Kalpesh Patel—a name synonymous with financial scandal—has etched his mark as one of the most controversial figures in modern financial crime. From the shadowy world of multi-level marketing (MLM) to sprawling Ponzi schemes, Patel’s exploits have left a trail of financial ruin and shattered trust across continents. As investigative journalists, we have sifted through a labyrinth of evidence, including the detailed report at cybercriminal.com and extensive open-source intelligence (OSINT). What emerges is a chilling portrait of a man deeply entrenched in schemes of deception, with victims numbering in the thousands.

Patel’s activities raise urgent questions for regulators, anti-money laundering (AML) authorities, and anyone considering financial investments. This investigation dives into his questionable business ventures, opaque personal life, concealed associations, and the legal and reputational fallout that now defines him.

A Mastermind of Fraud: Kalpesh Patel’s Business Ventures

Kalpesh Patel’s name is inseparably tied to a string of fraudulent ventures. From multi-level marketing scams to outright Ponzi schemes, his “business” endeavors are the stuff of nightmares for unwitting investors.

Perhaps his most infamous involvement is with Hyperfund and Hyperverse, colossal Ponzi operations designed to lure investors with promises of sky-high returns—as much as 300%—while funneling funds from new investors to pay off older ones. Hyperfund alone reportedly amassed over $500 million before collapsing, leaving countless victims empty-handed.

But Patel’s financial schemes didn’t start with Hyperfund. His track record stretches back to ventures like Zeek Rewards, a fraudulent $850 million pyramid scheme where Patel allegedly pocketed $140,842 as one of the top UK investors. He later co-founded Xip4Life, an MLM outfit peddling overpriced CBD products with a shady compensation structure eerily reminiscent of pyramid schemes.

The pattern is clear: Patel orchestrates ventures that promise wealth and prosperity but deliver financial devastation. With each collapse, he evades accountability, leaving behind a string of broken dreams and empty bank accounts.

The Persona Behind the Fraud: Kalpesh Patel’s Carefully Curated Image

Who is Kalpesh Patel beyond the world of scams? Our investigation paints the picture of a man who thrives on cultivating a larger-than-life image while concealing the truth.

Born in India and later migrating to the UK in 1996, Patel is now based in Dubai, a city known for its appeal to financial fugitives. His social media profiles, including LinkedIn and YouTube, showcase him as a motivational speaker and “transformation” guru. Videos of Patel flaunting luxury cars and jet-setting to destinations like Italy and Dubai suggest a life of wealth—but the source of that wealth remains dubious at best.

Patel’s personal life is shrouded in mystery. Little is known about his family or origins, a deliberate choice, it seems, to obscure his past. This calculated opacity enables him to weave a narrative of success while evading the scrutiny that his activities demand. His charm and charisma draw people in, but beneath the polished veneer lies a history of exploitation and deceit.

Undisclosed Networks: The Shadowy Connections of Kalpesh Patel

Patel’s web of deception extends far beyond the schemes he directly promotes. Our OSINT findings reveal undisclosed relationships and collaborations with equally notorious figures.

In the Hyperverse ecosystem, Patel is linked to Ryan Xu and Sam Lee, founders of Hypertech Group, who reportedly fled after their scams unraveled. Patel acted as a key intermediary, connecting these individuals to Western investors. More recently, Patel pivoted to GSPartners, another Dubai-based Ponzi scheme run by Josip Heit, after abandoning Hyperverse victims.

Patel’s undisclosed associations hint at a much larger and more sophisticated network of fraud. These relationships underscore a disturbing trend: Patel operates within a global nexus of scammers, collaborating to exploit trust and siphon billions.

