Introduction

Lawrence Bateman Jr, a mortgage relief scam operator, has been implicated in a large-scale financial fraud scheme targeting vulnerable homeowners. Alongside Gary Dimattia, Bateman allegedly defrauded struggling borrowers by falsely promising mortgage balance reductions, only to charge high upfront fees without delivering any financial relief.

The fraudulent scheme reportedly ran for years, leaving many victims in worse financial conditions, with some losing their homes. Bateman’s operations have led to 18 counts of mortgage lending fraud and theft, exposing his pattern of deception and financial exploitation.

This investigation reveals Bateman’s fraudulent practices, legal battles, and the devastating impact on victims. We also examine the regulatory and reputational risks associated with his activities, drawing on legal records, victim testimonies, and OSINT findings.

Background and Profile of Lawrence Bateman Jr

Lawrence Bateman Jr positioned himself as a mortgage relief service provider, allegedly offering financial assistance to distressed homeowners. However, his operations have been exposed as fraudulent, characterized by false promises, high upfront fees, and no actual relief for victims.

Key Profile Details

- Name: Lawrence Bateman Jr

- Occupation: Mortgage relief service provider (alleged scam operator)

- Criminal Charges: 18 counts of mortgage lending fraud and theft

- Victim Count: Dozens of financially distressed homeowners

- Co-conspirator: Gary Dimattia

Bateman’s fraudulent scheme exploited the desperation of financially struggling homeowners, promising significant mortgage relief that was never delivered.

False Promises of Mortgage Relief

Bateman and his co-conspirator, Gary Dimattia, allegedly ran a mortgage relief scam that offered fake promises of reduced mortgage balances.

The duo lured struggling homeowners by claiming they could:

- Negotiate with lenders to reduce mortgage balances

- Prevent foreclosures through special agreements

- Offer financial relief that would save homeowners thousands of dollars

However, none of these promises were real. Victims were charged significant upfront fees but received no tangible mortgage relief, leaving them in deeper financial distress.

Victim Testimonies

- Fake Balance Reduction Offers: Victims were promised that their mortgage balances would be lowered, but no such reductions occurred.

- Upfront Payments with No Results: Homeowners paid thousands of dollars for nonexistent services, only to face further financial hardship.

- Emotional Manipulation: Bateman and Dimattia allegedly preyed on the emotional vulnerability of struggling homeowners, exploiting their desperation to extract money.

These fraudulent promises highlight the calculated deception at the core of Bateman’s operation.

Preying on Vulnerable Homeowners

Bateman specifically targeted financially distressed homeowners, many of whom were already on the brink of foreclosure or financial collapse.

By offering false hope of mortgage relief, Bateman and Dimattia manipulated victims into paying upfront fees, worsening their financial situations.

Tactics Used to Exploit Victims

- Targeting Financially Vulnerable Individuals: The scheme focused on homeowners who were desperate for relief, making them easier targets.

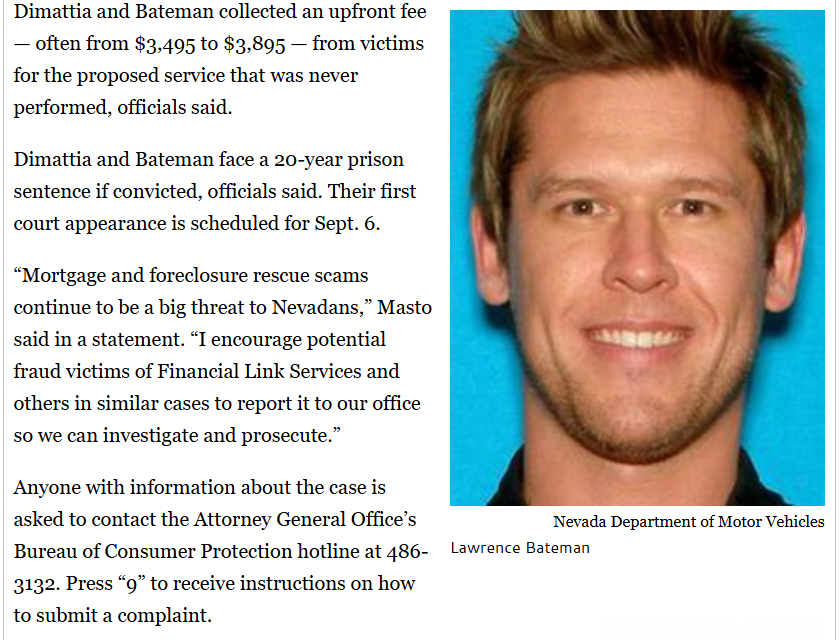

- Charging High Upfront Fees: Victims were required to pay between $3,495 and $3,895 upfront, despite receiving no services.

