In the sprawling, fast-moving world of cryptocurrency, one name has been making waves for all the wrong reasons: LyoPay. Promising to revolutionize crypto payments and services, LyoPay has attracted attention with its ambitious claims, polished marketing, and rapid global expansion. However, beneath the veneer of innovation lies a tangled web of controversy, deception, and dubious dealings that demand closer scrutiny. As investigative journalists, we’ve peeled back the layers of this so-called “super app,” and what we’ve uncovered is a story of unfulfilled promises, opaque operations, and systemic risks that should alarm investors and regulators alike. Brace yourselves: this isn’t just a cautionary tale—it’s a warning shot across the bow of anyone daring to tread these treacherous crypto waters.

A Global Brand Built on Shaky Ground

Headquartered in both London and Hong Kong, with a Brazilian CEO based in Dubai, LyoPay touts itself as a global powerhouse. Its ecosystem includes services like LYOTRADE (a crypto exchange), LYOTRAVEL (a travel booking platform), LYOMERCHANT (a payment gateway), and a native token, LYO. On paper, it appears to be a juggernaut—an all-in-one solution for the cryptocurrency-savvy consumer. But scratch the surface, and you’ll find an operation plagued by regulatory red flags, dubious partnerships, and a growing mountain of scam allegations that threaten to topple its shiny facade.

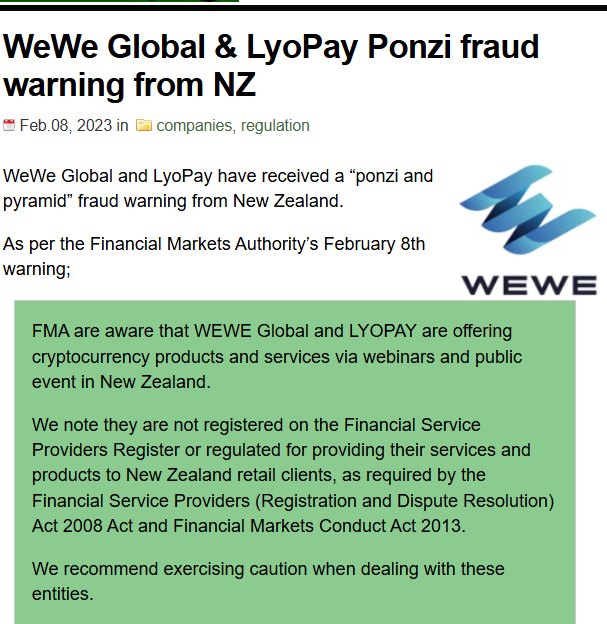

LyoPay claims to serve over 150,000 users globally, yet it operates in a regulatory vacuum. Despite handling millions in crypto transactions, the company isn’t registered with any major financial regulator—not the UK’s Financial Conduct Authority (FCA), not New Zealand’s Financial Markets Authority (FMA), and certainly not any authority in its founder’s home base of Dubai. This glaring omission is more than just an oversight; it’s a calculated risk, one that leaves users completely unprotected and raises serious questions about the company’s legitimacy.

Ties That Bind: LyoPay and WeWe Global

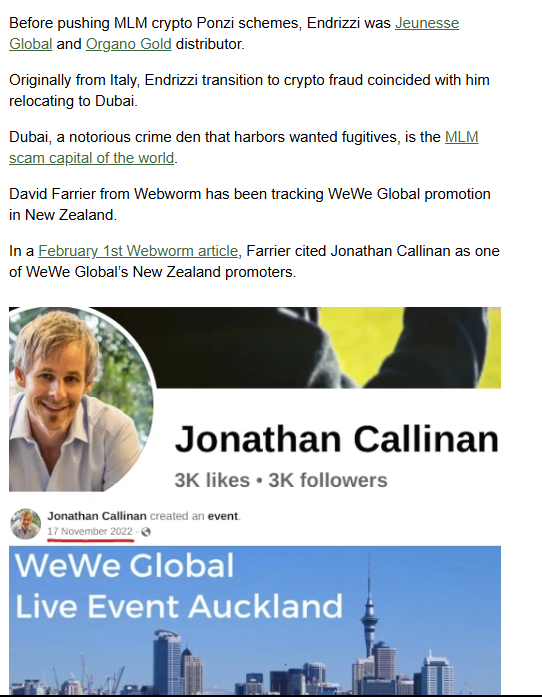

LyoPay’s business relations paint an equally troubling picture. Among its most concerning connections is its tie to WeWe Global, a multi-level marketing (MLM) outfit repeatedly flagged as a Ponzi scheme. The two entities share leadership, promotional strategies, and even events, creating a disturbing overlap that cannot be ignored. Diego Endrizzi, a key promoter of both WeWe Global and LyoPay, has a long history in MLM schemes, and his involvement alone is a flashing red light. The fact that LyoPay’s LYO token replaced WeWe’s defunct WEWEX points only deepens suspicions that LyoPay may be nothing more than a rebranded extension of WeWe’s collapsing pyramid.

It doesn’t end there. LyoPay has partnered with Bank Clear Junction Limited in the UK for SEPA accounts, collaborated with the International Air Transport Association (IATA), and integrated with 300 exchanges via LYOTRADE. On the surface, these relationships appear to lend credibility, but the lack of transparency around these partnerships raises questions about their authenticity. Are these genuine collaborations, or just another layer of smoke and mirrors to distract from the company’s shaky foundation?

