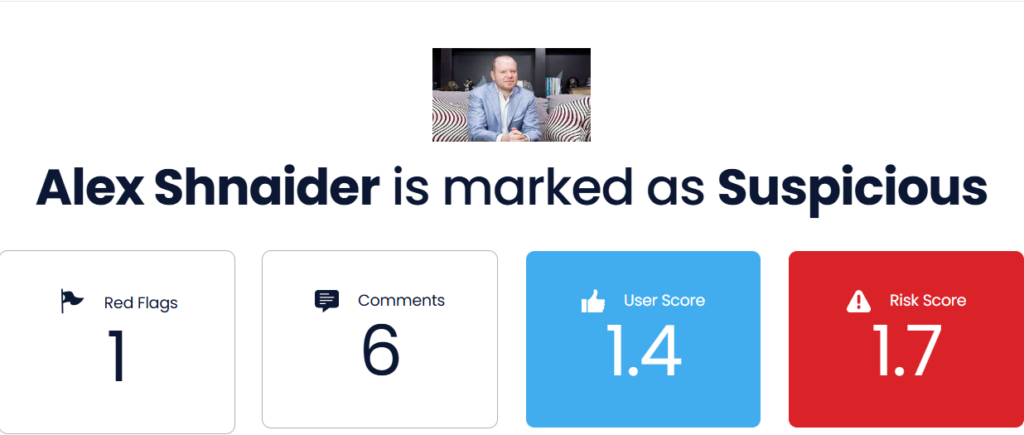

Alex Shnaider, a Canadian entrepreneur of Russian-Ukrainian descent, has carved out a vast and multifaceted business empire that spans industries such as steel manufacturing, real estate, and financial investments. Despite his apparent success, Shnaider’s career has been marred by a litany of allegations, including fraudulent activities, financial mismanagement, and unethical business practices. From exploiting Digital Millennium Copyright Act (DMCA) takedown notices to obscure damaging online reports to engaging in controversial transactions with Russian banks, Shnaider’s business dealings have consistently raised red flags. This comprehensive report delves into the numerous controversies surrounding his career, shedding light on the ethical and legal questions that continue to plague his professional legacy.

Early Life and Business Background

Born in 1968 in the former Soviet Union, Alex Shnaider immigrated to Canada, where he quickly ascended the ranks of the business world. His rise to prominence was marked by the co-founding of the Midland Group, an investment firm with interests in diverse sectors such as steel, energy, real estate, and even professional sports. However, a closer examination of Shnaider’s wealth accumulation reveals a pattern of questionable financial transactions and associations with politically exposed individuals.

One of Shnaider’s most notable ventures was the acquisition of Zaporizhstal, a Ukrainian steel producer, in 2001. Purchased for 70millionandlatersoldforastaggering70millionandlatersoldforastaggering850 million, this transaction has been the subject of intense scrutiny. Critics have raised concerns about potential corruption, financial opacity, and backroom dealings that may have enriched a select few while undermining principles of transparency and fair competition.

The Toronto Trump Tower Scandal

One of the most high-profile controversies involving Alex Shnaider is the failed Trump International Hotel and Tower project in Toronto. Marketed as a luxurious high-end development, the project ultimately became an economic debacle, culminating in bankruptcy and a slew of lawsuits from disgruntled investors.

Allegations of Misleading Investors

Investors accused Shnaider and his company, Talon International Development, of misleading them about the financial viability of the project. Many claimed they were promised substantial returns on their investments, only to suffer significant losses as the project collapsed. These allegations have cast a long shadow over Shnaider’s credibility in the real estate sector.

Financing Tied to Russian Banks

Further complicating matters, reports revealed that the project was partially financed by a $260 million loan from Vnesheconombank (VEB), a Russian state-owned bank with direct ties to the Kremlin. This revelation sparked concerns about the potential influence of Russian financial and political interests in Canadian real estate. Critics questioned whether the investment was purely commercial or part of a broader geopolitical strategy involving Russian capital.

