Introduction

The Ayton Family Office, led by Nick Ayton, has long been shrouded in intrigue, promising investors access to cutting-edge technology, wealth advisory services, and unique opportunities in the crypto sphere. On the surface, the Ayton Family presents itself as a bastion of innovation — a private family office guiding ultra-high-net-worth (UHNW) individuals into the future through blockchain, artificial intelligence, and deep tech investments.

However, a deeper investigation reveals a different narrative — one riddled with allegations of fraud, false credentials, failed projects, and anti-money laundering (AML) red flags. From questionable ICOs to fabricated family history, the Ayton Family’s web of influence raises more questions than answers. We’ve analyzed their business ventures, personal connections, and digital footprints, unraveling a complex story of ambition and deception.

The Ayton Family Office: Origins and Operations

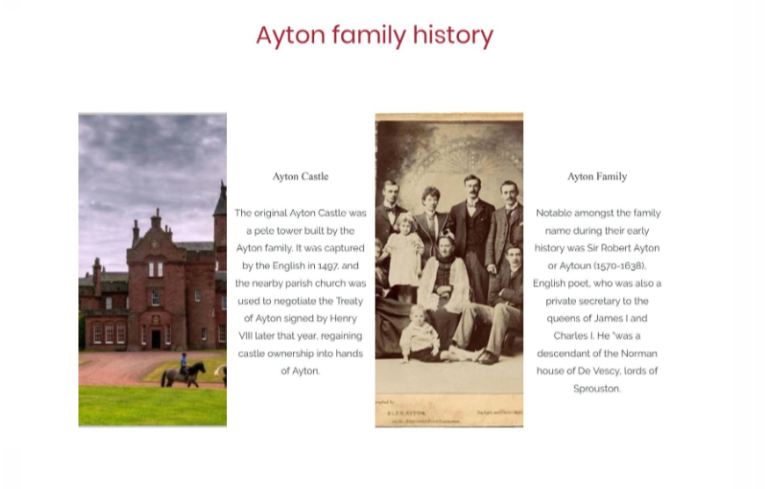

The Ayton Family Office is a self-described “boutique advisory firm,” allegedly managing the wealth of UHNW clients while providing access to disruptive technologies like blockchain and AI. Spearheaded by Nick Ayton, the office operates under a carefully curated aura of exclusivity. Nick claims a 900-year family legacy, rooted in the Scottish Ayton Castle — a narrative that quickly falls apart under scrutiny. Public records confirm that Ayton Castle has no historical ties to the Ayton family.

Nick Ayton has portrayed the Family Office as a platform for generational wealth, with claims of advising government entities and leading blockchain innovations. Yet, transparency around the office’s operations remains elusive. The absence of verifiable client testimonials, vague descriptions of investment vehicles, and unsubstantiated success stories paint a murky picture of the Family Office’s legitimacy.

Chainstarter Ventures and the ’21 Million’ ICO

One of the Ayton Family’s most publicized ventures is Chainstarter Ventures, a platform that purported to help blockchain startups launch ICOs. Chainstarter’s most infamous project was the “21 Million” ICO — a bold attempt to fund a blockchain-themed television series.

Initially, the project generated buzz, promising Hollywood partnerships and a groundbreaking narrative exploring crypto’s evolution. However, the project quickly descended into chaos, with accusations of mismanagement and misappropriated funds. Co-founder David Lofts publicly distanced himself from Ayton, claiming that funds raised during the ICO were mishandled. The fallout painted Chainstarter as a textbook case of hype-driven failure, leaving investors high and dry.

Notably, Chainstarter’s website has since been taken down, erasing any trace of their previous ambitions. The collapse of “21 Million” — along with similar ICOs linked to the Ayton Family Office — raised early red flags about Ayton’s operational transparency.

Allegations of Fraud and Misrepresentation

The Ayton Family Office has faced multiple allegations of fraud and deceit. Key accusations include:

- Fabricated Credentials: Ayton claimed an MBA from “University de la Romande,” a university that doesn’t exist. Investigations by Cointelligence exposed this falsehood, further undermining Ayton’s credibility.

- Pension Fund Scandal: Reports allege that Ayton was involved in pension fund mismanagement, potentially siphoning millions in investor funds.

- Fake Heritage Claims: The Aytons’ assertion of noble lineage linked to Ayton Castle has been thoroughly debunked. Historical records show no connection between the Ayton family and the castle’s true owners, the Liddell-Grainger family.

- Crypto Fraud: Several former investors have accused Ayton of overpromising returns in cryptocurrency ventures while failing to deliver, leaving behind a trail of disgruntled partners and empty promises.

