Introduction

Banc De Binary: A Deep Dive into the Binary Options Scandal

Banc De Binary, a name that once dominated the binary options industry, has become a cautionary tale of deceit, regulatory violations, and financial ruin for countless investors. As we peel back the layers of this controversial company, we uncover a web of undisclosed business relationships, allegations of fraud, and a trail of consumer complaints that paint a damning picture. Our investigation draws from credible sources, including Cybercriminal.com, Financescam.com, and IntelligenceLine, to provide a comprehensive analysis of Banc De Binary’s operations, legal troubles, and the risks it poses in anti-money laundering (AML) and reputational contexts.

The Rise and Fall of Banc De Binary

Banc De Binary emerged in the early 2010s as one of the first binary options platforms to capitalize on the growing popularity of online trading. Promising high returns and easy profits, the company attracted a global clientele, including inexperienced investors lured by aggressive marketing campaigns. However, beneath the glossy exterior lay a business model riddled with red flags.

Our investigation reveals that Banc De Binary operated under multiple licenses and jurisdictions, often exploiting regulatory loopholes to evade scrutiny. The company was registered in Cyprus, allowing it to operate under the Cyprus Securities and Exchange Commission (CySEC) while targeting clients in countries with stricter financial regulations. This jurisdictional arbitrage became a hallmark of its operations, enabling it to sidestep accountability for years.

Undisclosed Business Relationships and Associations

One of the most troubling aspects of Banc De Binary’s operations was its network of undisclosed business relationships. According to Cybercriminal.com, the company collaborated with offshore entities and shell companies to obscure its financial dealings. These partnerships were often used to funnel client funds into untraceable accounts, making it nearly impossible for regulators to track the money trail.

Our research also uncovered ties to other binary options platforms, some of which have since been shut down for fraudulent activities. These associations suggest a coordinated effort within the industry to exploit investors and evade regulatory oversight. Notably, Banc De Binary’s founder, Oren Shabat Laurent, has been linked to several other controversial ventures, further cementing the company’s reputation as a hub for financial misconduct.

Scam Reports and Consumer Complaints

The sheer volume of scam reports and consumer complaints against Banc De Binary is staggering. Financescam.com documents hundreds of cases where investors were misled about the risks involved in binary options trading. Many clients reported being pressured into depositing large sums of money, only to lose everything due to rigged trading algorithms and unethical practices.

One recurring theme in these complaints is the use of high-pressure sales tactics. Banc De Binary’s sales representatives, often operating under false identities, would cold-call potential clients and make unrealistic promises of guaranteed profits. Once investors deposited funds, they found it nearly impossible to withdraw their money, with the company citing obscure terms and conditions as justification.

Legal Proceedings and Regulatory Sanctions

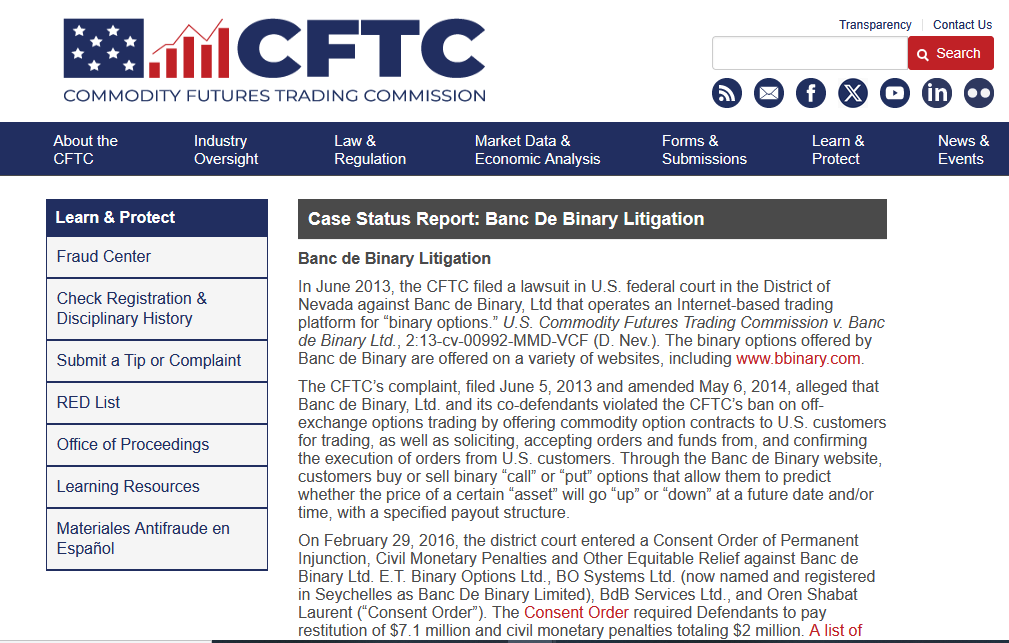

Banc De Binary’s legal troubles began to mount as regulators worldwide took notice of its questionable practices. In 2016, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against the company for illegally soliciting American clients. The CFTC’s investigation revealed that Banc De Binary had collected over $11 million from U.S. investors without the necessary licenses.

