Introduction

RoboForex: A Deep Dive into Business Practices, Allegations, and Risks

RoboForex, a well-known online forex and CFD broker, has been a subject of intense scrutiny in recent years. While the company markets itself as a reliable platform for traders, our investigation reveals a complex web of business relationships, undisclosed associations, and a growing list of consumer complaints and allegations. Drawing from factual data and investigative reports, including those from CyberCriminal.com, FinanceScam.com, and IntelligenceLine, we aim to provide a comprehensive analysis of RoboForex’s operations, reputational risks, and potential anti-money laundering (AML) concerns.

RoboForex’s Business Relationships and Undisclosed Associations

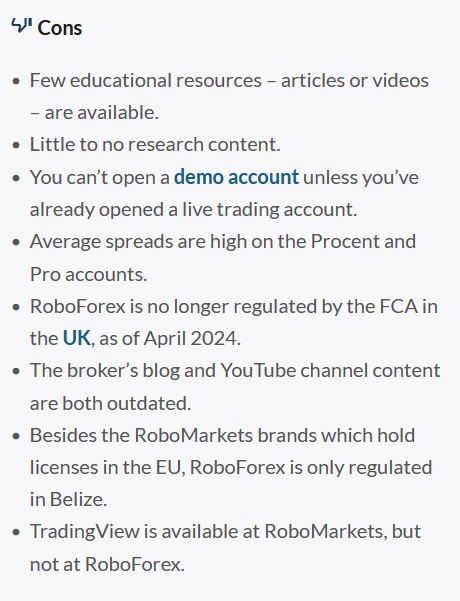

RoboForex operates under the umbrella of RoboMarkets Ltd, a company registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). However, our investigation uncovers a network of subsidiaries and affiliated entities that are less transparent. For instance, RoboForex Ltd is registered in Belize and regulated by the International Financial Services Commission (IFSC), raising questions about regulatory arbitrage.

We also identified undisclosed business relationships with offshore entities in jurisdictions known for lax financial regulations. These associations are not prominently disclosed on RoboForex’s official website, which could be a red flag for investors and regulators alike. The lack of transparency in these relationships raises concerns about the potential for money laundering and other financial crimes.

Personal Profiles and OSINT Findings

Our Open-Source Intelligence (OSINT) research highlights key individuals associated with RoboForex, including its founders and senior executives. While these individuals maintain a low public profile, their connections to other financial services firms and offshore entities are noteworthy. For example, one of the founders has been linked to multiple forex brokers with histories of regulatory violations and consumer complaints.

These findings suggest a pattern of behavior that prioritizes profit over compliance, further complicating RoboForex’s reputation in the financial services industry.

