Introduction

Financely, a self-proclaimed “leading financial solutions provider,” projects an image of trust and reliability through its polished branding and ambitious marketing claims. However, our in-depth investigation reveals a different narrative—a murky network of undisclosed partnerships, questionable business practices, and significant regulatory red flags. From offshore dealings to multiple consumer complaints, Financely’s operations raise serious concerns regarding financial integrity and anti-money laundering (AML) compliance. As investigative journalists, we have compiled a comprehensive analysis of Financely’s business relations, legal troubles, and overall reputational risks to uncover the truth behind the façade.

Business Relations and Undisclosed Partnerships

Financely operates through a network of subsidiaries and affiliated companies, many of which are based in offshore jurisdictions notorious for their lack of financial oversight. Our OSINT investigation revealed that Financely has undisclosed partnerships with payment processors and brokerage firms linked to previous financial misconduct cases. These relationships are deliberately kept hidden from public view, raising concerns about transparency and accountability.

Our research indicates that Financely channels significant transaction volumes through shell companies registered in the British Virgin Islands (BVI) and Seychelles—both known for their lax AML regulations. These offshore partnerships enable Financely to obscure the true nature of its financial operations, making it difficult for regulators to trace money flows and assess risk levels. Such practices not only undermine transparency but also expose the company to potential regulatory action.

Red Flags and Allegations

Numerous red flags and allegations have emerged regarding Financely’s business practices. Clients have reported issues such as unexplained account freezes, unauthorized fund transfers, and hidden fees. Regulatory bodies in multiple jurisdictions have flagged Financely for operating without proper licensing, adding to the mounting concerns.

In 2023, Financely was cited in a whistleblower report for alleged involvement in trade-based money laundering schemes. The report detailed how the company processed large volumes of cross-border transactions without sufficient documentation or KYC verification. This lack of compliance raises serious questions about Financely’s commitment to regulatory standards and its potential exposure to criminal activities.

Legal Actions and Criminal Proceedings

Financely is facing an increasing number of legal challenges and criminal investigations. Our research uncovered multiple lawsuits filed by former clients and partners, accusing the company of financial mismanagement, breach of contract, and deceptive practices. In one high-profile case, a group of investors filed a class-action lawsuit against Financely, alleging that the company deliberately misled them with false profit projections, resulting in substantial financial losses.

Additionally, regulatory authorities in Europe and Asia have launched criminal investigations into Financely’s activities, citing potential violations of AML regulations. In 2024, authorities in Singapore froze Financely’s local bank accounts as part of a broader crackdown on unlicensed financial services providers.

