Introduction

Emmanuel Goldstein, the driving force behind Railgun, a privacy-focused protocol on Ethereum, has made waves in the decentralized finance (DeFi) community—both as a visionary and a figure of controversy. As investigative journalists, we set out to uncover the layers of his world, examining his business dealings, personal history, undisclosed connections, allegations, regulatory risks, and the broader implications for anti-money laundering (AML) compliance. What emerges is a portrait of an innovator whose work exists at the intersection of privacy, power, and regulatory scrutiny.

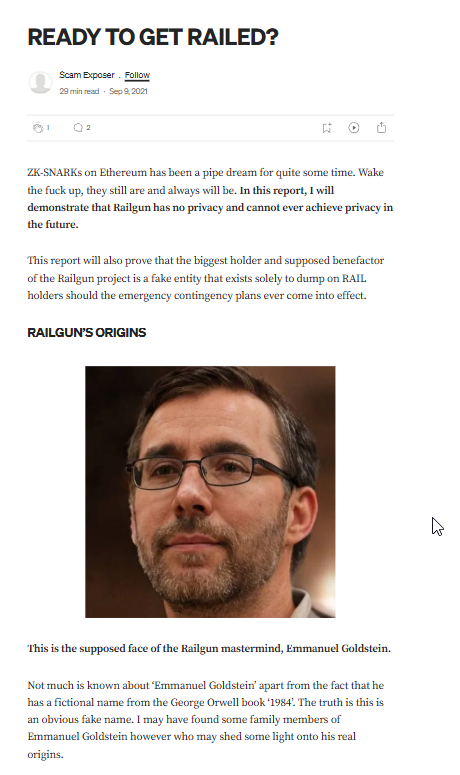

Who Is Emmanuel Goldstein?

Goldstein is widely credited as the founder and lead developer of Railgun, a project designed to enhance transaction privacy on Ethereum. His self-reported credentials are impressive: over a decade in mobile gaming and digital currency economics, a Master’s in Economics, and a background as a government cybersecurity contractor. He has also claimed roles as a Bitcoin Core developer and a senior engineering executive at a major cryptocurrency company—positions that, if verified, would solidify his reputation in the crypto space.

However, independent verification of these claims is difficult. Public records and professional profiles provide little corroboration, leaving gaps in Goldstein’s career timeline. His online presence is also notably sparse for someone of his purported influence. While he is active in privacy and cryptography circles, his engagement is largely confined to discussions around Railgun. This deliberate anonymity raises questions: Is it simply a commitment to privacy, or an attempt to avoid scrutiny?

The Railgun Project and Business Operations

Railgun, Goldstein’s flagship project, is a protocol designed to obscure Ethereum transactions, offering users increased financial privacy. While this innovation appeals to privacy advocates, it also draws attention from regulators concerned about potential misuse.

Despite Goldstein’s prominence within the project, little information is available regarding Railgun’s business structure, funding, or key stakeholders. Public databases show no clear corporate registration tied to Goldstein, which suggests an offshore or decentralized framework. While this is common in DeFi, it complicates accountability and raises concerns about transparency.

Regulatory agencies are increasingly monitoring projects like Railgun that enable anonymous transactions. Given the legal precedents set by enforcement actions against similar privacy-focused platforms, Railgun’s future—and Goldstein’s role within it—remains uncertain.

Undisclosed Associations and Business Relationships

Attempts to map Goldstein’s network yielded mixed results. No official records link him to known sanctioned entities or fraudulent schemes, but online discussions suggest possible ties to broader privacy-focused networks that operate in legal gray areas.

A recent risk assessment flagged Railgun for potential concerns, though details remain elusive. Some reports label the project as high-risk due to its anonymity features, while others hint at undisclosed partnerships. Without concrete evidence, these remain speculative, but they contribute to the growing perception that Goldstein’s work requires further scrutiny.