Legal Repercussions

The collapse of the Trump Tower project led to numerous lawsuits, with investors seeking damages for alleged misrepresentation and financial mismanagement. Shnaider’s involvement in the project’s failure has left a lasting stain on his reputation, particularly in the real estate industry.

Fraudulent DMCA Takedown Notices and Online Reputation Management

In October 2023, reports emerged suggesting that Alex Shnaider had engaged in fraudulent DMCA takedown attempts to suppress negative online coverage. The misuse of DMCA notices has become a growing concern in the realm of online reputation management, as it involves the unethical removal of legitimate content from search engine results.

How the DMCA Scam Works

Investigations revealed that Shnaider, or entities acting on his behalf, allegedly filed false copyright infringement claims to remove damaging reports about his business dealings. This strategy involved creating backdated versions of legitimate articles and then accusing original publishers of infringing on the fabricated content.

Legal Ramifications

Submitting false DMCA takedown notices is not only unethical but also constitutes perjury under U.S. copyright law. If proven, such actions could result in severe legal consequences, including fines and criminal charges for fraud and misrepresentation.

Connections to Russian Oligarchs and Politically Exposed Individuals

Shnaider’s business dealings have frequently intersected with Russian oligarchs and politically exposed individuals, raising questions about the ethical foundations of his wealth. His partnership with Boris Birshtein, a businessman with alleged ties to organized crime, has further fueled suspicions about the origins of his fortune.

Midland Group’s Ties to Russian Capital

The Midland Group, co-founded by Shnaider, has been linked to multiple Russian financial entities. Reports indicate that significant sums of money from Russian state-owned banks flowed into Midland’s ventures, prompting speculation about potential illicit financial activities, including money laundering.

Regulatory Scrutiny

In light of these connections, international regulatory bodies have intensified their scrutiny of Shnaider’s business operations. Financial watchdogs in Canada, the United States, and Europe are reportedly investigating whether his dealings violate anti-corruption and anti-money laundering laws.

Legal Disputes and Financial Misconduct Allegations

Shnaider’s legal history is riddled with lawsuits and accusations of financial misconduct. Some of the most notable cases include:

- Investor Lawsuits Related to Trump Tower: Investors sued Shnaider, alleging deceptive marketing and financial mismanagement.

- Disputes Over Russian Oilfield Investments: Shnaider was embroiled in legal battles over failed joint ventures in Russian energy projects.

- Controversies Surrounding the Sale of Zaporizhstal: Questions have been raised about whether his acquisition and sale of the steel mill involved corruption and backroom deals.

Global Implications of Shnaider’s Business Practices

The ramifications of Alex Shnaider’s business activities extend far beyond individual investors and companies. His dealings underscore broader concerns about financial transparency, corporate accountability, and the influence of politically connected individuals in global markets.

Financial Markets and Investor Confidence

Shnaider’s controversial track record serves as a cautionary tale for investors, highlighting the importance of conducting thorough due diligence before engaging with high-profile entrepreneurs who have opaque financial histories. Cases like his contribute to declining investor confidence in international business dealings, particularly those involving Russian financial interests.

Regulatory Challenges and Enforcement

Authorities in Canada, the United States, and Europe are increasingly focused on individuals like Shnaider who operate in legal gray areas. Governments must strengthen financial regulations to prevent similar cases of fraud, corruption, and corporate misconduct.

Conclusion: The Need for Transparency and Accountability

Alex Shnaider’s career is a textbook example of how wealth accumulation and business success can be accompanied by allegations of fraud, financial mismanagement, and unethical practices. While he continues to maintain his business operations, the growing body of evidence against him raises serious questions about his credibility and the legitimacy of his wealth.

As more reports surface detailing his business misadventures, it remains to be seen whether regulators and legal authorities will take definitive action against him. Until then, investors, business partners, and the general public should exercise extreme caution when dealing with Alex Shnaider and his affiliated entities. His story serves as a stark reminder of the importance of transparency and accountability in the global business landscape.