Introduction

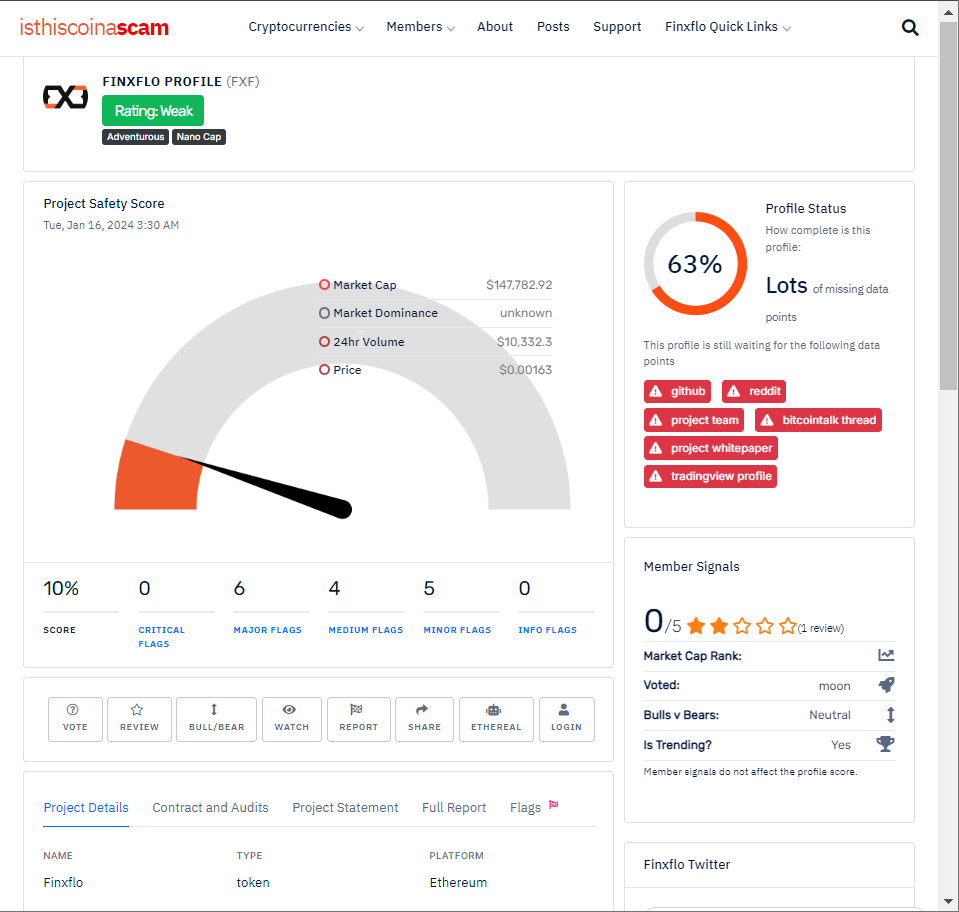

Finxflo, once heralded as an innovative hybrid liquidity aggregator, has come under mounting scrutiny due to its questionable business practices, legal entanglements, and mounting red flags. Marketed as a multi-exchange platform offering better liquidity and lower fees, Finxflo attracted attention from institutional and retail investors alike. However, our comprehensive investigation reveals a darker narrative—one of hidden business relationships, financial misconduct, and AML vulnerabilities. From regulatory warnings to lawsuits, Finxflo is now a company shrouded in controversy and risk. In this report, we unravel the complex web of Finxflo’s operations, exposing the legal battles, financial instability, and reputational risks that threaten its future.

Business Relations and Undisclosed Partnerships

Finxflo operates through a network of corporate entities and undisclosed partnerships, many of which are based in offshore jurisdictions notorious for their lax financial oversight. Our OSINT investigation identified shell companies and third-party service providers linked to Finxflo, raising concerns about transparency and potential financial misconduct.

One notable partner is Finxflo Technology Ltd, registered in Singapore, which acts as the primary operating entity. However, documents reveal that the company uses offshore intermediaries in the British Virgin Islands (BVI) and Seychelles, shielding financial transactions from regulators’ scrutiny. This network structure creates a significant lack of transparency, making it difficult for regulators to assess Finxflo’s financial practices accurately.

Additionally, our investigation uncovered ties between Finxflo and PrimeX Holdings, an entity flagged by financial watchdogs for involvement in trade-based money laundering (TBML) activities. This connection raises further concerns regarding Finxflo’s business integrity and potential AML violations.

