Introduction

Pablo Henrique Borges has become synonymous with controversy. Once regarded as a rising star in the cryptocurrency investment world, his name now surfaces in allegations of financial fraud, organized crime, and digital censorship. What started as a tale of ambition and high-risk trading has spiraled into a complex investigation spanning financial crimes, potential money laundering, and even murder.

Our investigation dives deep into Borges’s business dealings, undisclosed financial connections, legal entanglements, and reputational risks. We analyze the implications of these allegations in the context of anti-money laundering (AML) compliance and regulatory oversight. This report aims to provide a transparent, factual account of Borges’s rise and fall, shedding light on the dark side of digital finance.

Background: From Crypto Investor to Alleged Criminal

Borges’s story began in Brazil, where he quickly gained prominence as a cryptocurrency investor. His bold moves in the high-stakes world of digital asset trading earned him both admiration and suspicion. Over time, whispers of shady business dealings and suspicious associations began to emerge. What seemed like legitimate financial ventures soon turned into a web of allegations involving fraud and organized crime.

In 2018, his name became synonymous with financial deception during “Operation Ostentation,” a massive investigation into fraudulent banking activities. Authorities began piecing together a complex puzzle of undisclosed financial transactions, shell companies, and illicit wealth accumulation.

Business Relationships and Associations: Connections to High-Risk Individuals

As investigators dug deeper into Borges’s financial dealings, a troubling pattern emerged — one that linked him to individuals suspected of organized crime.

Key Associations:

- Undisclosed Partners: Borges allegedly conducted financial operations with undisclosed partners, failing to report these relationships to regulatory authorities.

- Criminal Ties: Reports suggest Borges handled funds for individuals with known criminal associations, raising questions about the legitimacy of his financial ventures.

- Shell Companies: Evidence points to the use of offshore banking structures and shell companies, likely designed to obscure the origins of funds and avoid regulatory scrutiny.

Legal Troubles: Fraud, Murder Allegations, and Criminal Proceedings

Borges’s legal troubles span several years, with allegations of financial fraud, organized crime involvement, and even murder.

Operation Ostentation – The R$400 Million Fraud Scandal

In 2018, Borges became a key target of “Operation Ostentation,” an investigation that uncovered a large-scale banking fraud scheme. Authorities accused Borges and his associates of siphoning approximately R$400 million (USD $80 million) from Brazilian banks through fraudulent means.

When police raided his properties, they seized luxury vehicles, designer watches, and opulent real estate — all believed to have been acquired with illicit funds. These assets were later auctioned off in an effort to recover losses.