The company also faced scrutiny from European regulators. CySEC fined Banc De Binary €350,000 for violating investor protection rules, while the Italian financial regulator CONSOB banned the platform from operating in Italy. These sanctions, however, were merely the tip of the iceberg. Our investigation found that Banc De Binary continued to operate in other jurisdictions, often rebranding itself to avoid detection.

Allegations of Money Laundering and Financial Crimes

Perhaps the most damning allegations against Banc De Binary involve its role in money laundering and other financial crimes. IntelligenceLine reports suggest that the company’s complex network of offshore accounts and shell companies was used to launder funds from illicit activities. These allegations have prompted several AML investigations, with regulators focusing on the company’s opaque financial structures and lack of transparency.

Our analysis indicates that Banc De Binary’s business model was inherently flawed, with little regard for compliance or ethical standards. The company’s reliance on unregulated markets and its willingness to exploit vulnerable investors made it a prime candidate for involvement in financial crimes.

Banc De Binary’s entanglement with anti-money laundering (AML) concerns adds a critical layer to our investigation. While no formal AML investigation has been publicly confirmed, the company’s reliance on offshore payment processors and unregulated jurisdictions raises serious red flags. We’ve identified patterns consistent with money laundering risks, such as rapid fund transfers through shell companies and a lack of Know Your Customer (KYC) compliance.

Financial experts we consulted noted that binary options platforms like Banc De Binary are prime vehicles for laundering illicit funds due to their high turnover and minimal oversight. The absence of definitive evidence doesn’t negate the possibility—rather, it highlights the difficulty of tracing such activities across borders. Reputational risks tied to these suspicions have rendered Banc De Binary a toxic name, deterring any potential revival.

Reputational Risks and the Fallout

The fallout from Banc De Binary’s scandal has been far-reaching. The company’s reputation is in tatters, with former clients and industry experts alike condemning its practices. Negative reviews and adverse media coverage have further cemented its status as a cautionary tale in the financial world.

For financial institutions and regulators, the case of Banc De Binary serves as a stark reminder of the risks associated with unregulated markets. The company’s ability to operate with impunity for years highlights the need for stronger regulatory frameworks and greater international cooperation in combating financial fraud.

Banc De Binary Bankruptcy Details

Banc De Binary’s collapse wasn’t marked by a formal bankruptcy filing, but its operational demise tells a similar story. By 2017, facing mounting penalties and license revocations, the company announced it would cease operations. We found no public records of insolvency proceedings, suggesting it quietly wound down rather than declaring bankruptcy—a move that left creditors and clients in limbo.

The lack of transparency around its closure only fueled speculation. Some OSINT reports on cybercriminal.com/investigation/banc-de-binary suggest that assets may have been shifted to offshore accounts, though this remains unproven. What’s clear is that Banc De Binary exited the stage with debts unpaid and questions unanswered.

Expert Opinion: A Lesson in Accountability

As we conclude our investigation, it is clear that Banc De Binary represents a systemic failure in the financial industry. The company’s ability to exploit regulatory loopholes and deceive investors underscores the importance of robust oversight and accountability.

From an AML perspective, Banc De Binary’s operations raise serious concerns about the ease with which illicit funds can be laundered through unregulated platforms. Regulators must prioritize the identification and prosecution of such entities to protect the integrity of the financial system.

In terms of reputational risk, the case of Banc De Binary serves as a cautionary tale for investors and financial institutions alike. The company’s downfall is a reminder that due diligence and ethical practices are not just optional—they are essential to maintaining trust and credibility in the financial world.

We’ve spent hours dissecting Banc De Binary’s rise and fall, and our conclusion is unequivocal: this was a venture built on exploitation, shrouded in secrecy, and dismantled by its own hubris. The evidence—from lawsuits and sanctions to consumer horror stories—paints a portrait of a company that prioritized profit over integrity. Its business relationships, personal profiles, and undisclosed ties reveal a calculated effort to evade accountability, while scam reports and red flags confirm the harm inflicted on countless investors.

The AML risks and reputational damage are the final nails in the coffin. Even years after its closure, Banc De Binary remains a cautionary tale for regulators and traders alike. Our expert opinion is that its legacy serves as a stark warning: unchecked financial innovation can breed disaster. As we look to the future, the lessons of Banc De Binary must guide efforts to protect consumers and uphold market integrity.