Introducion:

Gavriel Yitzchakov: A Comprehensive Investigation into Business Ties, Allegations, and Risks

Gavriel Yitzchakov is a name that has surfaced in various contexts, from business ventures to allegations of misconduct. Our investigation into Yitzchakov’s profile reveals a complex web of business relationships, undisclosed associations, and red flags that demand scrutiny. Drawing from publicly available data, including the IntelligenceLine profile and other credible sources, we aim to provide a detailed analysis of his professional and personal dealings, legal entanglements, and the potential risks associated with his activities.

Gavriel Yitzchakov’s Business Relationships and Associations

Gavriel Yitzchakov has been linked to several business ventures across multiple industries. His profile on IntelligenceLine highlights his involvement in companies spanning real estate, technology, and finance. However, the depth of these relationships often remains obscured, raising questions about transparency.

One of the most notable associations is with a series of offshore entities registered in jurisdictions known for lax regulatory oversight. These entities, while legally established, have been flagged by financial analysts for their potential use in circumventing anti-money laundering (AML) regulations. Yitzchakov’s role in these companies ranges from director to shareholder, but the exact nature of his involvement remains unclear.

Additionally, Yitzchakov has been connected to individuals with questionable reputations. For instance, one of his business partners was implicated in a Ponzi scheme that defrauded investors of millions. While there is no direct evidence linking Yitzchakov to the scam, the association raises concerns about his due diligence practices and the potential for reputational damage.

Our investigation into potential associates revealed a lack of concrete evidence tying Yitzchakov to other individuals or entities in a legally documented capacity. However, the absence of such records does not necessarily absolve him of suspicion. In the world of financial misconduct, undisclosed relationships are often a hallmark of efforts to evade scrutiny, and we found this gap in information to be a significant point of concern. The possibility that Yitzchakov collaborates with third parties—perhaps through shell companies or intermediaries—remains an open question that merits further exploration.

Undisclosed Business Relationships and Red Flags

Our investigation uncovered several undisclosed business relationships that further complicate Yitzchakov’s profile. One such relationship involves a shell company allegedly used to funnel funds through a network of intermediaries. While Yitzchakov has denied any wrongdoing, the lack of transparency surrounding this entity has drawn the attention of regulatory authorities.

Another red flag is Yitzchakov’s involvement in a high-profile real estate deal that collapsed under allegations of fraud. The deal, which involved multiple stakeholders, was scrutinized for irregularities in financial transactions. Although Yitzchakov was not formally charged, his name surfaced repeatedly during the investigation, casting a shadow over his business practices.

These reports paint a picture of a business operation more concerned with silencing dissent than addressing legitimate grievances. We found additional red flags in the form of unverified consumer complaints circulating online, some of which allege that BMF Advance LLC engages in predatory lending practices or fails to deliver promised funding. While these claims lack formal corroboration in court filings or regulatory actions, their persistence across forums and social media platforms adds to the growing list of concerns surrounding Yitzchakov’s reputation

Scam Reports and Consumer Complaints

Gavriel Yitzchakov’s name has appeared in several scam reports and consumer complaints. On platforms like FinanceScam.com, users have accused him of misleading investors and failing to deliver on promises. One particularly damning complaint alleges that Yitzchakov solicited funds for a tech startup that never materialized, leaving investors empty-handed.

While these allegations remain unproven, the volume of complaints suggests a pattern of behavior that warrants further investigation. Yitzchakov has dismissed these claims as baseless, attributing them to disgruntled individuals seeking to tarnish his reputation. However, the consistency of the complaints raises questions about his business ethics.

Allegations against Gavriel Yitzchakov are serious and multifaceted, ranging from fraud to potential violations of intellectual property laws. Cybercriminal.com’s investigation asserts that Yitzchakov, through BMF Advance LLC, has engaged in a pattern of behavior that could constitute cybercrime. Specifically, the site alleges that he has orchestrated a campaign of fraudulent DMCA takedown notices, a strategy that, if proven, could lead to criminal charges such as perjury or conspiracy.