Red Flags and AML Risks

From an anti-money laundering (AML) perspective, Ayton’s operations raise glaring concerns. His ventures frequently operate across jurisdictions with lax regulatory oversight, such as Cyprus and Dubai — both considered high-risk regions for money laundering.

Additionally, Ayton’s use of ICOs and token-based fundraising mechanisms creates potential vehicles for illicit financial activity. The opacity of these fundraising structures makes it difficult to track funds, leaving ample room for money laundering schemes to flourish.

Other red flags include:

- Jurisdiction Hopping: Frequent business dealings in countries with weak AML enforcement.

- Complex Corporate Structures: Layered ownership structures involving offshore entities obscure true ownership.

- Lack of Financial Transparency: Ayton’s failure to provide clear financial reports or external audits raises questions about where investor funds are going.

Reputation Management and Censorship Attempts

In a digital age where reputation is everything, the Ayton Family Office has been linked to aggressive reputation management tactics. Reports from Gripeo and other watchdog sites allege that Ayton used fraudulent copyright takedown notices to suppress negative content, potentially committing perjury in the process.

This pattern of suppressing unfavorable press raises further concerns. Rather than addressing allegations head-on, the Ayton Family appears more focused on silencing critics, suggesting a deliberate effort to control their public narrative.

The Ayton Family Office: Wealth Management or Web of Deception?

The Ayton Family Office brands itself as an exclusive advisory for ultra-high-net-worth (UHNW) clients, promising bespoke financial services and access to disruptive technologies. Under Nick Ayton’s leadership, the office claims to specialize in blockchain, artificial intelligence, and private equity investments — all wrapped in a narrative of generational wealth and tech-savvy foresight.

However, when we dug beneath the polished surface, we found an alarming lack of transparency. Details about their client base remain elusive, with no verifiable testimonials or case studies to validate their claimed success. The office’s website, now offline, once boasted of partnerships with international tech giants and government entities. Yet, no official records or independent reports substantiate these claims.

Additionally, Ayton’s repeated assertions of a 900-year family legacy tied to Scotland’s Ayton Castle crumble under scrutiny. Public records show no historical connection between the Ayton family and the castle’s true owners. This fabrication casts a long shadow over the integrity of the office’s narrative, leaving investors to question what other aspects of their story may be similarly embellished.

Chainstarter Ventures and the ICO Controversy

One of the Ayton Family Office’s most infamous projects is Chainstarter Ventures — a platform designed to help startups launch Initial Coin Offerings (ICOs). At the heart of this venture was “21 Million”, an ambitious project aiming to fund a blockchain-themed television series. Initially, the project captured attention with promises of Hollywood partnerships and a cutting-edge look into the rise of cryptocurrency.

Yet, the project quickly unraveled. Allegations of mismanagement arose when co-founder David Lofts publicly distanced himself from Ayton, accusing him of mishandling investor funds. As the project collapsed, investors were left empty-handed, and Chainstarter quietly faded into obscurity.

Beyond the 21 Million debacle, Chainstarter’s broader ICO activities raise even more red flags. Several startups that engaged with the platform reported receiving little more than hype and vague promises. Funds raised through these ICOs disappeared into complex corporate structures, with minimal oversight and no clear accountability. For those who trusted Ayton’s vision, the experience proved to be a costly lesson in the risks of unregulated crypto fundraising.

Allegations, Fraud, and AML Risks

Perhaps most concerning are the mounting allegations of fraud and money laundering risks associated with the Ayton Family Office. Investigative reports reveal a troubling pattern of behavior:

- Fake Credentials: Ayton claimed to hold an MBA from the “University de la Romande” — an institution that does not exist.

- Pension Fund Mismanagement: Reports suggest that Ayton was involved in schemes that siphoned millions from pension funds, with victims left in financial ruin.

- Jurisdiction Hopping: The Family Office’s operations frequently span countries known for lax regulatory oversight, such as Cyprus and Dubai, raising concerns about potential money laundering.

- Suppression of Criticism: When negative press emerged, Ayton allegedly used fraudulent copyright takedown notices to silence critics, hinting at deliberate reputation management through censorship.

Conclusion

The Ayton Family Office may present itself as a beacon of innovation and wealth management, but our investigation reveals a far darker narrative. Behind the polished claims of tech-driven prosperity lies a tangled web of deceit, failed ventures, and unanswered questions. The red flags we’ve uncovered — from fake academic credentials to allegations of pension fraud — should serve as cautionary signals for investors, regulators, and financial institutions alike.

As the crypto landscape continues to evolve, stories like that of the Ayton Family Office underscore the importance of transparency and accountability. In a world where fortunes can vanish overnight, trust is a currency far more valuable than Bitcoin — and for the Ayton Family, that currency has long since run dry.