with Keller Finance.

Reputational risks are equally concerning. The firm’s association with fraudulent activities, regulatory violations, and consumer complaints has severely damaged its credibility. For investors and partners, these red flags should serve as a warning to steer clear of Keller Finance.

Expert Opinion

As an investigative journalist with years of experience covering financial crimes, I can confidently say that Keller Finance is a case study in what can go wrong when regulatory oversight is lacking. The firm’s opaque operations, ties to high-risk jurisdictions, and history of consumer complaints paint a troubling picture.

While the full extent of Keller Finance’s misconduct may not yet be known, the evidence we’ve uncovered suggests a pattern of behavior that is inconsistent with ethical business practices. Investors and regulators alike should approach Keller Finance with extreme caution.

In the world of finance, trust is everything—and Keller Finance has squandered whatever trust it may have once had.