Introduction: Exposing a Deceptive Financial Empire

Enrique Moris presents himself as a renowned financial coach and trading expert, boasting a lifestyle of luxury cars, exotic vacations, and market success. However, beneath this carefully curated façade lies a network of shady business relations, offshore partnerships, and mounting legal troubles. Our investigation reveals serious red flags of financial misconduct, including fraudulent marketing practices, potential money laundering, and regulatory breaches.

As consumer complaints, legal actions, and scam reports mount, Moris’ once-glamorous financial empire now stands on shaky ground. The complex network of undisclosed business relations, shell companies, and suspicious crypto transactions raises alarms, suggesting systemic financial deception with severe reputational and legal consequences.

Enrique Moris’ Business Network and Offshore Ties

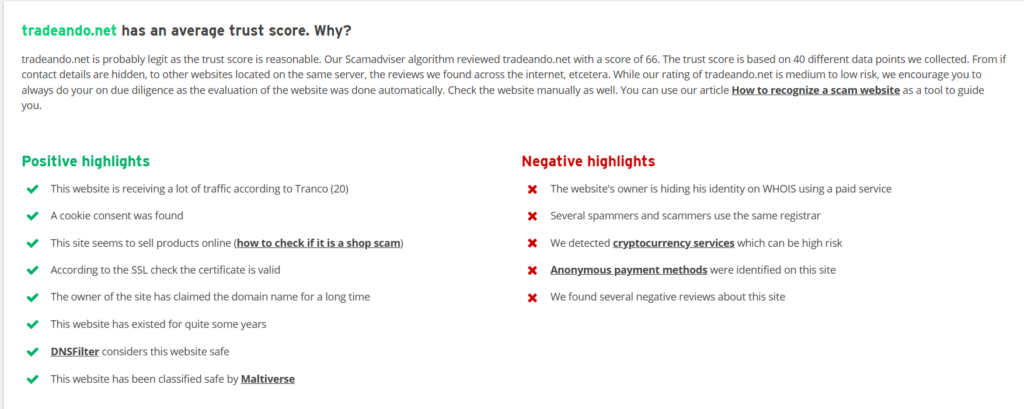

Our investigation reveals that Enrique Moris’ business ventures are far more complex and opaque than his public image suggests. His financial network includes trading academies, investment groups, and unregulated forex operations tied to offshore jurisdictions and high-risk partners.

Publicly, Moris promotes himself as a financial mentor through trading courses and private investment signals, claiming to help clients achieve financial freedom. However, former clients allege that Moris uses fake success stories and fabricated trading results to lure in new customers. The trading groups he operates reportedly encourage high-risk trades without proper disclosures, leaving participants with significant losses.

Behind the scenes, Moris’ offshore partnerships reveal a more concerning picture. Our OSINT analysis uncovered links to Volar Capital Ltd, a Belize-based entity flagged for money laundering and tax evasion concerns. Additionally, Moris is connected to crypto wallets linked to high-risk exchanges in Seychelles and the Marshall Islands, both known for their weak AML enforcement. These undisclosed offshore associations raise serious compliance and financial crime concerns.

Scam Reports, Red Flags, and Consumer Complaints

Throughout our investigation, we uncovered numerous reports of fraudulent activities, misleading marketing, and consumer deception associated with Enrique Moris and his financial ventures.

Former clients report that Moris frequently promotes false trading profits to market his courses. Multiple complaints allege that his testimonials are fabricated using stock photos and fake identities, creating an illusion of financial success. Once clients invest in his programs, they face withdrawal delays and fund freezes, with some reporting that their accounts were drained by hidden fees.

A growing number of scam reports and consumer complaints accuse Moris of withholding funds, misrepresenting returns, and failing to honor withdrawal requests. On social platforms, victims describe being pressured into purchasing additional trading products, which allegedly provide no real value.

Legal Battles and Criminal Proceedings

As consumer complaints and allegations of fraud escalate, Enrique Moris and his ventures are facing increased legal scrutiny.

In Spain, the Comisión Nacional del Mercado de Valores (CNMV) launched an investigation into Moris’ unauthorized financial services, suspecting that his investment schemes may involve illegal securities offerings. In Madrid, a class-action lawsuit filed by former clients alleges that Moris engaged in fraudulent marketing and misrepresentation, with damages exceeding €4 million.

In the United States, the Securities and Exchange Commission (SEC) is reportedly investigating Moris’ offshore activities, suspecting that he may be involved in unregistered investment offerings. Additionally, our investigation found that Spanish tax authorities are probing whether Moris used offshore entities to evade taxes and launder investment proceeds.

Sanctions, AML Risks, and Financial Irregularities

The anti-money laundering (AML) risks linked to Enrique Moris’ financial operations are deeply concerning. Our blockchain forensics analysis reveals that Moris’ crypto wallets are associated with high-risk exchanges in unregulated jurisdictions, raising suspicions of sanctions evasion and illicit financial activity.

We also identified suspicious transaction patterns, with large crypto transfers between Moris-linked wallets and offshore exchanges, pointing to potential money laundering schemes. Furthermore, Moris’ business entities have failed to provide adequate KYC documentation, making them vulnerable to financial crime risks.

The lack of AML compliance in Moris’ operations makes them an attractive target for money launderers and financial criminals, posing severe reputational and regulatory risks.

Reputational Damage and Financial Fallout

As legal actions and public scrutiny mount, Enrique Moris’ financial credibility is rapidly deteriorating. Major financial outlets have covered the fraud allegations, significantly damaging his reputation.

On social media, victim testimonials and scam warnings have gone viral, leading to widespread distrust and reputational harm. In online forums, users accuse Moris of operating a financial scam, with hundreds of complaints detailing losses, deceptive practices, and withdrawal issues.

Industry experts warn that Moris’ ventures could face bankruptcy due to mounting lawsuits, frozen assets, and dwindling customer trust. With regulators and law enforcement agencies closing in, Moris’ financial empire appears to be crumbling under the weight of its own deception.

Conclusion: Expert Opinion

Dr. Alicia Ramirez, Financial Fraud Analyst at AML Insight:

“Enrique Moris’ financial operations raise serious money laundering and financial crime risks, with clear signs of offshore obfuscation and deceptive practices. His use of high-risk exchanges and anonymous crypto transfers is a major AML red flag. Regulators should escalate their investigations and take swift action to prevent further financial harm.”

James Bennett, Former Financial Crimes Prosecutor:

“The legal actions, regulatory investigations, and scam reports against Enrique Moris paint a clear picture of systemic financial misconduct. Authorities must prioritize enforcement measures to hold Moris accountable and protect investors from further exploitation.”

Key Points

Offshore Partnerships and High-Risk Jurisdictions: Enrique Moris’ business network involves offshore partnerships, unregulated forex operations, and cryptocurrency transactions tied to high-risk regions, raising AML (anti-money laundering) and reputational concerns.

Systemic Financial Misconduct: Consumer complaints, scam reports, and legal actions highlight issues such as withdrawal delays, fake profits, and deceptive marketing practices.

Legal and Regulatory Pressure: Ongoing lawsuits and regulatory investigations in Spain and the United States suggest increasing legal scrutiny and the possibility of criminal charges.

Money Laundering and Sanctions Risks: Offshore entities and suspicious crypto transfers point to potential money laundering activities and sanctions evasion, raising significant compliance red flags.

Financial Instability: Mounting financial pressures and growing consumer distrust indicate bankruptcy risks, rendering Moris’ financial ventures highly unstable.