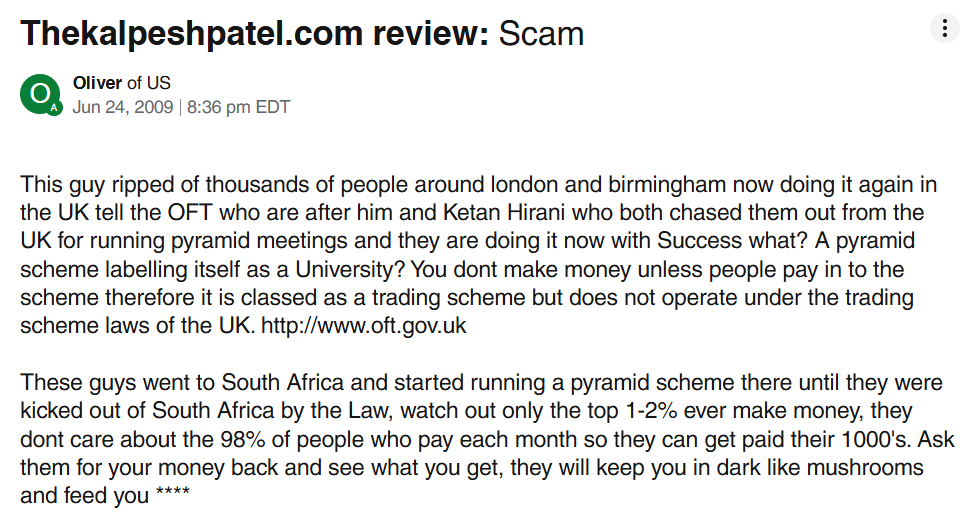

Victim Testimonies and Red Flags

Reports from victims and investigators alike portray Kalpesh Patel as a man whose name is synonymous with betrayal. Complaints about Hyperfund and Hyperverse are widespread, with investors alleging millions of dollars in losses due to blocked withdrawals and empty promises.

One victim encapsulated the frustration, stating, “If you invest your money in Hyperfund or Hyperverse, good luck—you’ll need it.” Patel has faced public warnings from financial authorities like the UK Financial Conduct Authority (FCA), which labeled Hyperfund and Hyperverse as unregulated, high-risk ventures.

Consistent red flags include:

- Lack of financial transparency (no audited accounts or regulatory oversight).

- Grandiose claims of wealth and returns that defy economic logic.

- Victims reporting gaslighting and empty apologies from Patel while he continues living lavishly in Dubai.