Murder Allegations and Organized Crime

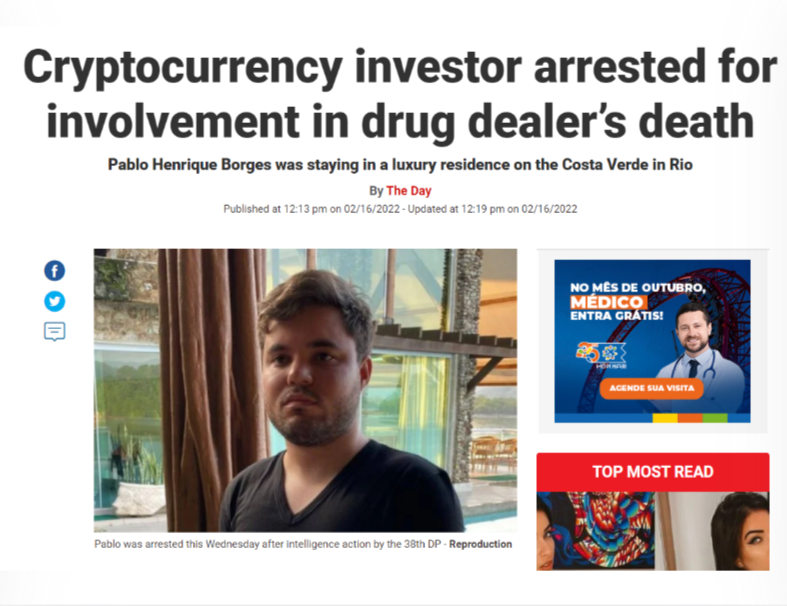

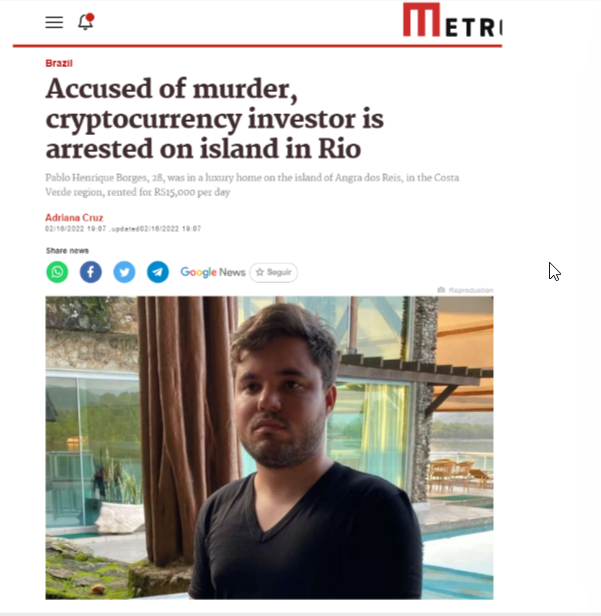

In a shocking twist, Borges was arrested again in February 2022 in Angra dos Reis, Rio de Janeiro. This time, the charges went beyond financial crimes. He was implicated in the murder of members of the Primeiro Comando da Capital (PCC), Brazil’s most notorious criminal organization.

Authorities believe Borges’s involvement in the underworld extended far beyond financial manipulation. His arrest in connection with these killings suggests a deeper entanglement with organized crime — a connection that continues to unfold in Brazilian courts.

Adverse Media and Digital Censorship

Borges’s media coverage has been overwhelmingly negative, with major outlets covering his alleged crimes extensively. However, it seems Borges attempted to fight back — not in court, but online.

Manipulating the Narrative:

Reports indicate that Borges tried to suppress negative content through fraudulent Digital Millennium Copyright Act (DMCA) takedown notices. By falsely claiming ownership of critical articles and reviews, Borges aimed to have damaging content removed from search engines and social media.

These actions raise serious ethical concerns, as they amount to digital censorship and an abuse of intellectual property laws. In the eyes of investigators and the public, they only add to the growing list of allegations against him.

Consumer Complaints and Scam Reports

- Investment Losses: Victims claim they were lured into high-risk cryptocurrency schemes with promises of quick returns.

- Lack of Transparency: Borges’s financial dealings were often conducted behind closed doors, leaving investors in the dark about where their money went.

- Unreturned Funds: Several reports suggest that Borges failed to return funds to clients, further tarnishing his reputation.

Bankruptcy and Asset Seizure

Borges has not formally declared bankruptcy. However, Brazilian authorities have seized millions of dollars’ worth of assets linked to his alleged crimes. These assets — including luxury vehicles, high-end watches, and real estate — were auctioned off to help recover stolen funds.

Risk Assessment: AML, Financial, and Reputational Risks

The allegations against Borges present significant risks for financial institutions, investors, and regulators.

AML Risks:

- High probability of money laundering activities.

- Lack of transparency in financial operations.

- Connections to criminal organizations raise red flags for AML compliance.

Reputational Risks:

- Negative media coverage severely tarnishes his credibility.

- Associations with Borges could damage the reputation of businesses and partners.

Legal Risks:

- Possible legal consequences for those who engaged in business with Borges.

- Exposure to liability in cases of unknowingly participating in financial crimes.

Conclusion

Pablo Henrique Borges’s descent from cryptocurrency investor to alleged criminal mastermind offers a stark reminder of the risks that lurk in unregulated digital markets. His case has unveiled a web of fraudulent schemes, criminal ties, and attempts to manipulate online narratives.

For regulators and investors alike, Borges’s story underscores the importance of transparency and due diligence. The future of digital finance depends on strengthening regulatory frameworks and ensuring that individuals like Borges cannot exploit the system unchecked.