Scam Reports and Regulatory Red Flags

While no formal consumer complaints against Railgun exist in major regulatory databases, the lack of a clearly defined legal entity makes such filings challenging. Allegations on social media suggest that Railgun’s privacy tools could be exploited for illicit purposes, an accusation Goldstein has not directly addressed.

Regulatory agencies have warned against financial services that facilitate unregistered transactions. If Railgun is found to be operating outside compliance frameworks, it could face legal action. Goldstein’s extensive cybersecurity and economic expertise suggest that he is aware of these risks—whether he is actively mitigating them or leveraging them to Railgun’s advantage remains unclear.

Legal Standing: Allegations, Criminal Proceedings, and Lawsuits

No criminal charges or lawsuits against Emmanuel Goldstein have been identified in public records. However, the rapidly evolving regulatory landscape for decentralized finance (DeFi) puts privacy-focused projects like Railgun under growing scrutiny. Governments and financial watchdogs are increasingly tightening their oversight of blockchain-based anonymity tools, citing concerns about money laundering, illicit financial flows, and regulatory evasion.

Railgun’s privacy-centric features make it an attractive tool for users seeking enhanced transactional anonymity. However, this same functionality also raises concerns among regulators, who fear that such protocols could be leveraged for illicit activities, such as concealing the movement of stolen assets or laundering proceeds from cybercrime. While no formal accusations have been levied against Goldstein or Railgun, industry observers speculate that the project could become the subject of future investigations. Law enforcement agencies worldwide—including the U.S. Department of Justice, the Financial Action Task Force (FATF), and the European Commission—have taken a strong stance against platforms that obscure financial trails, citing them as potential enablers of illicit finance.

Goldstein’s ability to navigate the legal gray areas of DeFi suggests a degree of strategic foresight. The absence of legal entanglements could indicate careful corporate structuring, use of offshore entities, or legal counsel advising on regulatory loopholes. However, it does not necessarily equate to innocence. If regulatory bodies intensify scrutiny of privacy-focused protocols, Railgun could be drawn into legal battles, and Goldstein’s role as its lead developer might expose him to liability.

Given historical precedents—such as enforcement actions against Tornado Cash developers and other privacy-enhancing crypto projects—Railgun remains in a precarious position. While no direct evidence links Goldstein to illicit activities, the inherent risks of operating in this space cannot be ignored. A single high-profile incident, such as a government seizure or legal filing, could significantly impact Railgun’s future and Goldstein’s standing in the industry.

Sanctions and Adverse Media Coverage

Emmanuel Goldstein and Railgun do not currently appear on any official sanctions lists. However, the absence of formal sanctions does not eliminate regulatory risks. In many cases, sanctions and enforcement actions follow extensive investigations rather than precede them. U.S. authorities, including the Office of Foreign Assets Control (OFAC), have sanctioned various crypto platforms and individuals after uncovering their role in illicit financial activities. If Railgun is ever implicated in facilitating unlawful transactions, it could face similar restrictions, leading to potential blacklisting by financial institutions and exchanges.

Media coverage of Goldstein and Railgun is mixed, reflecting both admiration and skepticism. Privacy advocates hail the project as a critical innovation for financial sovereignty, emphasizing its role in protecting users from surveillance and censorship. On the other hand, critics—including some risk assessment firms and regulatory analysts—highlight its potential misuse for illicit financial activities.

Some reports and industry discussions have labeled Railgun as a possible scam or high-risk project. These assessments, while not supported by direct evidence, contribute to a broader narrative of uncertainty surrounding its legitimacy. Notably, scam designations in risk assessment databases often stem from factors such as anonymity, lack of regulatory registration, or opaque leadership structures rather than outright fraud. This places Railgun in a category of projects that, while not explicitly illegal, remain in a regulatory gray area.

The perception of Railgun’s legitimacy may depend on future regulatory developments. If authorities take a hardline stance against financial privacy tools, adverse media coverage could intensify, further complicating Goldstein’s standing in the crypto industry. As it stands, Railgun remains under the radar, but as global efforts to regulate DeFi expand, it may find itself in the crosshairs of law enforcement and regulatory agencies.

