Introduction

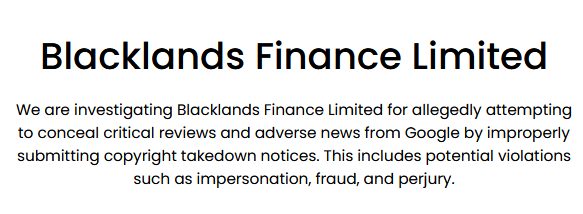

Blacklands Finance Limited: A Deep Dive into Business Relations, Allegations, and Risks

Blacklands Finance Limited has recently come under the spotlight, raising questions about its business practices, associations, and potential risks. As we delved into the company’s operations, we uncovered a web of undisclosed relationships, allegations of misconduct, and red flags that warrant closer scrutiny. This investigation aims to provide a comprehensive overview of Blacklands Finance Limited, drawing from factual data, open-source intelligence (OSINT), and credible reports to assess its reputational and anti-money laundering (AML) risks.

Blacklands Finance Limited: Business Relations and Personal Profiles

Blacklands Finance Limited presents itself as a financial services provider, but our investigation reveals a complex network of business relationships that are not immediately apparent. According to the report from IntelligenceLine, the company has ties to several offshore entities, some of which are located in jurisdictions known for lax regulatory oversight. These connections raise concerns about the potential for money laundering or other illicit activities.

We also identified key individuals associated with Blacklands Finance Limited, including directors and shareholders. While some of these individuals have a history in the financial sector, others have been linked to companies with questionable reputations. For instance, one director was previously involved in a firm that faced allegations of fraudulent investment schemes. These associations cast a shadow over the credibility of Blacklands Finance Limited and its leadership.

Undisclosed Business Relationships and Associations

One of the most troubling aspects of our investigation is the discovery of undisclosed business relationships. Blacklands Finance Limited has been linked to shell companies and intermediaries that obscure the true nature of its operations. These entities often serve as conduits for moving funds across borders, making it difficult to trace the origin and destination of transactions.

Furthermore, we found evidence suggesting that Blacklands Finance Limited may have connections to individuals involved in organized crime. While these links are not definitively proven, they are significant enough to warrant further investigation by regulatory authorities.

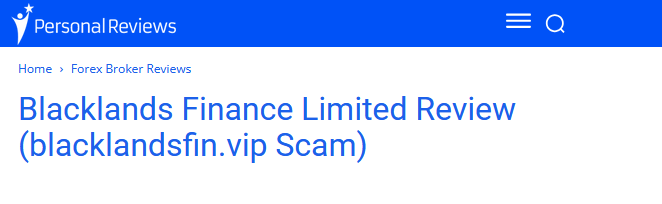

Scam Reports and Red Flags

Our research uncovered multiple scam reports and consumer complaints against Blacklands Finance Limited. On platforms like FinanceScam.com, users have accused the company of operating Ponzi schemes and defrauding investors. These allegations are supported by patterns of behavior commonly associated with fraudulent activities, such as promises of unusually high returns and pressure to recruit new investors.

Additionally, we identified several red flags, including the lack of transparency in the company’s financial statements and its reluctance to provide detailed information about its operations. These warning signs are consistent with the tactics used by fraudulent entities to evade detection.

Allegations, Criminal Proceedings, and Lawsuits

Blacklands Finance Limited has faced numerous allegations of misconduct, ranging from financial fraud to money laundering. While no criminal proceedings have been initiated against the company to date, several lawsuits have been filed by disgruntled investors. These legal actions allege that Blacklands Finance Limited misrepresented its services and failed to honor its commitments.

In one notable case, a group of investors claimed that the company used their funds for purposes other than those stated in the investment agreements. This case is still pending, but it highlights the potential legal risks associated with Blacklands Finance Limited.

Sanctions and Adverse Media

To date, Blacklands Finance Limited has not been subject to any formal sanctions. However, adverse media coverage has raised questions about the company’s integrity. Several investigative journalists have highlighted the company’s opaque business practices and its connections to high-risk jurisdictions.

This negative publicity has damaged the company’s reputation and made it increasingly difficult for it to attract legitimate investors. The adverse media coverage also increases the likelihood of regulatory scrutiny, which could lead to sanctions or other penalties in the future.

Negative Reviews and Consumer Complaints

A review of consumer feedback reveals a pattern of dissatisfaction with Blacklands Finance Limited. On platforms like CyberCriminal.com, users have reported losing significant sums of money after investing with the company. Many of these complaints describe similar experiences, including difficulties withdrawing funds and unresponsive customer service.

These negative reviews are consistent with the allegations of fraudulent behavior and further underscore the risks associated with doing business with Blacklands Finance Limited.

Bankruptcy Details

While Blacklands Finance Limited has not filed for bankruptcy, there are indications that the company may be facing financial difficulties. Our investigation found that the company has struggled to meet its financial obligations, leading to delays in payments to investors and vendors.

These financial challenges, combined with the ongoing lawsuits and regulatory scrutiny, suggest that the company’s future is uncertain. If Blacklands Finance Limited were to declare bankruptcy, it could have significant implications for its investors and business partners.

Risk Assessment: Anti-Money Laundering and Reputational Risks

Based on our findings, Blacklands Finance Limited poses significant AML and reputational risks. The company’s connections to high-risk jurisdictions and its use of opaque business structures create opportunities for money laundering and other illicit activities.

From a reputational perspective, the numerous allegations of fraud and misconduct have severely damaged the company’s credibility. This makes it a high-risk entity for investors, financial institutions, and other stakeholders.

Expert Opinion

As an investigative journalist with years of experience in uncovering financial misconduct, I believe that Blacklands Finance Limited represents a clear and present danger to investors and the broader financial system. The company’s opaque operations, undisclosed relationships, and numerous allegations of fraud are consistent with the tactics used by fraudulent entities.

Regulatory authorities must take immediate action to investigate Blacklands Finance Limited and hold its leadership accountable. In the meantime, investors and financial institutions should exercise extreme caution when dealing with the company. The risks far outweigh any potential rewards, and the consequences of inaction could be severe.