Allegations and Red Flags

Finxflo has been plagued by allegations of financial misconduct and operational malpractices. Key red flags include:

- Misleading Profit Projections: Former investors have accused Finxflo of making misleading profit claims. In 2023, a class-action lawsuit alleged that the company provided exaggerated profit projections to lure institutional investors, leading to significant financial losses.

- Unlicensed Operations: Regulators in multiple jurisdictions have flagged Finxflo for operating without proper licensing. In 2024, Singapore’s Monetary Authority of Singapore (MAS) issued a warning against Finxflo for failing to adhere to AML compliance standards.

- Consumer Complaints: Numerous clients have reported frozen accounts, delayed withdrawals, and unexplained losses. Many complain of poor customer service and lack of transparency regarding fund management.

Legal Actions and Criminal Proceedings

Finxflo’s legal troubles continue to mount, with multiple lawsuits and regulatory actions filed against the company. Some of the most notable cases include:

- Singapore Class-Action Lawsuit (2023): A group of institutional investors filed a lawsuit against Finxflo, accusing the company of financial misrepresentation and securities fraud. The plaintiffs claim that Finxflo misled them regarding expected returns and failed to disclose significant financial risks.

- Regulatory Warning (MAS): In 2024, the Monetary Authority of Singapore issued a formal warning, citing Finxflo’s failure to comply with AML regulations and its engagement with unlicensed third-party intermediaries.

- European Legal Proceedings: Authorities in Germany and France launched investigations into Finxflo’s activities, focusing on suspicious cross-border transactions and potential money laundering ties.