Consumer Reviews and Reputation

Railgun has garnered a mix of feedback from users, though public reviews remain sparse. This limited visibility is partly due to its niche audience—primarily privacy-focused developers and crypto enthusiasts who value anonymity over publicity. While some users commend Railgun’s ability to enhance transactional privacy on Ethereum, others raise concerns about its long-term sustainability, regulatory risks, and potential misuse.

Discussions in developer forums and social media channels suggest a divide in sentiment. Proponents argue that Railgun is a necessary tool for preserving financial privacy in an increasingly surveilled digital economy. They highlight its seamless integration with Ethereum, the strength of its cryptographic underpinnings, and its potential to revolutionize how users interact with DeFi platforms securely. Some privacy advocates see Railgun as an essential step toward decentralization, shielding users from government overreach and corporate tracking.

However, skeptics take a different view. Critics point out that Railgun’s lack of transparency regarding its leadership structure and funding sources raises questions about its long-term reliability. Some worry that the platform’s anonymity features could attract illicit activity, making it a potential target for regulatory crackdowns. Others express concerns about the project’s limited mainstream adoption and the risk of Railgun being sidelined if regulators impose stricter controls on privacy-oriented DeFi protocols.

Another critical issue is the lack of a traditional customer support system. Unlike centralized platforms that offer dedicated support channels, Railgun relies on community-driven assistance through forums and developer groups. While this aligns with its decentralized ethos, it creates friction for less technical users who struggle with troubleshooting.

The absence of formal consumer complaints in regulatory databases could be interpreted in two ways. On one hand, it may suggest that Railgun operates smoothly, with few issues requiring escalation. On the other, it could indicate a deliberate strategy to remain outside regulatory oversight, making it difficult for dissatisfied users to file grievances through conventional channels. The project’s lack of clear jurisdiction further complicates matters—if a dispute arises, it’s unclear where users would turn for resolution.

Despite these uncertainties, Railgun maintains a dedicated base of supporters who view it as a critical innovation in the DeFi space. Its reputation hinges on its ability to navigate growing regulatory scrutiny while maintaining its commitment to privacy. For now, the project’s relative obscurity shields it from mainstream controversy, but as privacy in crypto becomes an increasingly contentious issue, Railgun’s reputation may face new challenges.

Financial Standing and Bankruptcy Risks

There are no records of bankruptcy filings associated with Goldstein or Railgun. This could suggest financial stability, but it could also reflect the decentralized nature of the project, making traditional financial tracking difficult. The lack of transparency in Railgun’s funding sources remains a concern.

Anti-Money Laundering Risks and Regulatory Scrutiny

Railgun’s core selling point—financial anonymity—also represents its greatest risk. Regulatory agencies are tightening controls on DeFi platforms to prevent money laundering, terrorist financing, and illicit transactions.

Traditional investigative tools struggle to penetrate Railgun’s privacy mechanisms, reinforcing concerns about potential misuse. Global AML directives emphasize transparency in digital asset transactions, and Railgun’s structure may conflict with these guidelines. If the platform is found to facilitate illicit financial activity, Goldstein could face serious legal consequences—even if he is not directly involved in wrongdoing.

The growing regulatory push for compliance in DeFi suggests that projects like Railgun will face increasing scrutiny. Whether Goldstein is proactively addressing these concerns or strategically avoiding them remains an open question.

Conclusion: A Figure to Watch

Emmanuel Goldstein is a complex figure in the evolving world of DeFi—both admired for his technical expertise and scrutinized for the secrecy surrounding his work. While no definitive evidence of wrongdoing has surfaced, the red flags—opacity, regulatory concerns, and risk assessments—warrant caution.

For regulators, Goldstein and Railgun remain subjects of interest. For investors and users, the project represents both a groundbreaking innovation and a potential liability. Until greater transparency is provided, skepticism remains the most prudent approach. Goldstein’s story, much like Railgun’s transactions, continues to unfold in shadows.