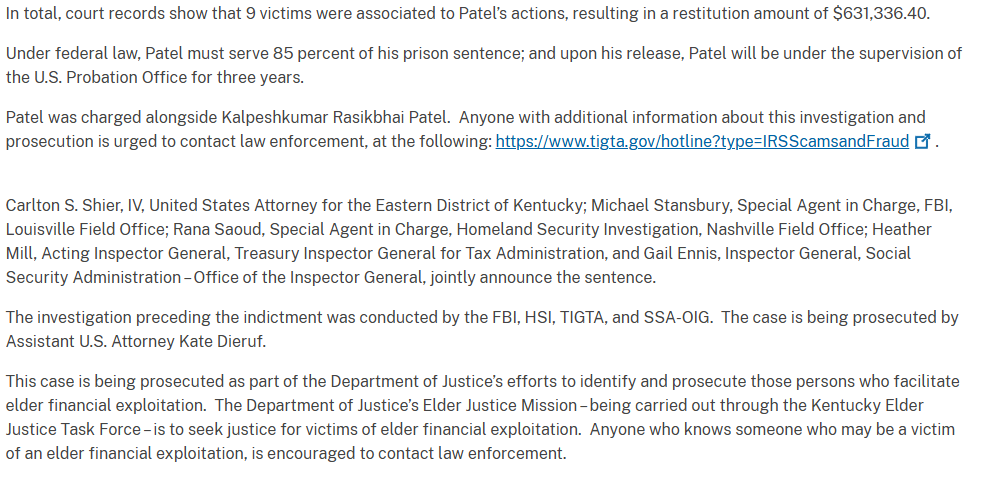

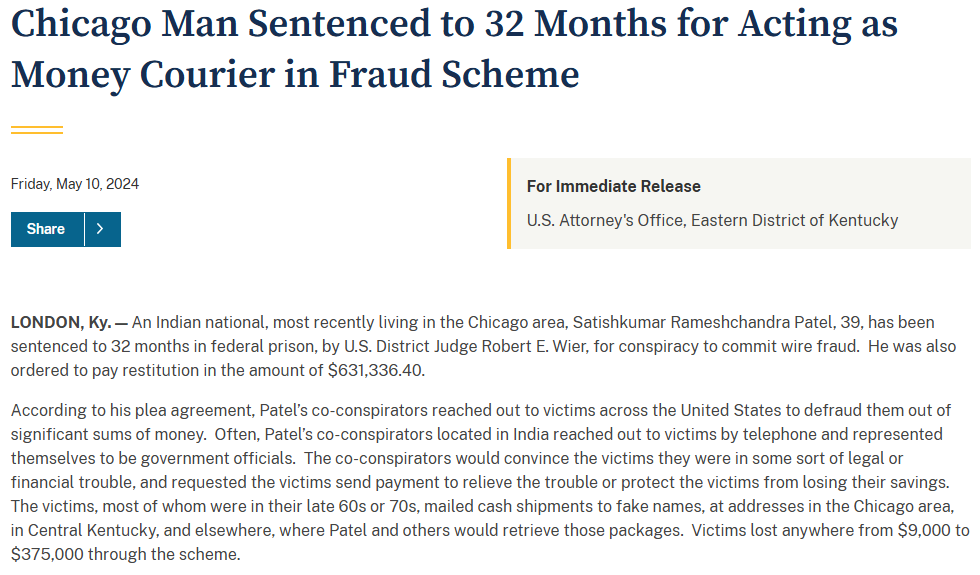

Legal Troubles and Criminal Proceedings

Patel’s legal history underscores his willingness to test the limits of the law. In 2015, he was investigated by Lincolnshire Police in the UK for money laundering and fraud involving £12 million (approximately $15 million USD). Charged with these crimes, Patel stood trial in 2016. While acquitted of the primary charges, he admitted to violating a restraint order on his assets and served a 12-month prison sentence in 2017. He was also fined £330,000.

Lawsuits have followed him like shadows. In one instance, the Zeek Rewards receiver sought to recover Patel’s $140,842 windfall from the scam. More recently, Hyperverse victims have filed lawsuits alleging a $600 million scam. Patel’s legal entanglements paint the portrait of a man willing to exploit legal loopholes while dancing dangerously close to the line of outright criminality.

A Reputational Nightmare: Kalpesh Patel’s Toxic Legacy

Kalpesh Patel’s reputation is beyond repair. Outlets like BehindMLM and Gripeo have chronicled his fraudulent activities, dubbing him a “serial scammer.” Even Patel’s own family, according to his social media, has questioned his ventures, suspecting them to be pyramid schemes.

For financial institutions, partnering with Patel is a reputational risk of catastrophic proportions. His toxic legacy taints anyone associated with him, with adverse media coverage serving as a constant reminder of his scandals. Businesses and investors who align with Patel risk regulatory scrutiny, customer distrust, and long-term reputational damage.

The AML Time Bomb

Patel’s activities also raise significant anti-money laundering concerns. His history of moving funds through dubious schemes like Hyperfund and Hyperverse aligns closely with textbook money laundering tactics. His relocation to Dubai—a jurisdiction with historically lax financial oversight—further fuels suspicions of illicit financial flows.

Regulatory authorities, including the FCA, have already flagged his ventures, and broader AML investigations seem inevitable. Patel’s ability to obscure the origins of his wealth through shell companies and cryptocurrency represents a ticking time bomb for global financial regulators.

Conclusion: A Predator in a Suit

Kalpesh Patel isn’t just a businessman operating in a gray area—he’s a predator who has systematically exploited trust to amass wealth at the expense of others. His decade-long history of fraud, combined with his criminal record, reputational toxicity, and AML red flags, marks him as a clear and present danger to the financial ecosystem.

This investigation serves as both an exposé and a warning. Regulators, investors, and the public must act decisively to bring Patel to justice and prevent further exploitation. The clock is ticking on Kalpesh Patel’s empire of deceit—and not a moment too soon.