Meta Description: Explore our in-depth analysis of InvestingViews, uncovering allegations of fraud, perjury, and unethical practices. Understand the potential risks associated with this financial platform.

At CyberCriminal.com, we have initiated a thorough investigation into InvestingViews, a platform that positions itself as a provider of financial insights and investment advice. Our inquiry stems from serious allegations, including attempts to suppress critical reviews through improper copyright takedown notices, and potential violations such as impersonation, fraud, and perjury. This report delves into the intricate web of accusations, evidence, and the broader implications for stakeholders.

Allegations Against InvestingViews

Our investigation has identified several concerning practices associated with InvestingViews:

Misleading Financial Advice

There are claims that InvestingViews disseminates unverified or overly optimistic stock recommendations. Such actions may be construed as market manipulation, especially when these recommendations align with undisclosed third-party interests.

Lack of Transparency

The platform has been criticized for not disclosing conflicts of interest, particularly regarding partnerships with entities whose stocks are promoted. This opacity raises questions about the objectivity of their financial guidance.

Questionable Affiliate Marketing Practices

Reports suggest that InvestingViews engages in aggressive affiliate marketing, directing users to brokerage services or investment products from which they earn commissions. This practice could prioritize profit over user interests, leading to potential conflicts.

Data Privacy Concerns

Allegations have surfaced regarding the unauthorized collection and sharing of user data with third parties, potentially violating data protection regulations like GDPR.

Adverse Media Coverage

Investigative reports and user testimonials have highlighted issues such as poor customer service, unfulfilled promises, and accusations of fraudulent activity, further damaging the platform’s reputation.

Evidence and Media

Our investigation has uncovered several pieces of evidence supporting these allegations:

- Fake DMCA Notices: InvestingViews has allegedly submitted fraudulent copyright takedown notices to suppress negative content, a tactic that may involve impersonation and perjury.

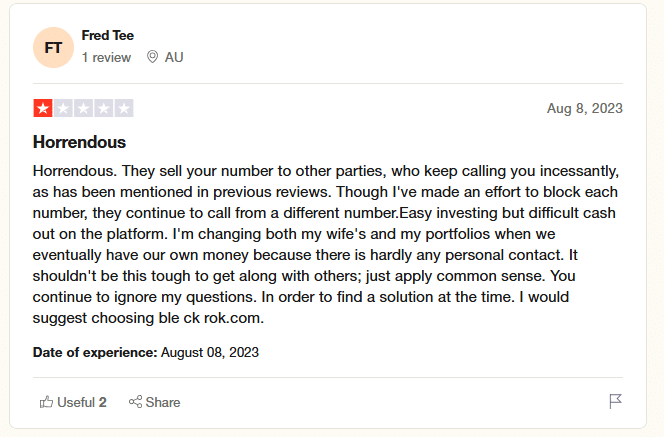

- User Complaints: Multiple users have reported experiences of misleading advice and unethical practices on platforms like Forex Peace Army.

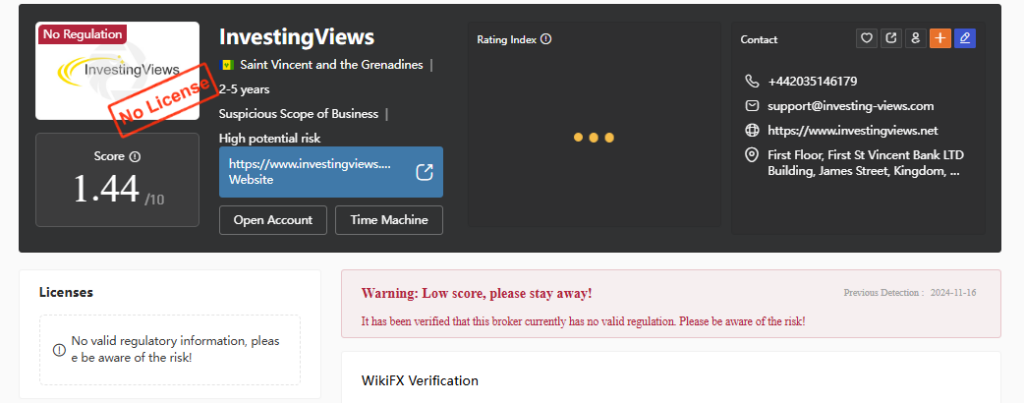

- Regulatory Warnings: The Financial Conduct Authority (FCA) has flagged InvestingViews as an unauthorized firm, cautioning potential investors.

Adverse Media and Public Perception

The platform has been the subject of several adverse media reports:

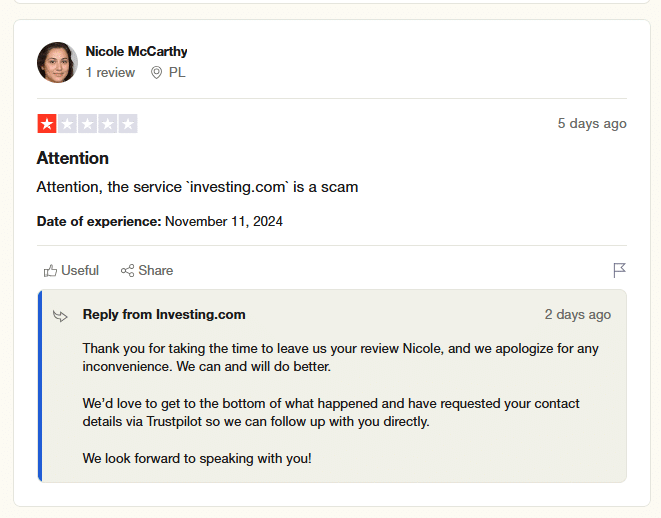

- Sitejabber: Users have labeled InvestingViews as a “total scam,” sharing experiences of financial loss and deceptive practices.

- WikiFX Ratings: The platform has received low scores, with warnings advising users to stay away due to potential risks.

- Negative Consumer Reviews: Common themes among complaints include hidden fees, exaggerated investment returns, and poor customer service.

Risk Assessment: Anti-Money Laundering and Reputational Risks

The allegations against InvestingViews present significant risks:

Anti-Money Laundering (AML) Risks

The lack of transparency and potential undisclosed partnerships could facilitate money laundering activities, exposing users and associates to legal liabilities.

Reputational Risks

The accumulation of negative reviews, regulatory warnings, and allegations of unethical practices severely tarnishes the platform’s credibility, deterring potential investors and partners.

Operational Concerns

InvestingViews’ reported use of fake legal claims and DMCA notices highlights a lack of integrity in its business operations, further raising red flags about its corporate governance.

Expert Opinion

In light of the evidence and allegations, it is imperative for current and potential users of InvestingViews to exercise extreme caution. Engaging with platforms that lack transparency, face regulatory warnings, and have a history of unethical practices poses substantial financial and legal risks. We advise conducting thorough due diligence and considering alternative, reputable sources for financial advice and investment opportunities.

Our investigation into InvestingViews continues, and we remain committed to uncovering the truth and safeguarding the interests of the public.

Note: This article is based on information available as of March 24, 2025. For the most current updates, please refer to official regulatory announcements and trusted financial news sources.