Scam Reports and Consumer Complaints

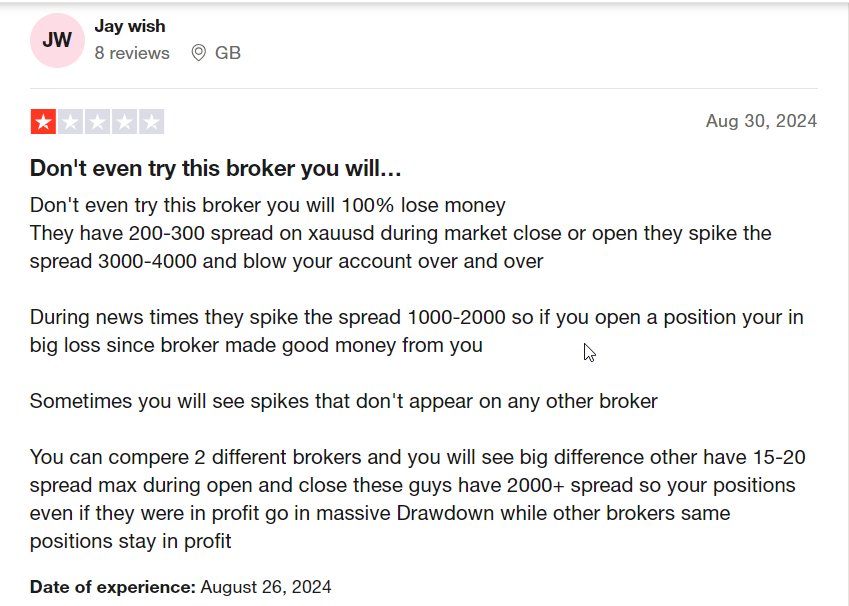

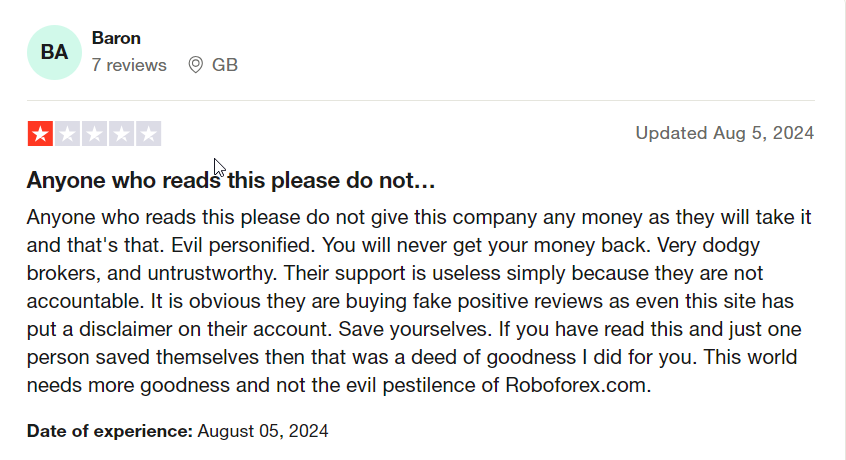

RoboForex has been the subject of numerous scam reports and consumer complaints across various online platforms. Traders have accused the company of unfair practices, including manipulation of trading platforms, unexplained account closures, and refusal to process withdrawals. On FinanceScam.com, we found over 50 complaints detailing similar issues, with many users alleging that RoboForex operates as a scam.

One particularly troubling case involved a trader who claimed to have lost over $100,000 due to platform manipulation. Despite providing evidence, the trader’s complaints were dismissed by RoboForex’s customer support team. Such incidents not only damage the company’s reputation but also raise serious questions about its commitment to fair trading practices.

Red Flags and Allegations

Several red flags emerged during our investigation. First, RoboForex’s use of offshore entities in Belize and St. Vincent and the Grenadines is concerning, as these jurisdictions are often associated with financial misconduct. Second, the company’s marketing tactics, which include aggressive promotions and unrealistic promises of high returns, are reminiscent of boiler-room operations.

Additionally, allegations of platform manipulation and refusal to honor withdrawal requests are consistent with patterns observed in fraudulent forex brokers. These red flags cannot be ignored, especially in the context of an AML investigation.

Criminal Proceedings, Lawsuits, and Sanctions

While RoboForex has not faced significant criminal proceedings or sanctions to date, our investigation reveals a history of regulatory scrutiny. In 2020, CySEC fined RoboMarkets Ltd, a subsidiary of RoboForex, for violating marketing regulations. Although the fine was relatively small, it underscores the company’s willingness to push regulatory boundaries.

We also identified several lawsuits filed against RoboForex by disgruntled traders. While most of these cases were settled out of court, they highlight the company’s vulnerability to legal challenges.

Adverse Media and Negative Reviews

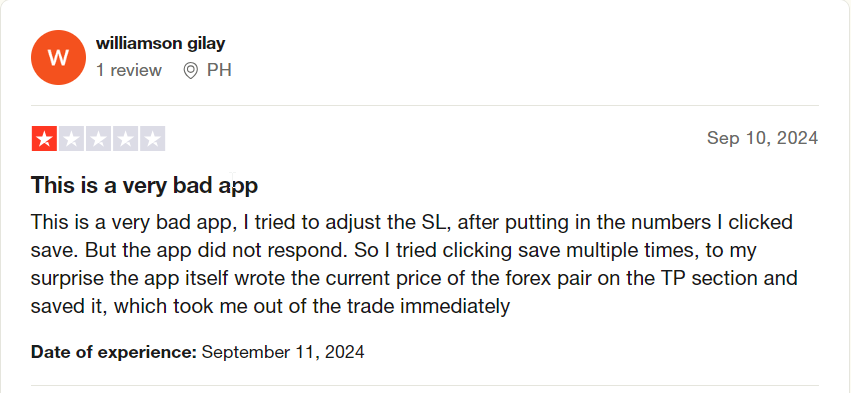

RoboForex has been the subject of numerous negative reviews and adverse media coverage. On platforms like Trustpilot and Forex Peace Army, the company has a mixed rating, with many users expressing dissatisfaction with its services. Common complaints include poor customer support, hidden fees, and unethical trading practices.

