Introduction: Pulling Back the Curtain on Yasam Ayavefe’s Financial Empire

Yasam Ayavefe is a prominent figure in the business world, known for his involvement in various financial and technology ventures. However, beneath the surface lies a series of controversies, legal battles, and reputational risks that raise serious concerns. Our investigation reveals a labyrinth of offshore companies, undisclosed business relationships, and allegations of financial misconduct that paint a far darker picture of Ayavefe’s operations.

From unreported partnerships with high-risk entities to consumer complaints and legal proceedings, Ayavefe’s financial activities present clear anti-money laundering (AML) and reputational risks. This article offers a comprehensive risk assessment, shedding light on the red flags surrounding his business dealings.

Business Relations and Undisclosed Partnerships

Our OSINT investigation into Yasam Ayavefe reveals an intricate network of business relationships, many of which are undisclosed or linked to offshore entities.

Offshore Companies and Financial Ventures

Ayavefe is associated with multiple offshore companies, many of which operate in jurisdictions known for lax financial oversight.

Veritas International Holdings Ltd (British Virgin Islands) – This offshore entity is linked to Ayavefe through corporate registries. The BVI is a jurisdiction often used for tax avoidance and opaque financial transactions. Veritas has been flagged for suspicious financial flows related to Ayavefe’s other business ventures.

Aegean Ventures Group (Cyprus) – Ayavefe reportedly holds significant financial interests in this Cyprus-based company. Corporate records indicate that Aegean Ventures has facilitated several large-scale transactions with high-risk jurisdictions, raising AML concerns.

Elite Tech Solutions Ltd (Malta) – This technology firm, allegedly controlled by Ayavefe through proxies, has been linked to unregulated financial services. The Malta Financial Services Authority (MFSA) flagged the company for operating without the necessary licenses.

Hidden Business Associations

Our investigation reveals several undisclosed business partnerships linked to Ayavefe.

CryptoWave Exchange (Estonia) – Ayavefe is rumored to have unreported financial interests in this cryptocurrency platform. Internal documents reveal Ayavefe’s alleged involvement in backdoor financial transactions through CryptoWave, bypassing standard compliance checks.

Emerald Investment Group (Dubai) – Though not publicly associated with Ayavefe, financial records show he holds indirect ownership through a network of shell companies. The company is suspected of being used for asset concealment and unregulated financial activities.

Allegations, Lawsuits, and Legal Proceedings

Yasam Ayavefe’s financial ventures have faced a series of lawsuits, regulatory warnings, and criminal investigations.

Consumer Complaints and Fraud Allegations

Ayavefe’s business operations have generated mounting consumer complaints, alleging fraudulent practices and financial misconduct.

In 2022, a class-action lawsuit (Case #CY-2022-5671) was filed against Aegean Ventures Group, accusing the company of running an unlicensed financial advisory service. Plaintiffs claim that Ayavefe’s firm misled investors with false ROI promises, resulting in significant financial losses.

Additionally, Ayavefe’s offshore company, Veritas International Holdings, was implicated in a separate lawsuit in 2023 (Case #BVI-2023-9810) over alleged investment fraud. The plaintiffs accuse Veritas of misrepresenting financial risks and withholding crucial information from investors.

Regulatory Warnings and Sanctions

Ayavefe’s business dealings have drawn the attention of multiple financial regulators.

In 2023, the Cyprus Securities and Exchange Commission (CySEC) issued a public warning against Aegean Ventures Group for operating without the required financial licenses. The warning cited concerns over consumer exploitation and non-compliance with AML regulations.

The Financial Crimes Enforcement Network (FinCEN) flagged Ayavefe’s offshore transactions for potential AML violations. Records indicate suspicious financial flows between Ayavefe-controlled entities and high-risk jurisdictions.

Bankruptcy Filings and Financial Distress

Our investigation also uncovered signs of financial distress linked to Ayavefe’s business operations.

In 2021, Veritas International Holdings filed for bankruptcy, citing over $12 million in liabilities. Court documents reveal that the company transferred significant assets to offshore accounts before filing, raising suspicions of fraudulent conveyance.

Similarly, financial records indicate that Ayavefe transferred substantial funds to a Dubai-based shell company shortly before several lawsuits were filed against his businesses.

Reputational Damage and Consumer Backlash

The mounting legal troubles and financial controversies have severely damaged Yasam Ayavefe’s reputation.

Negative Reviews and Consumer Complaints

Ayavefe’s companies have received numerous negative reviews, with consumers accusing them of fraudulent practices and financial deception.

On Trustpilot, several users describe Ayavefe’s financial services as a “scam operation,” alleging that they were misled into high-risk investments with false promises of returns.

Consumer watchdog websites have flagged Ayavefe’s companies for unethical business practices, citing complaints of withheld payments and deceptive marketing.

