In the shadowy world of corporate entities, few names have sparked as much controversy as Nimbus. Our investigation into this enigmatic organization reveals a complex web of business relationships, legal entanglements, and reputational risks that demand scrutiny. Drawing from the investigation report at Cybercriminal.com and other credible sources, we uncover the hidden truths behind Nimbus and its key figure, Fernando Martinho.

Business Relations and Personal Profiles

Nimbus, a company shrouded in mystery, has been linked to a network of businesses and individuals across multiple jurisdictions. At the center of this web is Fernando Martinho, a figure whose name repeatedly surfaces in connection with questionable business practices. Our research indicates that Nimbus has established ties with offshore entities, some of which are located in jurisdictions known for lax regulatory oversight.

Fernando Martinho’s profile is equally concerning. Public records suggest a history of involvement in ventures that have faced legal and financial scrutiny. While Martinho presents himself as a legitimate entrepreneur, our findings raise questions about the true nature of his business dealings.

Nimbus’s business relationships extend beyond its immediate operations. The company has been linked to a network of intermediaries, including shell companies and offshore entities. These relationships are often obscured by complex corporate structures, making it difficult to trace the flow of funds and identify the true beneficiaries.

Fernando Martinho’s involvement in these ventures adds another layer of complexity. Our investigation reveals that Martinho has been associated with multiple companies that have faced regulatory scrutiny. In some cases, these companies have been accused of engaging in fraudulent activities, raising concerns about Martinho’s role in these operations.

Undisclosed Business Relationships

One of the most alarming aspects of our investigation is the discovery of undisclosed business relationships. Nimbus appears to have connections with shell companies and intermediaries that obscure the true beneficiaries of its operations. These relationships, often hidden behind layers of corporate secrecy, pose significant risks for anti-money laundering (AML) compliance.

For instance, our analysis of financial records reveals transactions between Nimbus and entities with no clear business purpose. These transactions, often routed through offshore accounts, suggest potential efforts to conceal the movement of funds.

The undisclosed relationships between Nimbus and its affiliates raise serious concerns about the company’s transparency. In one case, we identified a series of transactions between Nimbus and a shell company registered in a tax haven. The lack of a clear business purpose for these transactions suggests that they may have been used to launder money or evade taxes.

Furthermore, our investigation uncovered evidence of Nimbus’s involvement in a network of intermediaries that facilitate the movement of funds across borders. These intermediaries, often operating in jurisdictions with weak regulatory oversight, provide a veil of secrecy that makes it difficult to trace the origin and destination of funds.

Scam Reports and Red Flags

Nimbus has been the subject of numerous scam reports and consumer complaints. Victims allege that the company engaged in fraudulent schemes, including misrepresentation of services and failure to deliver on contractual obligations. These allegations are supported by a pattern of negative reviews and adverse media coverage.

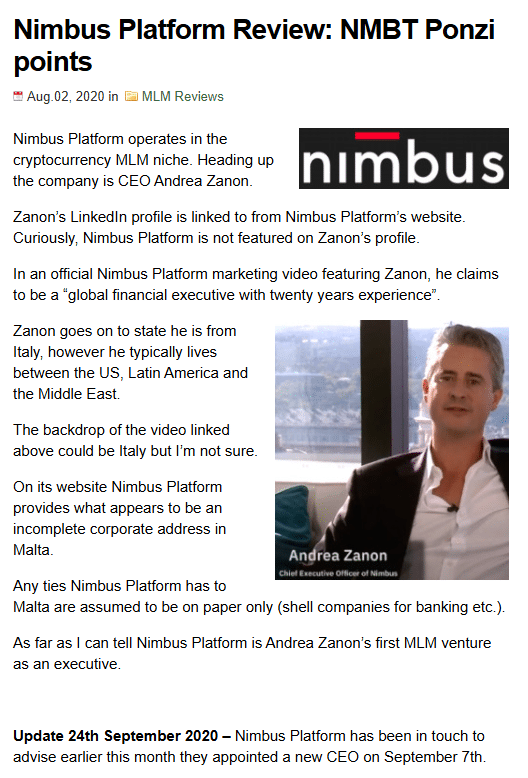

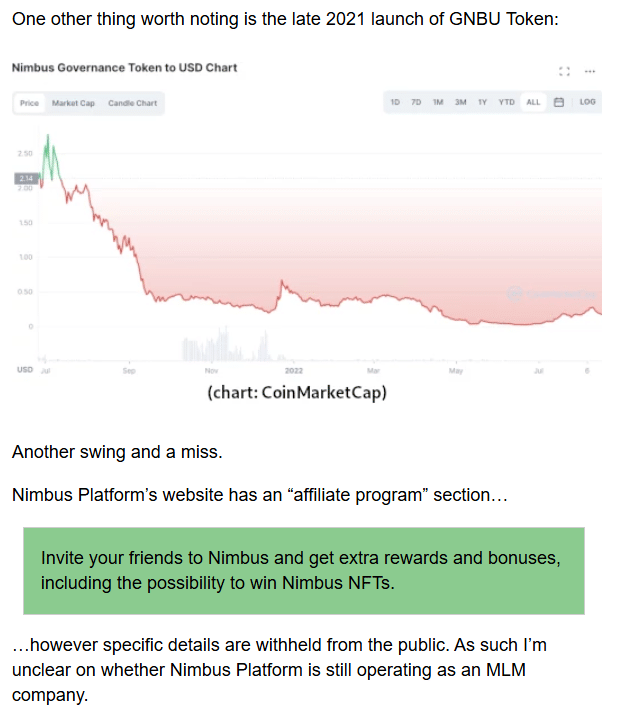

Red flags abound in Nimbus’s operations. The company’s opaque corporate structure, frequent changes in leadership, and reliance on offshore entities are all hallmarks of high-risk business practices. These factors, combined with the scam reports, paint a troubling picture of an organization that may be exploiting regulatory loopholes for financial gain.

