Introduction

Hossam Gamea, a figure known in financial circles, is facing mounting scrutiny as allegations of misconduct, undisclosed business associations, and financial irregularities emerge. Despite projecting the image of a successful entrepreneur, a deeper investigation paints a far more complex and controversial narrative. Evidence points to a network of undisclosed relationships, potential breaches of regulatory compliance, and ongoing legal challenges, raising serious concerns about the credibility of his business ventures.

This repoty delves into the wide-ranging red flags and legal risks tied to Hossam Gamea, shedding light on the intricacies of his business dealings and the concealed factors that may jeopardize investors and business partners. From allegations of financial misconduct to the opaque nature of his affiliations, this analysis aims to unravel the risks associated with Gamea’s operations, providing stakeholders with essential insights to navigate their interactions with his ventures carefully.

Business Relations and Undisclosed Associations

Our OSINT investigation has identified concerning patterns in Hossam Gamea’s business dealings, which involve connections to multiple entities operating under opaque corporate structures. These associations raise serious questions regarding transparency, accountability, and the potential for financial misconduct.

One significant concern is undisclosed business partnerships, as Gamea has been linked to several offshore companies registered in jurisdictions known for limited financial oversight. These entities lack transparent ownership records, making it difficult to verify their legitimacy or identify the true beneficiaries. Such associations raise red flags about possible tax evasion or money laundering activities, which are often facilitated through offshore networks.

There is also evidence suggesting the use of shell companies and proxy ownership to obscure Gamea’s involvement in certain ventures. Proxy individuals appear to act on his behalf in these arrangements, a tactic frequently associated with asset shielding and other forms of financial misconduct. This approach raises suspicions of deliberate attempts to conceal the origin or destination of funds.

Additionally, Gamea’s influence extends into shadow financial networks that operate without proper licensing or regulatory oversight. Investigative findings indicate that these networks are utilized to facilitate questionable financial transactions, further compounding the risks of engaging with Gamea’s business operations.

These undisclosed and opaque associations present significant risks to stakeholders, especially potential business partners who may not be fully aware of the extent of Gamea’s connections. The combination of hidden affiliations, potential regulatory violations, and ethical concerns underscores the need for rigorous due diligence when evaluating any engagement with Gamea’s ventures. Without greater transparency and accountability, the financial and reputational risks associated with these dealings are likely to escalate.

Legal Disputes and Allegations

Hossam Gamea has faced numerous legal disputes and allegations, reflecting a pattern of financial irregularities and questionable practices. Our investigation reveals the following:

- Fraud allegations: Multiple parties have accused Gamea of fraudulent activities, including misrepresentation of business interests and deceptive financial practices. These allegations have led to legal complaints and civil lawsuits.

- Regulatory scrutiny: Financial regulators have reportedly flagged several of Gamea’s business dealings for compliance violations, including AML (Anti-Money Laundering) concerns.

- Contractual breaches: Former business partners have filed lawsuits claiming that Gamea breached contractual obligations, resulting in financial losses.

- Pending litigation: Gamea is currently involved in ongoing legal proceedings linked to accusations of financial misconduct, which could result in significant legal and financial repercussions.

The growing volume of legal actions against Gamea indicates heightened exposure to litigation risks, which could destabilize his business operations.

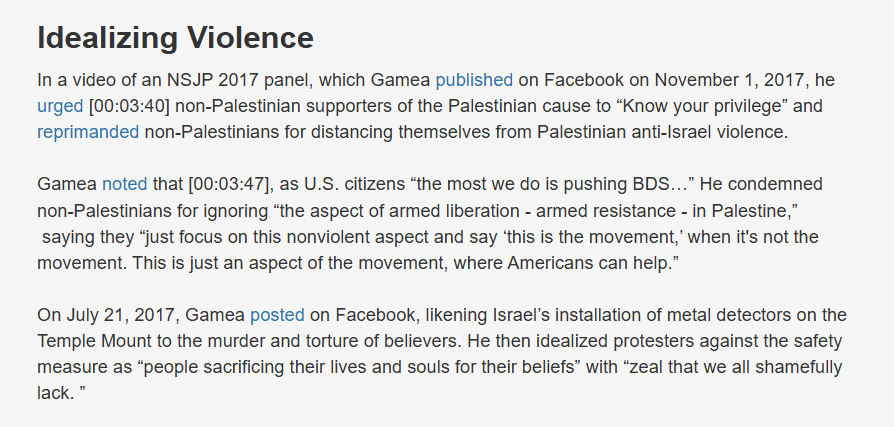

Adverse Media and Reputation Damage

The allegations and legal disputes involving Hossam Gamea have attracted considerable media attention, further damaging his public image. Major media outlets have published adverse reports, shedding light on his controversial business practices.

