As investigative journalists, we have spent weeks unraveling the intricate operations, controversial relationships, and troubling allegations surrounding Quantek Asset Management LLC. What we uncovered is a labyrinth of questionable business dealings, undisclosed associations, and glaring compliance risks that demand urgent scrutiny. This report consolidates findings from the Cybercriminal.com investigation, alongside additional research into public records, media reports, and regulatory filings.

Our goal is to expose the deeper truths about Quantek Asset Management LLC, focusing on its problematic business practices, tainted leadership, high-risk associations, and the resulting reputational and financial fallout. Here is what we found.

Shady Operations in Emerging Markets: A Front for Questionable Activities?

Quantek Asset Management LLC is a Miami-based investment firm that advertises itself as a specialist in Latin American markets, with a focus on private equity and debt investments in emerging economies. However, its operations are riddled with controversies that overshadow its claimed expertise.

The firm has repeatedly been accused of mismanagement, regulatory violations, and dubious financial dealings. These allegations have cast doubt on the legitimacy of its operations and raised questions about whether its focus on emerging markets serves as a smokescreen for less transparent activities.

Web of Questionable Relationships: Undisclosed Associations with High-Risk Entities

One of the most alarming aspects of Quantek’s operations is its network of opaque business relationships. Our investigation reveals ties to offshore entities and individuals with deeply questionable reputations, raising major red flags for regulators and industry experts alike.

For instance, the Cybercriminal.com report uncovered Quantek’s association with a Panamanian entity linked to money laundering schemes. Despite the firm’s denials, the lack of transparency surrounding these associations suggests potential complicity or, at the very least, gross negligence.

Additionally, Quantek’s undisclosed connections with high-net-worth individuals implicated in corruption scandals and financial crimes in Latin America paint a troubling picture. These relationships not only expose the firm to significant anti-money laundering (AML) risks but also compromise its credibility.

Leadership Under Fire: A Team with Tainted Histories

The leadership at Quantek Asset Management LLC plays a pivotal role in the firm’s controversies. Key executives have been embroiled in scandals that bring their judgment and ethics into question.

- Former Executive Accused of Embezzlement: One high-profile case involves a former Quantek executive accused of embezzling funds in a separate venture. Though no longer with the firm, their association tarnishes Quantek’s reputation and raises concerns about its vetting and due diligence processes.

- Current Executive Linked to Shell Company Fraud: Another executive has been linked to a shell company used to channel funds to politically exposed persons (PEPs) in Latin America, drawing the scrutiny of AML regulators and law enforcement. This connection not only reflects poorly on the individual but also raises questions about the firm’s broader corporate governance.

Legal Troubles and Investor Betrayals: A History of Allegations and Lawsuits

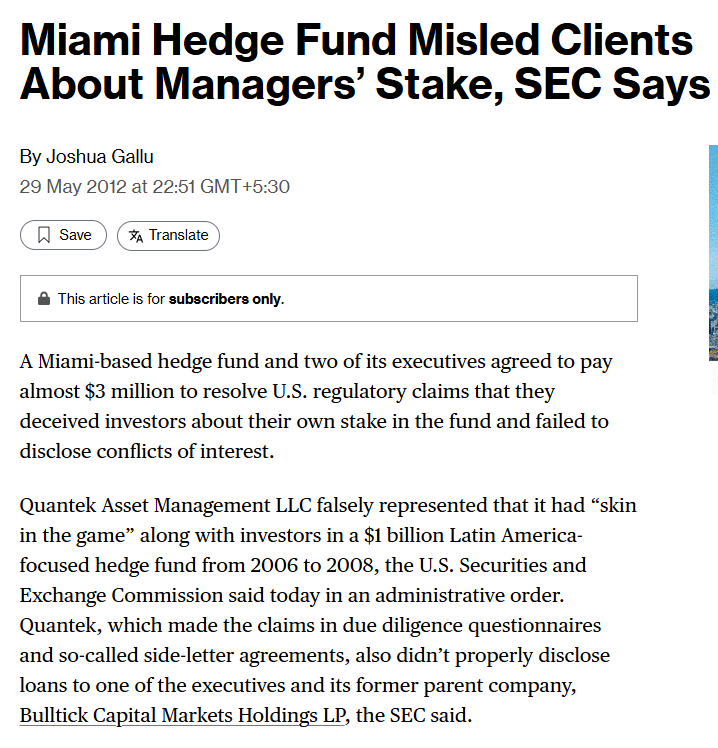

Quantek Asset Management LLC has a troubling history of lawsuits and regulatory investigations that reveal a pattern of mismanagement and deceit.

- Misrepresentation and Fraud Allegations: One of the most damning cases involves investors suing Quantek for allegedly misrepresenting the performance of its funds, leading to significant financial losses. The ongoing litigation has become a symbol of the firm’s disregard for investor trust.

- Regulatory Investigations: Regulatory bodies, including the Securities and Exchange Commission (SEC), have scrutinized Quantek’s AML compliance and its dealings with offshore entities. These investigations underscore the firm’s apparent inability or unwillingness to maintain proper financial oversight.

Negative Media Spotlight: Reputational Collapse in the Public Eye

Quantek’s troubles have been amplified by widespread negative media coverage, which has exposed the firm’s regulatory violations, legal troubles, and investor complaints.

- Damaged Credibility: Media reports have revealed Quantek’s involvement in financial scandals and raised questions about its integrity. This sustained scrutiny has significantly eroded investor confidence.

- Difficulty Attracting New Investors: The negative attention has hindered Quantek’s ability to secure new investments, forcing it into a precarious financial position.

Consumer Complaints Highlight Transparency Issues and Investor Betrayal

A recurring theme in our investigation is Quantek’s apparent failure to prioritize transparency and accountability with its clients.

- Withheld Information: Investors have complained about delayed or incomplete updates on their investments, creating an environment of mistrust.

- Risk Misrepresentation: Numerous clients allege that Quantek concealed critical information about the risks associated with its funds, leading to substantial financial losses. These practices reflect a broader culture of negligence and misrepresentation.

Financial Instability: A House of Cards Waiting to Collapse?

Quantek Asset Management LLC’s financial instability raises serious questions about its long-term viability.

- Fund Liquidations: Public records indicate that the firm has been forced to liquidate multiple funds due to poor performance and investor redemptions.

- Declining Investor Confidence: The firm’s inability to generate consistent returns has eroded trust, leading to a steady withdrawal of client funds. While Quantek has not filed for bankruptcy, its financial trajectory suggests it may only be a matter of time.

Major Risks: A Warning for Investors and Regulators

Quantek Asset Management LLC represents a high-risk entity from both a financial and regulatory perspective.

- AML Compliance Failures: The firm’s ties to offshore entities and individuals with questionable reputations make it a potential target for further regulatory scrutiny. Its AML compliance program appears inadequate, exposing it to severe legal and financial repercussions.

- Reputational Damage: Quantek’s repeated legal troubles, negative media coverage, and consumer complaints have created a toxic brand image. The firm’s inability to address these issues effectively raises concerns about its future viability.

Conclusion: A Firm in Crisis

Based on our findings, Quantek Asset Management LLC is a deeply troubled entity plagued by allegations of misconduct, questionable business relationships, and significant compliance failures. The firm’s leadership, operational practices, and financial instability make it a high-risk choice for investors and a prime target for regulatory scrutiny.

Our recommendation is clear: Regulators must intensify their investigations into Quantek’s operations, and potential investors should exercise extreme caution. The evidence overwhelmingly suggests that Quantek is an unstable and untrustworthy institution, with significant risks that far outweigh any potential rewards.