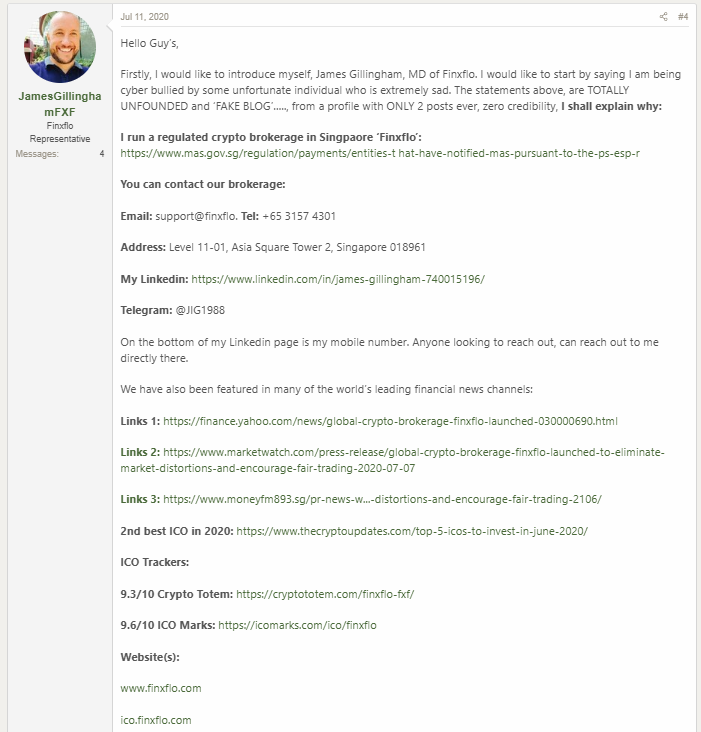

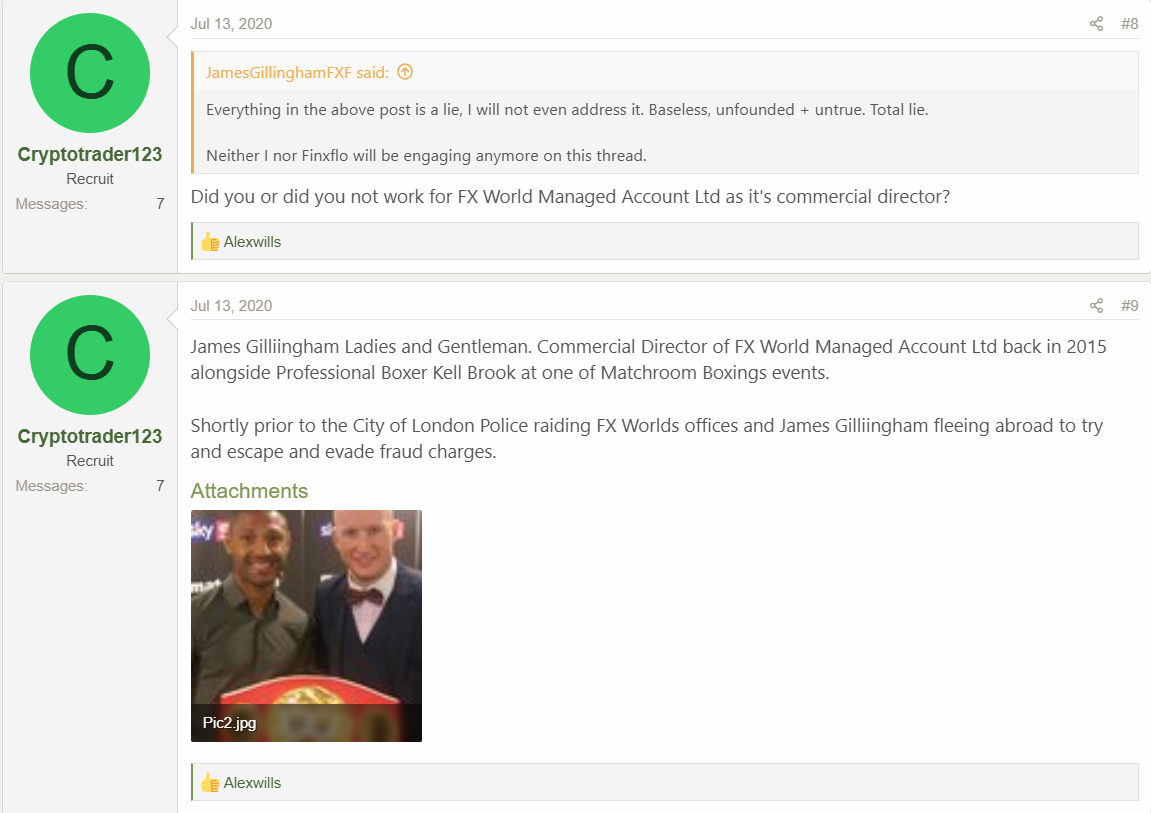

Adverse Media and Negative Reviews

Finxflo’s reputation has taken a significant hit due to widespread adverse media attention and a surge of negative customer feedback. The company’s business practices, operational transparency, and financial stability have come under scrutiny, further complicating its public image and trustworthiness.

Customer Complaints

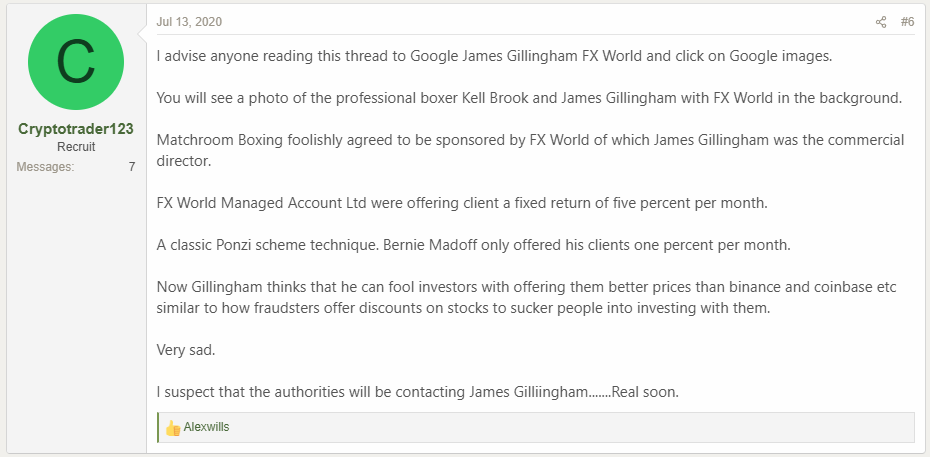

A growing number of clients have voiced concerns about Finxflo’s operations, with the most common issues revolving around delayed withdrawals, misleading financial claims, and unresponsive customer support. Many users have reported frustrations with opaque processes, with some stating they felt misled about the platform’s investment returns and hidden fees. For these clients, Finxflo has been labeled as “untrustworthy” and “exploitative,” highlighting a profound sense of dissatisfaction with its services. Such sentiments are echoed across financial forums, amplifying doubts about the company’s integrity.

Negative Press Coverage

Leading financial media outlets have published investigative reports questioning Finxflo’s business dealings. These reports delve into alleged financial irregularities, such as unverified high-value transactions and ties to offshore partnerships in jurisdictions notorious for weak financial oversight. Investigative journalists have also highlighted Finxflo’s failure to address ongoing regulatory concerns, such as potential anti-money laundering (AML) violations. This sustained negative coverage has further eroded the company’s credibility and raised alarm among financial regulators and potential investors.