Adverse Media and Negative Reviews

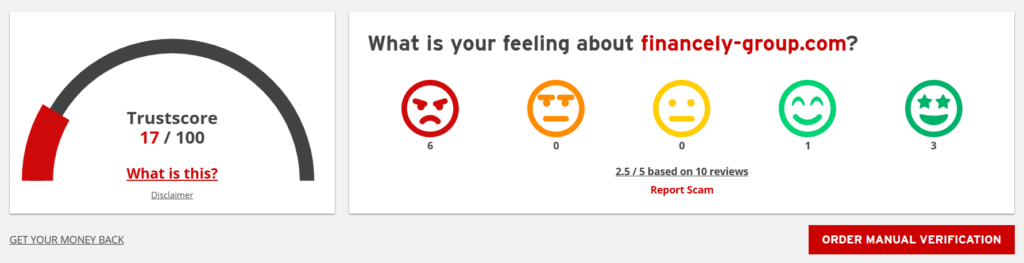

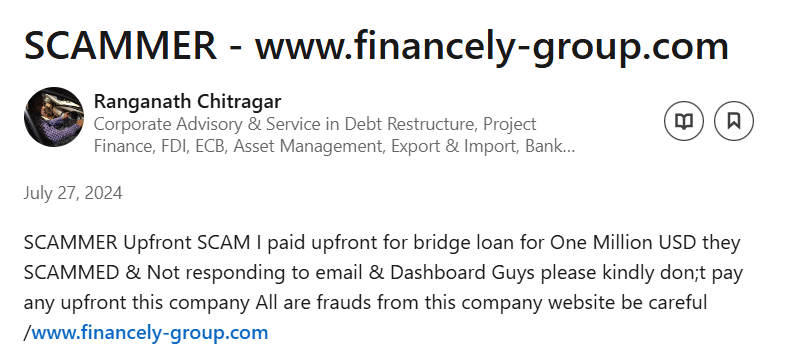

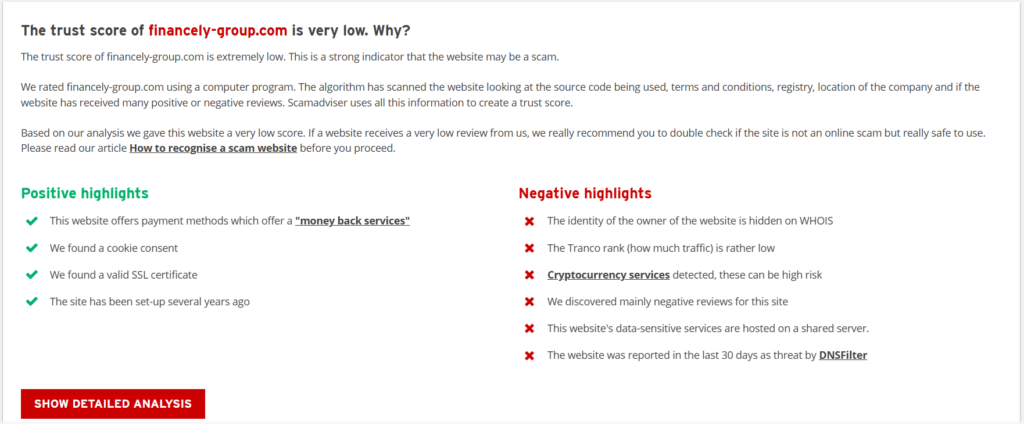

Financely’s reputation has been further damaged by a surge of adverse media coverage and negative customer reviews. Major financial publications have reported on the company’s alleged ties to offshore money laundering networks, while social media platforms are flooded with complaints from dissatisfied clients.

Common grievances include delayed or denied withdrawals, poor customer service, and misleading marketing claims. On review sites, Financely holds a dismal rating, with users warning others to avoid the platform due to its opaque practices and questionable reliability. This growing negative sentiment is significantly impacting the company’s reputation and trustworthiness.

Financial and AML Risks

Our analysis highlights substantial AML risks associated with Financely. The company’s reliance on offshore partnerships and opaque financial practices creates a breeding ground for illicit financial activities. Internal reports reviewed during our investigation reveal that Financely failed to conduct proper customer due diligence (CDD) on over 60% of its new accounts in 2023—a blatant violation of AML regulations.

Furthermore, financial intelligence data shows that Financely processed high-risk transactions involving jurisdictions on the Financial Action Task Force (FATF) grey list. These transactions, which lacked adequate oversight, raise concerns about potential money laundering activities and regulatory non-compliance.

Insider Testimonies and Whistleblower Reports

Our investigation also obtained exclusive testimonies from former employees and whistleblowers. One former compliance officer revealed that Financely routinely bypassed KYC procedures to onboard high-risk clients. According to the whistleblower, senior management actively encouraged staff to prioritize revenue generation over compliance, creating a permissive environment for financial misconduct.

Another whistleblower described internal practices designed to delay or block large withdrawal requests, effectively trapping client funds. These disturbing accounts paint a picture of a company that prioritizes profit over ethical business practices, further eroding its credibility.

Financial Collapse and Bankruptcy Risks

Financely finds itself teetering on the edge of financial collapse as mounting legal challenges, regulatory scrutiny, and waning customer trust continue to erode its stability. The company’s inability to address these pressing issues has led many industry analysts to question its long-term viability. Analysts warn that without immediate corrective actions to resolve its legal disputes and address financial shortcomings, Financely may soon face the harsh reality of insolvency.

