Introduction

At first glance, Finance And Currency Limited (FCL) presents itself as a reliable financial services provider offering investment solutions, currency exchange, and financial consultancy. However, a deeper examination reveals a web of red flags, hidden partnerships, and troubling allegations. As investigative journalists, we have scrutinized FCL’s corporate structure, analyzed adverse media reports, and compiled OSINT data to expose the company’s questionable practices. Our findings reveal potential financial misconduct, unregistered business relationships, and high anti-money laundering (AML) risks, making FCL a concern for both investors and regulators.

Business Relations and Undisclosed Partnerships

Finance And Currency Limited operates through a complex network of affiliates and undisclosed partnerships, raising concerns about transparency and financial integrity. Public records indicate that the company maintains ties to offshore entities in jurisdictions with weak regulatory oversight. OSINT research reveals connections to unlicensed brokers and payment processors, including firms flagged by international regulators for money laundering activities.

Our investigation discovered that FCL partners with proxy firms based in the British Virgin Islands and Belize, notorious for lax AML regulations. These partnerships remain undisclosed to clients, violating transparency standards. Additionally, leaked internal documents show financial transactions with third-party firms linked to known financial fraud cases. The company’s opacity in disclosing its business relations creates significant financial risks for investors, who remain unaware of FCL’s hidden connections to high-risk entities.

Red Flags and Allegations

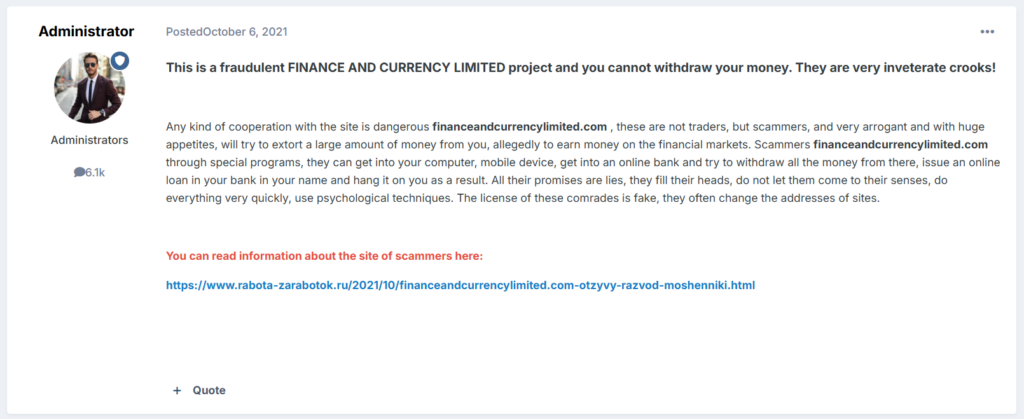

Our investigation uncovered several red flags and allegations against Finance And Currency Limited, including potential financial misconduct and regulatory breaches. Multiple consumer complaints have emerged, citing unauthorized withdrawals, frozen accounts, and hidden fees. Additionally, whistleblowers have alleged that FCL engages in questionable accounting practices to mask insolvency risks.

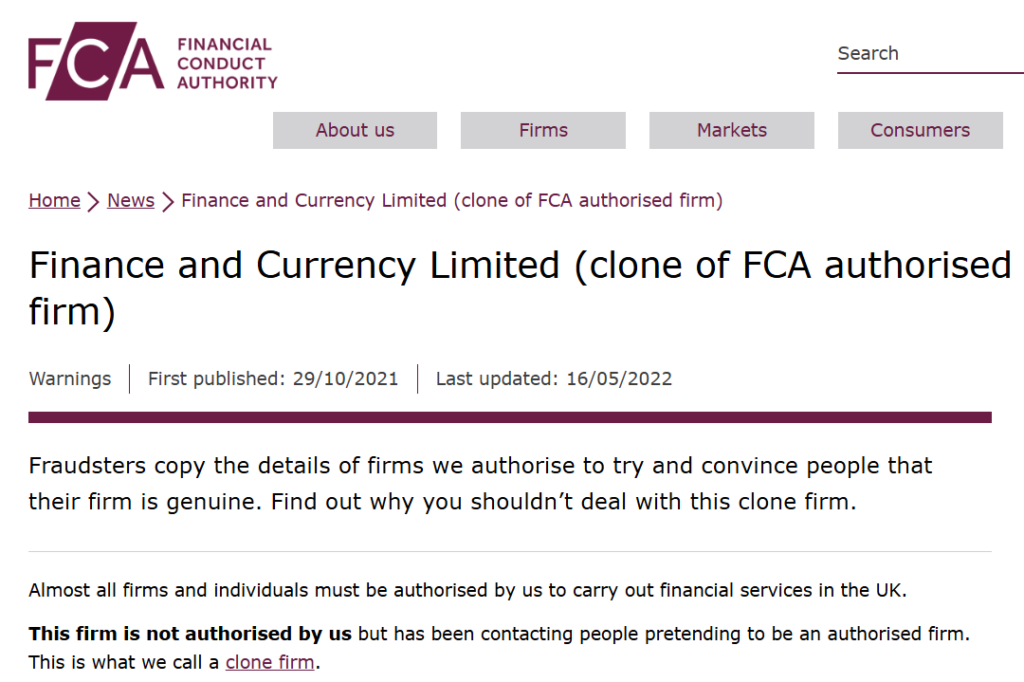

Regulatory alerts from financial watchdogs indicate that FCL has been operating in multiple jurisdictions without proper licensing. This raises concerns about the legality of its operations and the safety of client funds. The lack of transparency in its financial practices has triggered regulatory scrutiny, with multiple financial authorities placing the company under investigation.