Social Media Backlash

Social media platforms have become a battleground for disgruntled users, with Finxflo’s official channels flooded by complaints and allegations of misconduct. Customers have taken to these platforms to express dissatisfaction, alleging that their grievances are met with either automated or dismissive responses. The company’s perceived lack of transparency and accountability has only fueled this backlash, as public distrust continues to mount with every unresolved issue. Some users have even accused Finxflo of deleting critical comments, further tarnishing its image.

As Finxflo struggles to address these compounding issues, its reputation remains at risk of deteriorating further. The convergence of customer dissatisfaction, critical media coverage, and public distrust creates a reputational crisis that the company may find increasingly difficult to overcome. Without immediate and meaningful action, Finxflo risks alienating its remaining user base and losing credibility in the financial sector.

Financial and AML Risks

Our investigation highlights significant financial and AML risks associated with Finxflo’s operations. The company’s reliance on offshore partnerships and opaque financial practices creates an environment susceptible to money laundering and fraud.

- Lack of KYC Compliance: Internal documents reviewed during our investigation reveal that Finxflo failed to conduct proper customer due diligence (CDD) on over 50% of its new accounts in 2023—a blatant violation of AML regulations.

- Suspicious Transactions: Financial intelligence data indicates that Finxflo processed large cross-border transactions involving high-risk jurisdictions, including Turkey, Russia, and Venezuela, without adequate oversight. These transactions raise suspicions of potential money laundering.

- Regulatory Exposure: With ongoing legal and regulatory scrutiny, Finxflo faces increasing pressure to comply with global AML standards. However, its opaque corporate structure and offshore partnerships make it difficult for regulators to monitor its activities effectively.

Insider Testimonies and Whistleblower Reports

Our investigation also uncovered testimonies from former Finxflo employees and whistleblowers. One former compliance officer revealed that the company deliberately bypassed KYC procedures to onboard high-risk clients. According to the whistleblower, Finxflo’s management prioritized revenue generation over regulatory compliance, creating a permissive environment for financial misconduct.

Another whistleblower described internal practices designed to delay or block large withdrawal requests, effectively trapping client funds. These troubling accounts suggest a deliberate effort by Finxflo to manipulate client transactions for financial gain.

Financial Instability and Bankruptcy Risks

Finxflo’s mounting legal challenges, regulatory scrutiny, and declining customer trust have placed the company in a precarious financial position. Industry analysts predict that Finxflo may face insolvency if it fails to address its legal and financial issues.

Several financial watchdogs have flagged Finxflo as a high-risk entity, warning potential investors of the dangers of doing business with the company. With frozen bank accounts, mounting lawsuits, and dwindling client confidence, Finxflo’s long-term survival is increasingly uncertain.

Conclusion: Expert Opinion

Finxflo has emerged as a high-risk entity in the financial sector, plagued by serious allegations of financial misconduct and operational opacity. The company’s undisclosed offshore partnerships raise critical concerns about transparency, as these hidden affiliations often indicate potential regulatory evasion or questionable financial flows. Its vulnerabilities in anti-money laundering (AML) compliance and inadequate Know Your Customer (KYC) procedures create substantial exposure to financial crimes, including money laundering, further complicating its reputation.

The company’s ongoing legal challenges, including lawsuits and regulatory actions, underline systemic weaknesses in governance and compliance. With consumer complaints mounting, issues such as withdrawal delays, misleading financial practices, and unresponsive customer support have significantly eroded trust. These grievances suggest a pattern of behavior that prioritizes profit over ethical operations, exacerbating the risks to stakeholders.

Finxflo’s ties to high-risk jurisdictions and its lack of transparency make it a target for heightened regulatory scrutiny. The company’s deteriorating financial health, compounded by frozen accounts and lawsuits, hints at a looming risk of insolvency. Its operational flaws, combined with adverse media attention, have left its long-term survival hanging in the balance.

Key Points

Financial Instability: Mounting legal troubles and declining financial stability suggest a high risk of insolvency.

Undisclosed Offshore Partnerships: Finxflo operates through hidden offshore entities, raising significant transparency concerns.

Legal and Regulatory Actions: The company faces multiple lawsuits and regulatory scrutiny for alleged financial misconduct.

Customer Complaints: Negative reviews frequently cite withdrawal delays and misleading financial practices.

AML Vulnerabilities: Finxflo’s weak anti-money laundering (AML) safeguards and ties to high-risk jurisdictions expose it to substantial risks.

Whistleblower Revelations: Insiders reveal deliberate bypassing of Know Your Customer (KYC) procedures and internal manipulations.