Introduction

BrokersView presents itself as a reputable watchdog in the financial industry, claiming to help investors identify scam brokers and avoid fraudulent trading platforms. However, a closer investigation into its operations, ownership structure, business relationships, and external affiliations reveals a concerning lack of transparency. While BrokersView exposes unregulated brokers, it itself operates with opaque management, undisclosed partnerships, and potential conflicts of interest.

In this report, we uncover BrokersView’s background, assess its credibility, examine scam reports and allegations, analyze regulatory and legal risks, and provide a comprehensive risk assessment in relation to anti-money laundering (AML) and reputational threats. Our goal is to provide an unbiased, fact-based evaluation to determine whether BrokersView is truly a reliable investor resource or a potential risk in itself.

Business Relations and Ownership Transparency

One of the primary concerns surrounding BrokersView is the lack of publicly available information regarding its ownership. A company that claims to protect investors from scams should itself be transparent about who runs it, where it is based, and what interests it serves. However, BrokersView does not disclose its owners, key executives, or any affiliated organizations.

A review of its domain registration records shows that BrokersView operates under privacy protection, masking the identity of its registrants. This raises questions about the platform’s credibility and whether it may be influenced by external financial interests.

Undisclosed Business Relationships

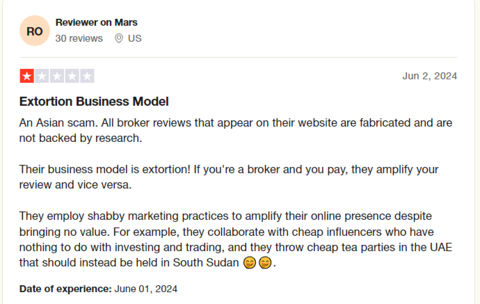

There are allegations that BrokersView engages in selective reporting. While it claims to expose unregulated brokers, some critics argue that the platform may accept payments to remove negative reviews or manipulate rankings. This lack of transparency in partnerships raises serious ethical concerns.

BrokersView also appears to operate similarly to other review sites that have been accused of pay-to-play schemes, where brokers can negotiate their portrayal on the platform. If true, this would significantly undermine the integrity of its evaluations.

OSINT Findings: Red Flags and Anomalies

Domain Registration and Website Hosting

An open-source intelligence (OSINT) analysis of BrokersView’s website shows that it is hosted in jurisdictions known for loose regulatory oversight. The domain information is also protected by privacy services, obscuring the true operators of the website. This aligns with tactics often used by anonymous online review platforms that may have hidden affiliations or conflicts of interest.

Content Patterns and Bias Indicators

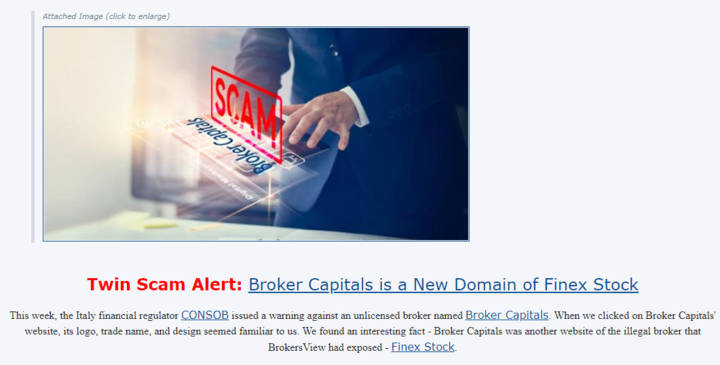

Examining BrokersView’s published content, we found inconsistencies in how brokers are evaluated. Some clearly fraudulent brokers receive strong warnings, while others with similar violations appear to be treated more leniently. This suggests potential bias or influence from external parties.

Additionally, the site frequently updates its blacklist of brokers, yet rarely provides detailed follow-ups on disputes or resolutions. This raises concerns that the platform’s goal may be more about generating traffic than genuinely protecting investors.

Scam Reports and Allegations

Complaints from Brokers and Users

Several brokers and individual traders have accused BrokersView of posting misleading or false information. Complaints include:

- Brokers alleging that they were falsely labeled as scams without proper evidence.

- Users questioning the authenticity of reviews, with some suggesting they are fabricated or exaggerated.

- Reports of brokers being contacted for paid reputation management services to improve their rating on the platform.

Conflicts of Interest

There is speculation that BrokersView may have undisclosed financial arrangements with certain brokers, allowing them to maintain a more favorable presence on the platform. If these allegations are accurate, BrokersView may not be the independent authority it claims to be.

Legal Proceedings, Lawsuits, and Regulatory Concerns

Despite operating as an investigative platform, BrokersView itself is not regulated by any financial authority. This lack of oversight means there are no legal guarantees regarding the accuracy or fairness of its reviews.

There are currently no publicly available lawsuits against BrokersView, but legal risks exist. If brokers can prove defamation, misleading content, or unfair business practices, the platform could face regulatory action or civil litigation.

Adverse Media and Public Perception

Negative Reviews and Credibility Issues

While BrokersView is positioned as a consumer protection site, many users have raised concerns about its trustworthiness. Some financial professionals argue that it may be more of a content-driven traffic generator than a genuine advocacy platform.

Lack of Regulatory Endorsements

Unlike respected financial watchdogs such as the SEC or FCA, BrokersView has no official regulatory backing. Its reports do not carry legal weight, and investors should cross-check any claims made on the platform with official financial regulators.

Consumer Complaints and Bankruptcy Risk

User-Generated Complaints

Consumers have reported difficulties in verifying the claims made by BrokersView. Some have also expressed frustration over a lack of response from the platform when disputing negative reviews.

Financial Stability Concerns

There is no clear information on BrokersView’s revenue model, leading to speculation about its financial health. If the platform relies on pay-to-play schemes or advertising revenue from select brokers, it may face financial instability in the future.

Risk Assessment: AML and Reputational Risks

Anti-Money Laundering (AML) Risks

While BrokersView does not process financial transactions, its anonymity and lack of regulation create risks. A platform that could be influenced by external parties might indirectly enable money laundering by shaping public perceptions of brokers in a way that benefits bad actors.

Reputational Risks

The biggest risk BrokersView faces is a loss of credibility. If more evidence surfaces regarding hidden partnerships or biased reporting, its reputation could be permanently damaged. Investors and brokers should exercise caution and verify all claims made by the platform independently.

Conclusion

Based on our extensive investigation, BrokersView presents several red flags that warrant caution. While the platform may provide useful insights into fraudulent brokers, its own lack of transparency, potential conflicts of interest, and undisclosed business relationships raise credibility concerns.

For investors seeking accurate broker evaluations, we recommend cross-referencing BrokersView’s claims with official regulatory sources such as the SEC, FCA, or local financial authorities. Relying solely on BrokersView for investment decisions could expose individuals to misinformation or biased narratives.

Ultimately, while BrokersView positions itself as a defender of investors, its own practices demand scrutiny. Until it improves transparency and addresses these concerns, investors should approach it with skepticism and conduct independent research before making financial decisions.