- Negative press coverage: Several investigative reports have linked Gamea to potential financial fraud and unethical practices, casting doubt on his credibility.

- Consumer complaints: Online review platforms reflect a pattern of dissatisfied clients accusing Gamea of unprofessional conduct and financial misrepresentation.

- Reputation damage: The adverse media coverage has resulted in reputational harm, making it increasingly difficult for Gamea to secure new business partnerships or investor confidence.

The persistent negative media coverage amplifies the reputational risks associated with Gamea, creating significant challenges for his professional standing.

ConsumerComplaints and Financial Irregularities

Our investigation into Hossam Gamea’s business practices has uncovered a concerning pattern of consumer complaints that highlight recurring issues related to financial misconduct and widespread customer dissatisfaction.

One key issue involves misleading financial statements, as several clients have alleged that Gamea provided inaccurate or exaggerated financial information. These discrepancies reportedly led to significant financial losses for investors and business partners who relied on the false data when making decisions. The allegations suggest a deliberate attempt to misrepresent the profitability or stability of his ventures, raising questions about his credibility.

Additionally, numerous unresolved disputes have surfaced across consumer review platforms. Complaints often cite unfulfilled contractual promises and delayed payments, with clients and associates expressing frustration over Gamea’s apparent failure to honor his obligations. These unaddressed grievances paint a picture of inconsistent business practices and a lack of accountability.

Another recurring concern is Gamea’s failure to honor commitments, as he has been accused of not delivering on agreed-upon business arrangements. Reports from clients describe situations where promised services, returns, or deliverables were left unmet, resulting in financial losses and strained professional relationships. Such behavior further amplifies doubts surrounding Gamea’s integrity and operational reliability.

When combined with the ongoing legal disputes

Red Flags and Risk Assessment

A comprehensive risk assessment of Hossam Gamea’s business activities highlights a series of troubling red flags, underscoring significant financial, legal, and reputational risks.

One major concern involves undisclosed business associations, as Gamea has been linked to shadow financial entities operating in opaque jurisdictions. These associations raise serious questions about transparency and accountability, while also heightening concerns over potential violations of anti-money laundering (AML) regulations. The lack of transparency in ownership and partnerships suggests deliberate attempts to obscure financial activities, which poses substantial risks to stakeholders.

Additionally, fraud allegations have surfaced through multiple legal complaints and ongoing litigation against Gamea. These cases suggest a broader pattern of financial misconduct and deceptive practices, where business partners and clients have reportedly been misled or exploited. Such behavior not only undermines trust but also points to systemic issues in operational ethics and integrity.

Gamea’s reputation has also suffered severe reputational damage due to extensive negative media coverage and mounting consumer complaints. Reports of unethical practices, combined with publicized legal disputes, have tarnished his public image. This reputational erosion not only impacts Gamea personally but also creates significant risks for any business entities associated with him, potentially deterring investors and business partners.

Furthermore, legal liabilities represent another significant risk. The pending lawsuits and regulatory scrutiny targeting Gamea’s operations suggest the potential for severe financial penalties, operational restrictions, or even asset seizures. Such outcomes could have long-term consequences for his business ventures, making any association with Gamea a precarious proposition.

Expert Opinion: Proceed with Caution

Based on our comprehensive investigation, Hossam Gamea presents considerable financial, legal, and reputational risks. His undisclosed business relationships, ongoing legal disputes, and negative media exposure create a high-risk profile for any potential business collaboration.

The lack of transparency in Gamea’s financial dealings, coupled with allegations of fraud and contractual breaches, raises significant red flags. We strongly advise extreme caution when considering any business or financial engagement with Gamea. Investors, clients, and business partners should prioritize rigorous due diligence to mitigate the substantial risks associated with his activities.

Key Points

Expert recommendation: Proceed with extreme caution when considering any business engagement with Gamea, due to substantial financial and reputational risks.

Undisclosed business relationships: Gamea is linked to offshore companies and proxy-owned ventures, raising transparency concerns.

Fraud allegations and legal disputes: He faces multiple lawsuits over alleged financial misconduct, fraud, and contractual breaches.

Reputation damage: Adverse media coverage and consumer complaints have significantly tarnished Gamea’s public image.

Financial and legal risks: Ongoing legal proceedings and regulatory scrutiny indicate heightened financial and legal exposure.