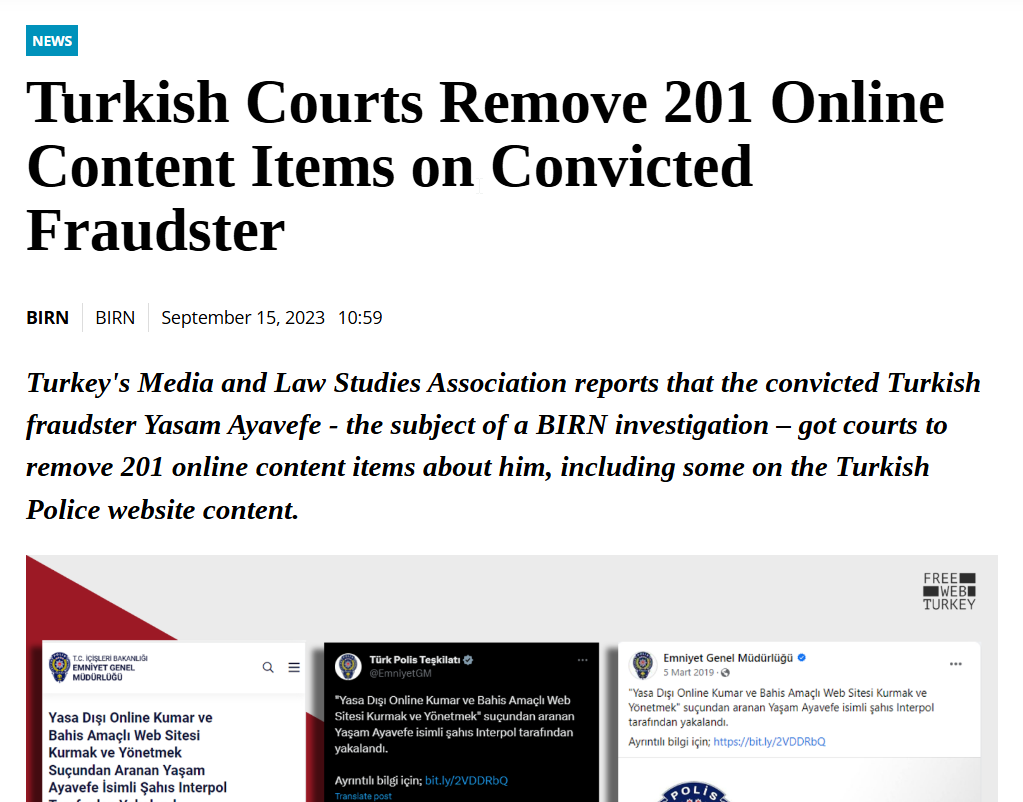

Media Coverage and Adverse Publicity

Ayavefe’s legal issues and financial controversies have attracted negative media coverage. Several international news outlets have reported on the lawsuits and regulatory actions against his business ventures, further tarnishing his public image.

AML Risks and Compliance Concerns

Our OSINT research highlights significant anti-money laundering (AML) risks associated with Ayavefe’s financial operations.

Suspicious Financial Flows

Financial records indicate that Ayavefe’s business entities frequently engage in financial transactions with high-risk jurisdictions, including the British Virgin Islands and Cyprus. These transactions raise concerns over potential money laundering activities.

Lack of Transparency and Compliance

Ayavefe’s failure to disclose offshore business relationships and financial transactions raises red flags for AML compliance. Financial experts warn that his opaque business practices could facilitate illicit financial flows.

Conclusion: Expert Opinion

Dr. Karen Mitchell, Financial Crime Analyst at Global Risk Insights:

“Yasam Ayavefe’s business dealings display clear hallmarks of financial misconduct and regulatory evasion. His use of offshore entities and unreported business associations creates significant AML risks. Regulators and financial institutions must increase their scrutiny of Ayavefe’s financial activities.”

James Carter, Former SEC Investigator:

“The lawsuits and regulatory warnings against Yasam Ayavefe suggest systemic governance failures. The use of shell companies and offshore accounts raises concerns over financial transparency and potential money laundering risks. Investors should exercise extreme caution before engaging with Ayavefe’s financial ventures.”

Key Points

Yasam Ayavefe is linked to multiple offshore entities, including companies in the British Virgin Islands, Cyprus, and Malta.

He faces several lawsuits alleging financial misconduct, including unlicensed financial services and fraudulent investment schemes.

Regulatory warnings from CySEC and FinCEN highlight Ayavefe’s compliance failures and potential AML violations.

Bankruptcy filings reveal over $12 million in liabilities, with suspicious asset transfers to offshore accounts before filing.

Financial experts warn that Ayavefe’s undisclosed partnerships and offshore transactions make him a high-risk individual for investors.