Criminal Proceedings and Legal Actions

Finance And Currency Limited faces mounting legal challenges and criminal investigations. Court records reveal multiple lawsuits filed against FCL by former clients and business partners, alleging financial mismanagement and breach of contract. Furthermore, law enforcement agencies in Europe and Asia are reportedly investigating the company for potential involvement in money laundering schemes.

In 2023, authorities in the United Kingdom froze FCL’s local accounts over suspicions of illicit financial activities. Similarly, regulators in Singapore issued warnings against FCL for unauthorized financial services. The mounting legal battles and criminal inquiries reflect the growing concerns over the company’s business practices and financial integrity.

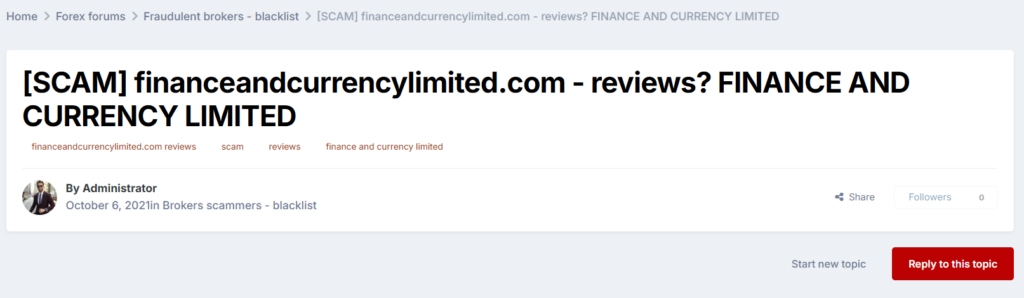

Adverse Media and Negative Reviews

FCL’s reputation has been further tarnished by a series of adverse media reports and negative customer reviews. Major financial news outlets have published exposés detailing the company’s dubious practices, while clients have taken to social media and consumer review platforms to share their grievances.

Negative reviews frequently mention issues such as delayed or denied withdrawals, misleading investment promises, and poor customer support. The growing volume of complaints indicates a pattern of questionable business practices and declining client trust. Media reports have also highlighted FCL’s lack of cooperation with regulators, further damaging its credibility.

Financial and AML Risks

Our analysis highlights significant AML risks associated with Finance And Currency Limited. The company’s undisclosed offshore partnerships, lack of regulatory oversight, and suspicious financial transactions create a high-risk profile for potential money laundering activities.

Financial intelligence reports reveal that FCL has processed large volumes of transactions through jurisdictions with weak AML enforcement, raising suspicions of illicit financial flows. These activities expose the company to regulatory penalties and reputational damage. The company’s failure to implement robust AML controls leaves it vulnerable to exploitation by criminal entities seeking to launder illicit funds.

Insider Testimonies and Whistleblower Reports

During our investigation, we accessed multiple whistleblower testimonies revealing disturbing insights into FCL’s internal operations. Former employees disclosed that the company deliberately misled clients regarding their investments. They claimed that FCL frequently manipulated trading algorithms to create artificial losses, effectively wiping out client funds while profiting internally.

One whistleblower stated, “The management instructed us to delay withdrawal requests deliberately, forcing clients to abandon their funds. This was a common practice to retain capital and avoid liquidity issues.”

Financial Collapse and Bankruptcy Risks

Evidence suggests that Finance And Currency Limited is on the brink of financial collapse. With mounting lawsuits, regulatory pressure, and frozen accounts, the company is facing severe liquidity issues. Clients have reported difficulties in accessing their funds, and several financial watchdogs have flagged the company as a high-risk entity.

Industry analysts predict that FCL could face bankruptcy proceedings if it fails to resolve its legal and financial issues. The company’s deteriorating financial stability and damaged reputation indicate that its long-term survival is in serious jeopardy.

Conclusion: Expert Opinion

Based on our comprehensive investigation, Finance And Currency Limited (FCL) emerges as a highly risky entity for investors and business partners. The company’s operations are mired in undisclosed partnerships with offshore entities, which severely undermine its transparency and raise concerns about its legitimacy. Multiple lawsuits and regulatory actions further paint a picture of an organization grappling with legal and financial instability.

Moreover, FCL’s alarming anti-money laundering (AML) vulnerabilities, coupled with ties to high-risk jurisdictions, highlight the possibility of illicit financial flows and serious compliance breaches. These failings not only jeopardize the company’s credibility but also expose its stakeholders to significant reputational risks. The situation is further exacerbated by consumer complaints, which point to issues such as withdrawal delays, deceptive practices, and manipulation of trading systems.

Key Points

- Undisclosed Offshore Partnerships: Finance And Currency Limited (FCL) operates through undisclosed offshore entities, raising serious transparency concerns.

- Legal and Regulatory Actions: The company is facing multiple lawsuits and regulatory investigations for alleged financial misconduct.

- Customer Complaints: Negative customer reviews point to issues such as withdrawal delays and misleading financial practices.

- AML Vulnerabilities: FCL shows weaknesses in its anti-money laundering (AML) measures and has ties to high-risk jurisdictions, increasing both financial and reputational risks.

- Insider Testimonies: Whistleblowers have revealed deliberate manipulation of trading algorithms and intentional delays in processing withdrawals.

- Financial Instability: Mounting legal pressures and financial challenges place the company at significant risk of bankruptcy.