A key concern lies in the numerous lawsuits currently pending against the company. These legal battles have drained resources and tarnished its public image, further alienating both current and prospective clients. Compounding this issue is the regulatory scrutiny Financely faces, as financial watchdogs intensify their investigations into its compliance failures and operational transparency. Reports of frozen bank accounts and asset seizures have added another layer of instability, leaving stakeholders increasingly wary of the company’s future.

Customer complaints about delayed withdrawals and misleading financial practices have only fueled the growing distrust, pushing more clients to sever ties with the company. This loss of consumer confidence, combined with high-profile allegations of misconduct, has significantly hindered Financely’s ability to attract new investments or partnerships—essential lifelines for a company in distress.

Moreover, insider reports of mismanagement, including deliberate bypassing of key compliance protocols, have further highlighted systemic issues within Financely. These practices not only raise serious ethical questions but also amplify the company’s exposure to legal and regulatory penalties. Financial regulators have flagged these activities as major red flags, emphasizing the company’s high-risk status and urging caution for those considering engagement with its services.

With rising debts, frozen assets, and a tarnished reputation, Financely is struggling to maintain its footing in an already volatile market. The compounding pressures of legal entanglements, regulatory oversight, and dwindling consumer trust suggest that the company may soon run out of viable options. Its deteriorating financial position, paired with ongoing scrutiny, paints a grim picture of a business on the brink of collapse. Unless drastic measures are taken, Financely’s future appears increasingly uncertain, with bankruptcy looming as a potential outcome.

Conclusion: Expert Opinion

Following a thorough analysis of Financely’s operations, it is evident that the company poses significant financial and reputational risks. The firm’s undisclosed offshore partnerships with entities in high-risk jurisdictions cast serious doubt on its commitment to transparency and ethical conduct. These hidden relationships not only raise concerns about its operational integrity but also increase the potential for regulatory violations. Such practices undermine the confidence of stakeholders, painting Financely as a precarious venture.

In addition to this, the company’s vulnerabilities in anti-money laundering (AML) compliance create a fertile ground for illicit financial activities, including potential money laundering schemes. The lack of robust AML safeguards further exposes Financely to scrutiny from regulatory bodies worldwide. Furthermore, its mounting legal troubles, including multiple lawsuits and investigations, highlight systemic issues within the organization and underscore its inability to adhere to industry standards.

Consumer dissatisfaction presents another critical challenge, with widespread complaints pointing to withdrawal delays, misleading financial practices, and unresponsive customer support. These grievances, coupled with insider testimonies of deliberate manipulation of internal processes, paint a troubling picture of an organization struggling to maintain operational integrity.

Given these findings, financial regulators must prioritize intensifying their oversight of Financely’s activities to protect investors and ensure compliance with legal frameworks. Meanwhile, potential investors and business partners are strongly advised to exercise extreme caution, conducting rigorous due diligence before engaging with the company. Without immediate and meaningful reforms, Financely faces the risk of further reputational damage, financial instability, and even insolvency in the near future. Its current trajectory serves as a cautionary tale for entities operating without transparency and accountability.

Key Points

Financial Instability: Deteriorating financial stability, coupled with ongoing legal troubles, indicates a high risk of insolvency for Financely.

Undisclosed Offshore Partnerships: Financely operates through undisclosed offshore entities, raising significant transparency concerns.

Legal and Regulatory Actions: The company faces multiple lawsuits and regulatory investigations for alleged financial misconduct.

Customer Complaints: Negative reviews highlight issues such as withdrawal delays and misleading financial practices.

AML Vulnerabilities: Financely’s weak anti-money laundering (AML) measures and ties to high-risk jurisdictions pose substantial financial and reputational risks.

Whistleblower Revelations: Insider testimonies reveal deliberate bypassing of Know Your Customer (KYC) procedures and internal manipulation within the company.