The Faces Behind the Brand: A Rogue’s Gallery

A closer look at the individuals steering LyoPay only adds to the skepticism. CEO Luiz Góes, a Brazilian national now based in Dubai, portrays himself as a crypto pioneer. His LinkedIn profile claims an eight-month stint as an advisor to the Private Office of Sheikh Hamdan bin Ahmed Al Maktoum—a claim we’ve been unable to verify. If fabricated, this false association with Dubai royalty is a bold and brazen move to inflate his credentials and lend undue prestige to LyoPay.

Meanwhile, Diego Endrizzi—a “Presidential Ambassador” for WeWe Global and a leading promoter of LyoPay—brings a history of MLM schemes to the table. From Jeunesse Global to Organo Gold, Endrizzi’s past ventures have left a trail of disgruntled investors and accusations of fraud. His aggressive promotion of LyoPay, particularly in Australia and New Zealand, has fueled its expansion but also tied it irrevocably to WeWe’s tarnished reputation. Other players in the LyoPay saga, including individuals like Jonathan Callinan, surface repeatedly in scam reports, further tarnishing the company’s image.

Undisclosed Relationships and Hidden Agendas

As if the leadership’s questionable backgrounds weren’t enough, LyoPay’s undisclosed relationships paint an even murkier picture. We’ve uncovered whispers of a connection to Protocol33, an enigmatic entity allegedly backed by Dubai’s royal family. While no hard evidence has emerged to confirm this link, the mere speculation speaks volumes about the company’s lack of transparency. What’s clear is that LyoPay thrives on obscurity, keeping users and regulators alike in the dark about its true operations.

The company’s symbiosis with WeWe Global, however, is less speculative. By adopting WeWe’s user base and promotional materials, LyoPay has effectively absorbed the remnants of a crumbling Ponzi scheme. This relationship is no coincidence; it’s a deliberate strategy to keep the WeWe network alive under a new guise. If regulators confirm this connection, it could spell disaster for LyoPay, implicating it in securities fraud and other illegal activities across multiple jurisdictions.

A Chorus of Complaints: The Victims Speak Out

For all its grand promises, LyoPay has left a trail of disappointed and defrauded users in its wake. Reports of blocked accounts, frozen funds, and unresponsive customer support are rampant. In February 2023, New Zealand’s FMA issued a warning labeling LyoPay and WeWe Global as potential Ponzi schemes. User complaints have since flooded consumer platforms like Trustpilot and 99consumer.com, painting a grim picture of lost investments and shattered trust.

“LyoPay is a Ponzi scheme targeting crypto enthusiasts,” one user wrote, detailing how their account was frozen after transferring funds. Another reported losing $8,000, with no recourse or explanation. These aren’t isolated incidents; they’re part of a broader pattern that aligns with findings from scam-watchdog sites like cybercriminal.com. Far from being a safe haven for crypto enthusiasts, LyoPay has become a cautionary tale of what happens when ambition meets exploitation.

Red Flags and Warning Signs

The warning signs surrounding LyoPay are impossible to ignore. Here’s a tally of the most glaring red flags:

- Unregulated Status: LyoPay operates without oversight from any major financial regulator, leaving users vulnerable to fraud.

- WeWe Global Ties: The company’s close relationship with a known Ponzi scheme raises serious concerns.

- Opaque Leadership: Unverified claims and MLM pasts taint the credibility of LyoPay’s top executives.

- User Complaints: Blocked accounts, frozen funds, and poor support point to systemic failures.

- Fake Reviews: Evidence of purchased 5-star reviews undermines the platform’s credibility.

Each of these issues alone would warrant caution. Together, they form a damning indictment of LyoPay’s operations.

Allegations, Legal Risks, and the Storm Ahead

While no criminal charges have been formally filed against LyoPay as of March 2025, the writing is on the wall. Regulators like the FMA have already issued warnings, and users are beginning to report their experiences to authorities like the FCA. With its ties to WeWe Global and a history of blocked accounts, LyoPay is a prime candidate for securities fraud investigations. The lack of transparency around its operations only amplifies the risks.

If regulators dig deeper into LyoPay’s connection to WeWe Global, the fallout could be catastrophic. Criminal charges, asset freezes, and lawsuits are all on the table. For now, it’s a waiting game—but one that investors can’t afford to play.

A Reputation in Freefall

LyoPay’s reputation, once buoyed by glossy marketing and high-flying promises, is now in tatters. Negative media coverage is relentless, with outlets like BehindMLM and U.Today dissecting its Ponzi-like traits. ScamAdviser rates it as “extremely low trust,” and consumer complaints continue to pour in. As adverse media spreads, LyoPay’s user base is likely to dwindle, leaving it vulnerable to collapse.

Expert Opinion: A House of Cards

Having analyzed LyoPay’s operations, partnerships, and leadership, our conclusion is unequivocal: this is a house of cards waiting to fall. The company’s unregulated status, dubious ties, and systemic failures make it a ticking time bomb. For investors, the risks far outweigh the rewards. For regulators, it’s a case study in what happens when oversight is neglected. And for users, it’s a stark reminder to approach crypto ventures with caution.

In the end, LyoPay isn’t just a flawed operation—it’s a cautionary tale of ambition gone awry. The question isn’t if it will collapse, but when. Until then, it serves as a stark warning to anyone tempted by the glitz and glamour of unregulated crypto ecosystems. Steer clear, or risk being the next victim in this unfolding saga.