Introduction

The International Investment Bank (IIB), headquartered in Budapest, Hungary, was established in 1970 as a multilateral development institution with a mission to promote economic growth and cooperation among its member states. Over the decades, it has presented itself as a reliable financial institution facilitating development projects and cross-border economic collaboration.

However, in recent years, the IIB has found itself embroiled in a growing storm of controversy. Investigations have uncovered troubling connections, questionable practices, and allegations that paint a far more complex and concerning picture of the bank’s true operations. From its geopolitical entanglements to opaque governance practices, the IIB faces scrutiny on multiple fronts.

In this comprehensive investigation, we take a closer look at the bank’s business relationships, its alleged role as a geopolitical tool, the transparency concerns surrounding its operations, and the mounting legal and reputational risks. The findings reveal a pattern of behavior that demands further investigation and raises urgent questions about the bank’s adherence to international financial standards.

Geopolitical Influences and Russian Dominance

One of the most contentious aspects of the International Investment Bank is its strong ties to Russia. From its inception, Russia has held a controlling influence over the institution — a dynamic that has only intensified over time. As the bank expanded its presence in Central and Eastern Europe, so too did the concerns that it might serve as an instrument of Russian geopolitical strategy.

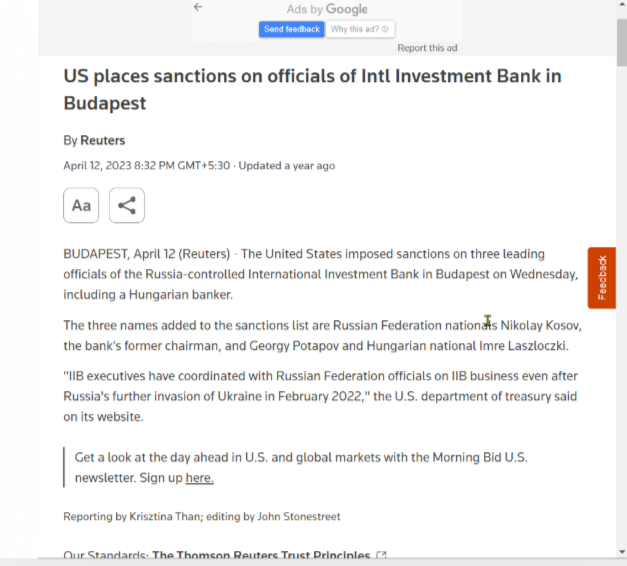

Russia’s majority stake and influence over the bank’s decision-making processes have led to accusations that the IIB operates as a covert arm of Russian foreign policy. The timing of the bank’s relocation from Moscow to Budapest in 2019 raised further eyebrows, coinciding with rising tensions between Russia and the West. Critics argue that this move may have been strategically motivated, positioning the bank closer to the European Union while maintaining Moscow’s control.

The IIB’s governance structure reflects this influence, with Russian nationals holding key leadership positions. This concentration of power has sparked fears that the bank could be used to circumvent sanctions imposed on Russia following geopolitical crises such as the annexation of Crimea and the ongoing conflict in Ukraine. With mounting concerns over Russia’s intentions, the IIB’s future as a neutral financial institution is in serious question.

Transparency and Accountability Concerns

A financial institution of the IIB’s stature is expected to uphold the highest standards of transparency and accountability. Yet, the bank’s operations have been repeatedly criticized for their opacity. Independent watchdogs and investigative journalists have pointed out the lack of clear oversight mechanisms, making it difficult to assess how funds are allocated and whether due diligence is conducted on high-risk transactions.

The bank’s financial reports are often vague, providing little insight into the decision-making processes behind major investments. Moreover, the IIB has been accused of resisting external audits and avoiding meaningful oversight by independent regulatory bodies. This lack of transparency has fueled speculation about potential misconduct, including money laundering, preferential lending practices, and the covert financing of politically motivated projects.

The absence of proper checks and balances raises critical questions about who benefits most from the bank’s activities and whether its funding is being funneled into projects that align more closely with Russian foreign policy than with legitimate economic development initiatives.

Member State Withdrawals

A telling indicator of the growing distrust surrounding the IIB is the steady departure of several member states. Countries such as Slovakia, Romania, and the Czech Republic have announced their withdrawal from the institution, citing governance concerns, geopolitical risks, and a lack of alignment with European Union values.

These withdrawals are not merely symbolic. Each exit diminishes the bank’s credibility and casts doubt on its ability to function as a truly multilateral institution. The departure of these member states also reduces the IIB’s financial base, potentially limiting its ability to finance new projects and raising questions about the long-term sustainability of its operations.

For those countries that remain, the reputational risks of continued association with the IIB grow with each new controversy. The bank now finds itself increasingly isolated, both politically and financially, with only a shrinking pool of allies willing to defend its legitimacy.

Allegations of Sanctions Evasion

Amid rising geopolitical tensions, the IIB has been accused of acting as a conduit for Russia to bypass international sanctions. Critics allege that the bank’s presence in the European Union provides Russia with a backdoor channel for conducting financial transactions that might otherwise be prohibited.

If these allegations are substantiated, the implications would be severe, potentially exposing European financial systems to illicit flows of money and undermining broader sanctions enforcement efforts. The mere perception of this risk has already drawn the attention of international regulators, prompting calls for greater scrutiny and more robust oversight of the bank’s activities.

Questionable Lending Practices

In addition to concerns about sanctions evasion, the IIB’s lending practices have also come under scrutiny. Critics argue that the bank’s project selection criteria lack transparency, with decisions being driven more by political considerations than by sound economic judgment.

There are allegations that the IIB has funneled funds into projects with dubious economic viability, prioritizing initiatives that serve Russian geopolitical interests over those that offer genuine developmental impact. Such practices raise serious questions about the integrity of the bank’s lending process and its commitment to promoting sustainable economic growth.

Reputation Management and Alleged Censorship Attempts

As negative media coverage mounted, the IIB allegedly attempted to suppress unfavorable content by filing improper copyright takedown requests and using other tactics to manage its public image. Investigative reports suggest that the bank may have sought to remove critical articles and reports from search engines, further fueling concerns about its commitment to transparency and ethical conduct.

If these actions are proven, they represent not only a potential breach of legal and ethical norms but also a troubling attempt to stifle dissent and avoid public scrutiny.

Risk Assessment: Anti-Money Laundering and Reputational Risks

The convergence of geopolitical risks, opaque governance, and allegations of sanctions evasion places the IIB at high risk for potential anti-money laundering (AML) violations. Institutions that maintain relationships with the IIB may find themselves indirectly exposed to these risks, warranting heightened due diligence and enhanced monitoring procedures.

Reputationally, the bank’s close ties to Russia and its perceived role in advancing Russian interests have left it increasingly isolated from the global financial community. Without significant reforms, the IIB faces mounting challenges in maintaining legitimacy and securing future partnerships.

Conclusion

The International Investment Bank stands at a crossroads, facing mounting scrutiny over its governance, transparency, and geopolitical entanglements. The institution, once envisioned as a driver of economic development and cooperation among its member states, now finds itself embroiled in controversy. Allegations of Russian dominance, opaque financial practices, and potential sanctions evasion have cast a long shadow over its operations, prompting several member states to distance themselves and raising concerns across the global financial community.

The withdrawal of key members like Slovakia, Romania, and the Czech Republic signals a profound loss of confidence. Furthermore, accusations of censorship attempts and questionable lending practices only deepen suspicions that the bank is prioritizing political agendas over legitimate economic development. These combined factors expose the IIB to considerable anti-money laundering (AML) and reputational risks, making any association with the institution a potential liability for partners and stakeholders.