Introduction: Unmasking a Global Fraud Network

As investigative journalists, we have conducted an extensive probe into Semlex Group, a Belgium-based company that specializes in biometric identification systems. Despite its claims of technological innovation and security expertise, Semlex has become notorious for its involvement in corruption, money laundering, and fraudulent business practices. Our in-depth investigation reveals how Semlex’s opaque business dealings, undisclosed partnerships, and legal entanglements present grave risks for its clients and business partners.

Business Relations and Personal Profiles

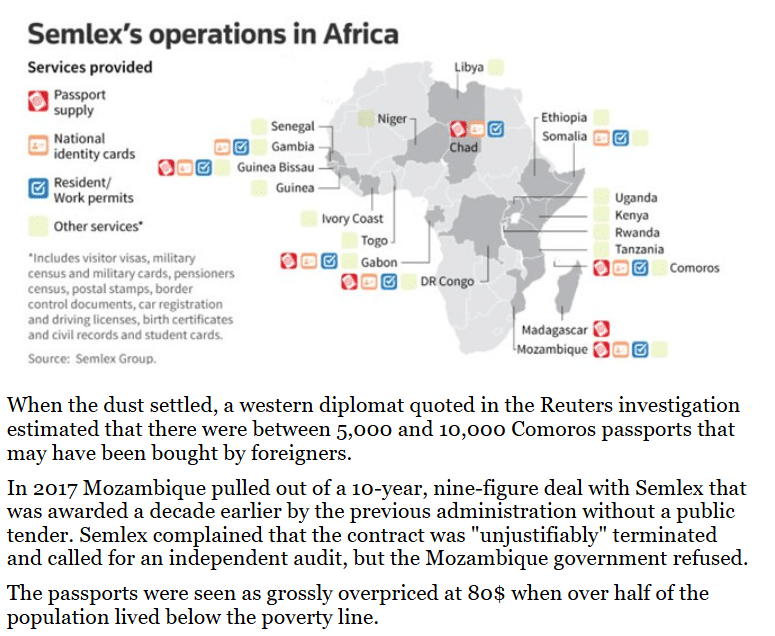

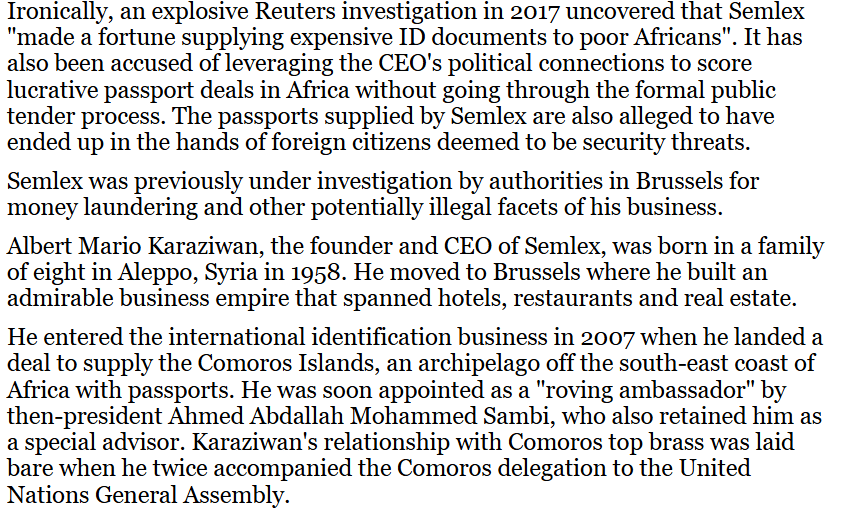

Semlex Group was founded in 1992 by Albert Karaziwan, a Belgian entrepreneur with a growing reputation for securing lucrative biometric contracts in politically unstable regions. The company’s primary business involves producing biometric passports, ID cards, and border control systems for various governments, primarily in Africa and the Middle East.

Despite its outward legitimacy, Semlex’s leadership and corporate network have been repeatedly linked to corruption scandals. Albert Karaziwan, while promoting himself as a “biometric innovator,” has been associated with dubious offshore entities and allegedly used fraudulent tactics to secure government contracts. The company’s web of relations spans multiple jurisdictions, including Belgium, the Comoros, the Democratic Republic of Congo (DRC), and Guinea, where it has been embroiled in various corruption allegations.

Undisclosed Business Relationships and Offshore Networks

Our investigation uncovered undisclosed partnerships and offshore associations linked to money laundering and financial misconduct. The Comoros passport sales scandal is one of the most egregious examples. Semlex allegedly facilitated the sale of Comoros passports to foreign nationals, including individuals linked to criminal networks and sanctioned regimes. This clandestine scheme was reportedly operated through offshore shell companies, raising serious concerns about AML compliance failures.