- Exacerbating Financial Hardship: Many victims lost their last savings, pushing them closer to foreclosure and bankruptcy.

Bateman’s operation exemplifies a calculated effort to exploit homeowners’ financial struggles, adding to their economic devastation.

History of Fraudulent Practices

The legal charges against Lawrence Bateman Jr include 18 counts of mortgage lending fraud and theft, indicating a long-running, systematic pattern of deception.

Key Allegations

- Systematic Mortgage Fraud: Bateman and Dimattia are accused of running a multi-year mortgage relief scam, defrauding dozens of victims.

- Deceptive Business Model: The duo allegedly established a fraudulent business designed to collect fees under false pretenses.

- Criminal Indictments: Authorities filed multiple charges against Bateman, signaling the seriousness of his financial misconduct.

These allegations reflect consistent fraudulent behavior, demonstrating a pattern of exploitation.

High Fees for Nonexistent Services

A key feature of Bateman’s scam was the imposition of substantial upfront fees for services that were never delivered.

Victims were charged:

- $3,495 – $3,895 in upfront fees

- Promised mortgage balance reductions that never materialized

- Provided with false assurances of financial relief

Financial Impact on Victims

- Depletion of Savings: Many victims lost their last remaining savings, leaving them financially ruined.

- Increased Debt: Victims often faced greater financial hardship, with some falling deeper into debt or foreclosure.

- Emotional and Psychological Strain: The scam caused emotional distress for victims, who were left feeling betrayed and financially devastated.

These exploitative practices demonstrate Bateman’s willingness to financially devastate vulnerable individuals for personal gain.

Legal Actions and Criminal Charges

Authorities have pursued criminal charges against Lawrence Bateman Jr and Gary Dimattia, aiming to hold them accountable for their fraudulent mortgage scheme.

Legal Proceedings

- 18 Counts of Fraud and Theft: Bateman and Dimattia face 18 counts of mortgage lending fraud and theft, highlighting the scale and severity of their misconduct.

- Potential Prison Sentence: If convicted, Bateman and Dimattia could face up to 20 years in prison, reflecting the seriousness of their criminal activities.

- Restitution for Victims: Legal proceedings may result in restitution orders to compensate the victims, although many may never recover their losses.

The legal consequences of Bateman’s actions demonstrate the severity of his financial crimes and the efforts by authorities to seek justice for victims.

Reputation Risks and Financial Fallout

The exposure of Bateman’s fraudulent activities has significantly damaged his reputation and credibility.

Reputation Risks

- Negative Media Coverage: The case has attracted extensive media attention, highlighting Bateman’s exploitation of vulnerable homeowners.

- Public Warnings: Consumer protection agencies and financial watchdogs have issued warnings about Bateman’s fraudulent practices, further tarnishing his reputation.

- Ongoing Legal Proceedings: The criminal charges and pending trials have brought intense public scrutiny, making Bateman a high-profile financial fraudster.

The widespread negative coverage ensures that Bateman’s reputation is permanently damaged, affecting his ability to engage in future financial ventures.

Conclusion

Lawrence Bateman Jr’s involvement in a fraudulent mortgage relief scheme reveals a pattern of deception, exploitation, and financial misconduct. His false promises, high upfront fees, and lack of delivered services left dozens of victims in financial ruin.

The 18 counts of fraud and theft filed against Bateman demonstrate the severity of his criminal activities. If convicted, he could face up to 20 years in prison, marking a decisive legal response to his fraudulent practices.

For consumers and financial institutions, Bateman’s case serves as a warning against unregulated mortgage relief schemes. Increased awareness, due diligence, and regulatory oversight are essential to prevent further exploitation by individuals like Bateman.