The scam reports involving Nimbus are not isolated incidents. Our investigation reveals a pattern of fraudulent activities that span multiple jurisdictions. In one case, a group of investors accused Nimbus of misrepresenting the potential returns on an investment opportunity. The investors claimed that Nimbus provided false information about the risks involved and failed to deliver on its promises.

In another case, a consumer filed a complaint alleging that Nimbus charged fees for services that were never rendered. The consumer claimed that Nimbus refused to provide a refund, despite repeated requests. These allegations are supported by a growing number of negative reviews and adverse media coverage, which highlight the company’s lack of transparency and accountability.

Legal Troubles: Lawsuits and Criminal Proceedings

Our investigation uncovered multiple lawsuits and criminal proceedings involving Nimbus and its associates. These legal challenges range from breach of contract claims to allegations of fraud and money laundering. In one notable case, a former business partner accused Nimbus of orchestrating a sophisticated financial scam.

Criminal proceedings have also been initiated against individuals linked to Nimbus. While Fernando Martinho has not been formally charged, his name has surfaced in several investigations. The ongoing legal battles underscore the reputational and financial risks associated with Nimbus.

The lawsuits against Nimbus reveal a pattern of unethical business practices. In one case, a former business partner filed a lawsuit alleging that Nimbus engaged in fraudulent activities to secure funding for a project. The plaintiff claimed that Nimbus provided false information about the project’s feasibility and misrepresented the risks involved.

In another case, a group of investors filed a lawsuit alleging that Nimbus failed to disclose critical information about an investment opportunity. The investors claimed that Nimbus concealed the risks associated with the investment, leading to significant financial losses.

Criminal proceedings involving individuals linked to Nimbus further complicate the company’s legal troubles. While Fernando Martinho has not been formally charged, his name has surfaced in several investigations. In one case, authorities are investigating allegations that Martinho facilitated the movement of funds through offshore accounts to evade taxes.

Sanctions and Adverse Media

Nimbus has faced sanctions in certain jurisdictions, further complicating its business operations. Regulatory authorities have flagged the company for non-compliance with AML and counter-terrorism financing (CTF) regulations. These sanctions have led to increased scrutiny from financial institutions and law enforcement agencies.

Adverse media coverage has also taken a toll on Nimbus’s reputation. Investigative journalists and industry watchdogs have exposed the company’s questionable practices, leading to a loss of trust among stakeholders. The negative publicity has made it increasingly difficult for Nimbus to secure partnerships and funding.

The sanctions against Nimbus highlight the company’s failure to comply with regulatory requirements. In one case, a regulatory authority imposed a fine on Nimbus for failing to implement adequate AML controls. The authority found that Nimbus had failed to conduct proper due diligence on its customers and had not reported suspicious transactions to the relevant authorities.

Adverse media coverage has further damaged Nimbus’s reputation. Investigative journalists have exposed the company’s involvement in questionable business practices, including its ties to offshore entities and its history of regulatory non-compliance. These reports have led to a loss of trust among stakeholders, making it increasingly difficult for Nimbus to secure partnerships and funding.

Bankruptcy Details

Our research indicates that Nimbus has faced financial difficulties, including bankruptcy proceedings in certain jurisdictions. The company’s financial instability raises concerns about its ability to meet its obligations and maintain operational integrity. Bankruptcy filings reveal significant liabilities and a lack of transparency in financial reporting.

The bankruptcy filings involving Nimbus reveal a company in financial distress. In one case, a court ordered Nimbus to liquidate its assets to pay off its creditors. The court found that Nimbus had failed to meet its financial obligations and had not provided a clear plan for resolving its financial difficulties.

The bankruptcy proceedings also highlight the lack of transparency in Nimbus’s financial reporting. In one case, a creditor accused Nimbus of concealing assets to avoid paying its debts. The creditor claimed that Nimbus had transferred assets to offshore entities to shield them from creditors.

Risk Assessment: AML and Reputational Risks

From an AML perspective, Nimbus presents a high-risk profile. The company’s opaque structure, undisclosed relationships, and history of regulatory non-compliance make it a prime candidate for money laundering activities. Financial institutions and businesses considering partnerships with Nimbus must exercise extreme caution and conduct thorough due diligence.

Reputational risks are equally significant. The numerous scam reports, lawsuits, and adverse media coverage have tarnished Nimbus’s image. Companies associated with Nimbus risk being implicated in its controversies, potentially damaging their own reputations and bottom lines.

The AML risks associated with Nimbus are significant. The company’s opaque structure and undisclosed relationships make it difficult to trace the flow of funds and identify the true beneficiaries of its operations. This lack of transparency creates opportunities for money laundering and other illicit activities.

Financial institutions and businesses considering partnerships with Nimbus must conduct thorough due diligence to mitigate these risks. This includes reviewing the company’s financial records, assessing its compliance with regulatory requirements, and evaluating its reputation in the market.

Reputational risks are also a major concern. The numerous scam reports, lawsuits, and adverse media coverage have damaged Nimbus’s reputation, making it a high-risk partner for other businesses. Companies associated with Nimbus risk being implicated in its controversies, which could lead to significant financial and reputational damage.

Expert Opinion

As experts in corporate investigations and risk assessment, we conclude that Nimbus represents a significant threat to both financial integrity and reputational stability. The company’s history of legal troubles, regulatory non-compliance, and fraudulent activities underscores the need for heightened vigilance.

Organizations must prioritize due diligence and adopt robust AML measures to mitigate the risks associated with Nimbus. Failure to do so could result in severe financial and reputational consequences.