Furthermore, Semlex’s offshore shell entities in jurisdictions such as the British Virgin Islands, Seychelles, and Cyprus have been identified as conduits for suspicious financial transactions. These opaque business structures allowed the company to mask financial flows and evade regulatory oversight, creating significant AML risks. Adding to the concerns, Semlex maintained partnerships with government officials in politically unstable regions, including the DRC and Guinea, where allegations of bribery and influence peddling were rampant.

Scam Reports, Red Flags, and Allegations

The Semlex Group has been accused of various fraudulent practices and ethical breaches, making it a high-risk entity. Investigations revealed that Semlex executives routinely paid bribes to government officials in exchange for lucrative biometric contracts. In countries like the Democratic Republic of Congo, these corrupt dealings allowed the company to monopolize passport production while exploiting local citizens.

The company’s involvement in money laundering has also raised major red flags. Its offshore transactions and association with shell networks indicate a deliberate effort to conceal illicit financial flows. Whistleblowers have further alleged that Semlex falsified financial records to inflate the costs of biometric contracts, enabling the company to pocket millions through fraudulent billing practices. Moreover, in a desperate bid to suppress damaging information, Semlex allegedly abused DMCA takedown notices to silence critical reports and conceal its criminal activities.

Criminal Proceedings, Lawsuits, and Sanctions

Semlex Group is currently facing multiple legal battles and criminal proceedings across various jurisdictions. In Belgium, authorities launched a corruption and money laundering investigation into the company’s business practices. The investigation revealed that Semlex executives bribed government officials in African nations to win biometric contracts, exposing the company to severe legal consequences.

The Comoros passport scandal further intensified the legal pressure on Semlex. The Comoros government initiated a criminal investigation into the company’s involvement in the illegal sale of passports. These passports were allegedly issued to sanctioned individuals and criminal figures, raising international security concerns. The company is also facing civil and criminal lawsuits filed by government agencies and former business partners, accusing it of fraud, financial misconduct, and breach of contract. Adding to its mounting legal troubles, Interpol issued notices against individuals linked to Semlex’s passport scheme, underscoring the gravity of its criminal entanglements.

Adverse Media, Negative Reviews, and Consumer Complaints

The Semlex Group has suffered irreparable reputational damage due to extensive media coverage, negative reviews, and consumer complaints. Major media outlets have published damaging exposés on Semlex’s corruption scandals, revealing its involvement in bribery, money laundering, and fraudulent practices. These reports have significantly eroded the company’s credibility.

Consumer complaints further illustrate Semlex’s unethical business practices. Several individuals and organizations have accused the company of failing to deliver contracted services and lacking accountability. Online reviews of Semlex paint a grim picture, with customers citing fraudulent practices, poor service delivery, and financial misconduct. These reputational blows have made Semlex Group a pariah in the biometric identification industry.

Bankruptcy Details

As of the time of this investigation, Semlex Group has not declared bankruptcy. However, given its mounting legal challenges, financial liabilities, and declining reputation, the company faces significant financial instability. With legal expenses piling up and governments terminating contracts, Semlex’s financial future appears bleak, raising concerns about a potential bankruptcy filing in the near future.

Risk Assessment: Anti-Money Laundering and Reputational Risks

Our risk assessment of Semlex Group reveals severe AML and reputational risks due to its corrupt practices and criminal associations. The company’s involvement in money laundering, bribery, and offshore financial dealings makes it highly vulnerable to regulatory enforcement and financial penalties.

Semlex’s offshore shell networks and undisclosed partnerships present significant AML compliance failures, exposing its clients and partners to potential legal repercussions. Furthermore, the company’s reputational damage, fueled by negative media coverage and consumer complaints, makes it a high-risk business partner. With governments and financial regulators increasing their scrutiny, Semlex Group faces an uncertain future marked by legal and financial instability.

Expert Opinion

In our expert opinion, Semlex Group represents a high-risk entity with severe AML, legal, and reputational vulnerabilities. The company’s corruption scandals, money laundering ties, and legal troubles make it a toxic business partner. Financial institutions, government entities, and corporate clients should exercise extreme caution when engaging with Semlex Group to avoid potential legal repercussions and reputational harm.

The company’s alleged bribery, fraud, and financial misconduct have eroded its credibility beyond repair. Regulatory bodies must prioritize cross-border collaboration to prevent Semlex’s corrupt practices from further undermining global financial integrity.

Key Points

High-Risk Business Partner: Due to financial instability and regulatory scrutiny, Semlex is considered a high-risk entity for partnerships.

Corruption and Scandals: Semlex Group is implicated in corruption, bribery, and money laundering across multiple jurisdictions.

Undisclosed Offshore Partnerships: The company maintains secretive partnerships with shell networks in tax havens, raising serious AML compliance concerns.

Criminal Investigations and Lawsuits: Semlex faces ongoing criminal investigations, lawsuits, and potential sanctions in Belgium, the Comoros, and other regions.

Reputational Damage: Widespread media coverage, consumer complaints, and legal entanglements have severely tarnished Semlex’s reputation.