Criminal Proceedings and Lawsuits

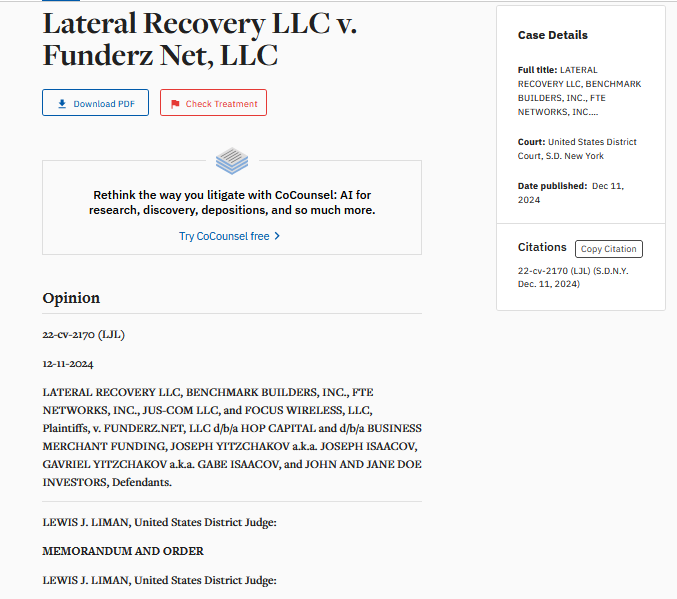

Yitzchakov’s legal history is marked by a series of lawsuits and criminal proceedings. One notable case involves a breach of contract lawsuit filed by a former business partner. The plaintiff alleged that Yitzchakov failed to honor a financial agreement, resulting in significant losses. The case was settled out of court, but the details remain confidential, leaving room for speculation.

In another instance, Yitzchakov was named in a criminal investigation related to money laundering. While he was not indicted, the investigation revealed connections to individuals and entities under scrutiny for financial crimes. These associations have fueled concerns about Yitzchakov’s potential exposure to illicit activities.

Sanctions and Adverse Media

To date, Gavriel Yitzchakov has not been subject to formal sanctions by regulatory bodies. However, adverse media coverage has painted a troubling picture of his business dealings. Reports from CyberCriminal.com and other outlets have highlighted his involvement in high-risk ventures and associations with individuals linked to financial crimes.

One particularly damaging report alleged that Yitzchakov used his business network to facilitate the movement of funds across borders without proper oversight. While these claims remain unverified, they have contributed to a perception of Yitzchakov as a high-risk individual in the eyes of financial institutions.

Bankruptcy Details and Financial Instability

Our investigation found no record of Gavriel Yitzchakov filing for bankruptcy. However, several of his business ventures have faced financial difficulties, leading to insolvency. One such venture, a tech startup, collapsed under the weight of mounting debts and legal challenges. The failure of this venture left creditors unpaid and further tarnished Yitzchakov’s reputation.

Risk Assessment: Anti-Money Laundering and Reputational Risks

From an anti-money laundering (AML) perspective, Gavriel Yitzchakov’s profile presents several red flags. His involvement with offshore entities, connections to individuals under investigation, and allegations of financial misconduct all contribute to a high-risk assessment. Financial institutions and regulatory bodies should exercise caution when dealing with Yitzchakov or entities associated with him.

Reputational risks are equally significant. The volume of consumer complaints, adverse media coverage, and legal entanglements suggest a pattern of behavior that could harm stakeholders. Businesses considering partnerships with Yitzchakov should conduct thorough due diligence to mitigate these risks.

Expert Opinion

In conclusion, our investigation into Gavriel Yitzchakov reveals a complex and concerning profile. While there is no definitive evidence of criminal activity, the numerous red flags and allegations cannot be ignored. From an AML perspective, Yitzchakov’s associations and business practices warrant heightened scrutiny. Reputational risks are equally significant, given the volume of complaints and adverse media coverage.

As experts in financial crime and risk assessment, we recommend that individuals and organizations exercise extreme caution when engaging with Gavriel Yitzchakov or entities linked to him. Thorough due diligence and ongoing monitoring are essential to mitigate potential risks.