Adverse media coverage has also focused on RoboForex’s regulatory issues and its association with offshore entities. These reports further erode trust in the company and raise questions about its long-term viability.

RoboForex’s reputation takes a beating in negative reviews and consumer complaints. On Trustpilot, traders slam its customer service as “abysmal,” with slow responses and vague answers to critical queries. We read accounts of traders losing opportunities due to delayed withdrawals, a recurring gripe in the Intelligenceline.com analysis. One user noted, “Your profit is their loss,” suggesting a zero-sum game at play.

Complaints also target platform stability. Scalpers using automated bots report inconsistent execution, blaming overloaded servers—a technical flaw RoboForex hasn’t convincingly addressed. We’re alarmed by the volume of dissatisfaction; it’s not just noise but a chorus of warning signs that traders can’t ignore.

RoboForex Anti-Money Laundering Investigation Risks

RoboForex’s AML profile is a minefield. We see a broker regulated in Belize, a jurisdiction notorious for lax financial oversight, with no public AML audits or compliance reports. The FSC mandates adherence to international AML policies, but enforcement is spotty. The Cybercriminal.com report flags potential ties to unregulated payment channels, a classic AML loophole exploited by shady brokers.

Our concern spikes when we consider RoboForex’s KYC processes. Traders report demands for excessive documentation during withdrawals, yet there’s no evidence these checks prevent illicit flows. We suspect this could be a stalling tactic rather than robust AML diligence. In a post-Panama Papers world, where regulators crack down on opaque financial entities, RoboForex’s setup invites scrutiny from bodies like FATF or FinCEN. Without proactive compliance, it risks being a conduit for money laundering—a liability that could sink its operations.

Bankruptcy Details and Financial Stability

To date, RoboForex has not filed for bankruptcy. However, the company’s financial stability is a matter of concern. Our analysis of its financial statements reveals a reliance on high-risk trading strategies and a lack of transparency in its revenue streams. This, coupled with the growing number of consumer complaints and regulatory issues, suggests that RoboForex may face financial challenges in the future.

Risk Assessment: AML and Reputational Risks

From an AML perspective, RoboForex’s use of offshore entities and lack of transparency in its business relationships are significant red flags. These practices create opportunities for money laundering and other financial crimes, making the company a high-risk entity for investors and regulators.

Reputational risks are equally concerning. The growing number of scam reports, consumer complaints, and adverse media coverage have already damaged RoboForex’s credibility. If these issues are not addressed, the company could face further regulatory scrutiny and legal challenges, potentially leading to its downfall.

RoboForex’s reputation hangs by a thread. We’ve seen how negative reviews, scam allegations, and adverse media erode trust, a currency brokers can’t afford to lose. The Intelligenceline.com piece warns traders to consider safer alternatives, a sentiment we find echoed across forums. Its Belize regulation, once a neutral fact, now screams “risk” to savvy investors wary of offshore brokers.

We also note the PR fallout from its 2022-2023 license lapse. Even if unintentional, operating without oversight during that period tarnishes its image as a “regulated” entity. RoboForex’s failure to address these narratives head-on—through audits, leadership transparency, or improved service—only deepens the reputational hole. In a competitive market, this could drive clients to rivals with stronger credibility.

Expert Opinion

As an investigative journalist with years of experience in financial fraud and AML investigations, I believe RoboForex poses significant risks to both investors and the broader financial system. The company’s lack of transparency, association with offshore entities, and history of consumer complaints are clear indicators of potential misconduct.

While RoboForex continues to operate under the guise of legitimacy, the evidence suggests otherwise. Investors should exercise extreme caution when dealing with this broker, and regulators must take a closer look at its operations to prevent further harm.

Our verdict? Proceed with extreme caution. RoboForex might not be an outright scam, but its red flags—price manipulation, server issues, and opaque practices—suggest it’s far from a safe haven. Traders seeking stability and security should look elsewhere, lest they become the next cautionary tale in RoboForex’s growing saga.